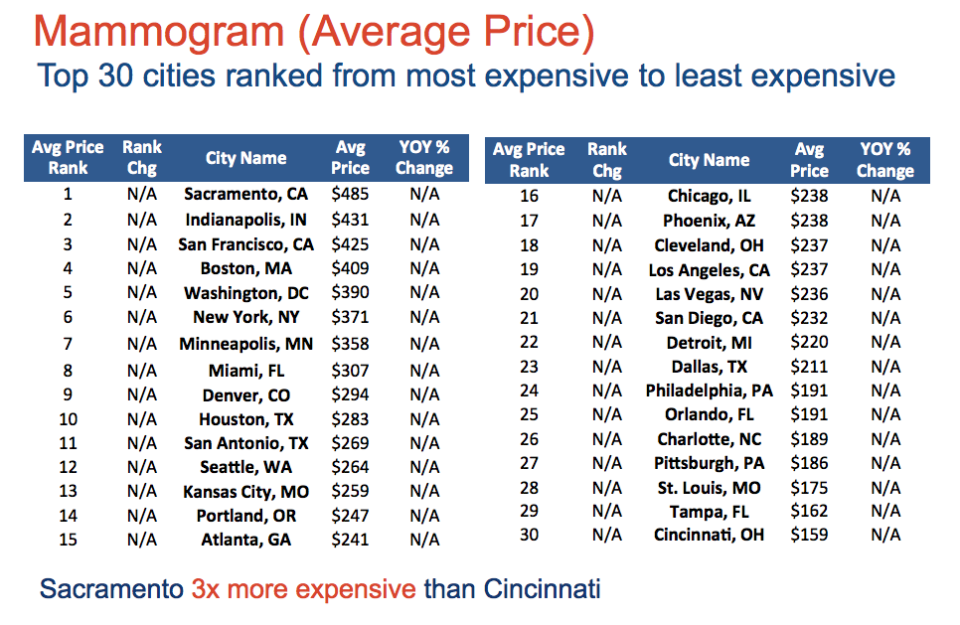

From $50 to $1,000 for a Mammogram: Health Care Costs for Women Vary Wildly

Are you overpaying for your health care compared with those in a nearby city? The arbitrary pricing strategies put in place by health care providers makes large pricing swings the rule rather than the exception, experts say. (Photo: Getty Images)

It’s a puzzling (and little-known) fact of the health care industry: Health care costs are not created equal. And a new study makes those discrepancies incredibly apparent.

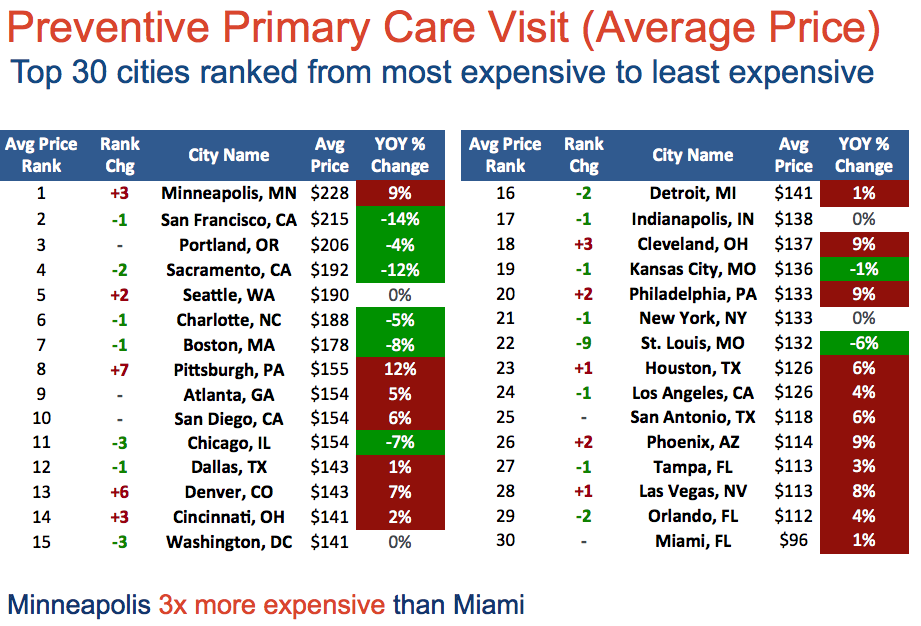

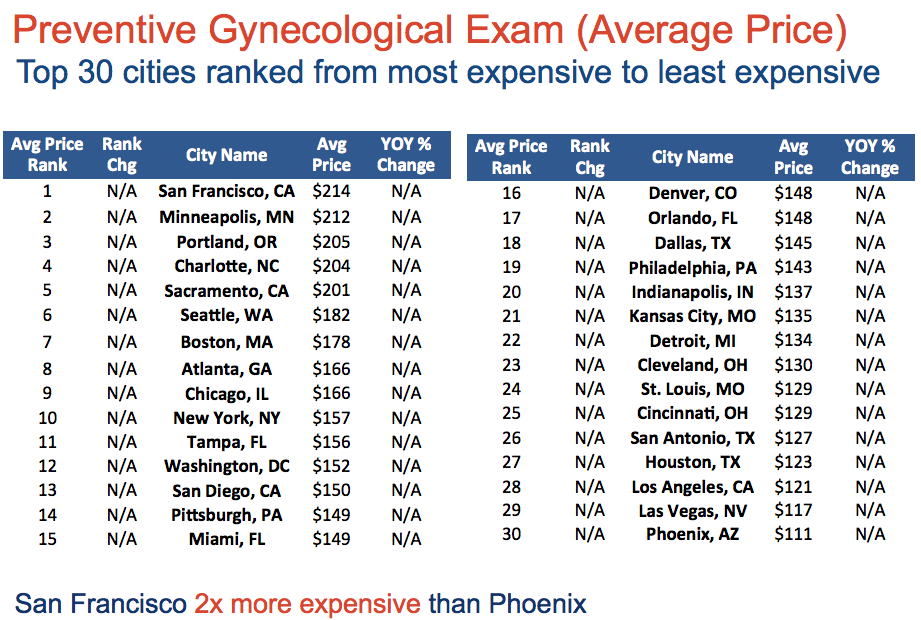

For the study, known as the U.S. Costliest Cities Index, enterprise health care management company Castlight Health analyzed hundreds of millions of health care claims to determine the prices of several critical women’s health procedures in the 30 most populated cities in the U.S. (Castlight defined “prices” as the employee cost-sharing plus the amount paid by that person’s employer.)

The study looked at the prices of several procedures, including mammograms, ob-gyn follow-up visits, preventive gynecological exams, and HPV tests.

The results are eye-opening, to say the least

Prices varied among cities — the average price of a preventive gynecological exam in San Francisco, for example, is $214, compared with the same procedure in Phoenix, which costs about $111.

(Data: Castlight Health)

But the cost of many procedures within the same city also were different — and sometimes dramatically so. For example, a routine mammogram in the Albany, N.Y., area could cost anywhere from $292 to $635.

Among other disturbing findings: A woman in Dallas can pay between $50 and $1,045 for a mammogram, and an HPV test can cost a woman in Philadelphia anywhere from $32 to $626.

(Data: Castlight Health)

What’s going on here?

Unfortunately, health care experts aren’t shocked by the findings. “The arbitrary pricing strategies put in place by health care providers make large pricing swings the rule rather than the exception,” Sarah O’Leary, founder of Exhale Healthcare Advocates, a national consumer health care advocacy group, tells Yahoo Health.

(Data: Castlight Health)

One of her clients experienced the issue firsthand when he was quoted $3,000 for an MRI he got for less than $500 at a different imaging center in his neighborhood.

Another factor leading to charge vs cost price discrepancies — outside of the Castlight data —is hospital charges. Health care expert Caitlin Donovan, spokeswoman for the National Patient Advocate Foundation, breaks down the source of that price issue to Yahoo Health this way: Hospitals have certain costs to provide the care, which are known as hospital costs. Hospitalization costs are what it costs the insurer, patient, or whoever is paying to have that care (essentially the amount actually paid). And then there are hospital charges, what the hospital may initially charge for the services.

(Data: Castlight Health)

“The charge for the service may bear little to no relation to the hospital costs, or even the hospitalization costs,” Donovan says. For example, between labor and materials used, it may cost a hospital $400 to treat a patient with a sprained ankle. They may charge $4,000, and it may actually cost the payer a total of $1,600, of which the patient may pay $400 and the insurance company $1,200.

“Hospitals give a lot of reasons for these discrepancies, the most frequent being that they have to cover for the services they provide to other patients who cannot pay at all,” Donovan says. “However, especially considering the wide discrepancies even within the same city, these fluctuations can seem rather arbitrary.”

Related: 8.8 Million More Americans Have Health Insurance in 2014 — But Can They Afford to Use It?

O’Leary points out that, under certain circumstances, some of these services should actually be of no cost to women due to the Affordable Care Act, including breast cancer mammography screenings every one to two years for women over the age of 40 and well-woman visits.

“You need to know what your plan covers and be ready to explain your coverage to your health care provider to avoid being overcharged,” she says. “It’s amazing how often we see people get charged copays for services that should be free.”

If you need nonemergency care and are concerned about what it will cost you, Donovan recommends doing your research. Call your doctor and ask ahead of time what your out-of-pocket costs will be under your insurance.

You can also consult your insurer’s website (most will provide you with that information ahead of time). O’Leary recommends getting an estimate on what the price for a particular test or procedure in your area should be by consulting a site like Healthcarebluebook.com.

Finally, stay within your network whenever possible. “It is absolutely essential to avoid going out of network — the costs are much, much higher,” says Donovan.

Unfortunately, O’Leary doesn’t anticipate things will get easier for consumers anytime soon: “Without real government oversight, we can expect that we will see these price discrepancies for the foreseeable future.”

Read This Next: 14 Secrets Every Health Insurance Company Knows (and You Should Too)