ZipRecruiter raises $156M at $1.5B valuation to boost AI-powered job searches

ZipRecruiter got a raise.

The online employment marketplace landed $156 million in new funding to scale growth and further develop its artificial intelligence-driven system to connect job seekers with employers.

Wellington Management Company and returning investor IVP co-led the round, bringing total funding to $219 million for the eight-year-old company. ZipRecruiter’s post-money valuation following the round is $1.5 billion, making it one of the latest startups to disclose that it had achieved proverbial “unicorn” status.

“In a tight and ever-evolving labor market, businesses need effective, innovative hiring solutions now more than ever,” Eric Liaw, general partner at IVP, said in a statement announcing the funding. “ZipRecruiter has modernized the recruitment experience in an essential, undeniable way. Their sophisticated implementation of AI technology has established them as the foremost platform in the space, having driven millions of employment matches—they’re truly poised to be the next internet marketplace success story.”

Available online and on iOS and Android, ZipRecruiter added an average of 1 million job seekers and 10,000 new employers per month in the first quarter of 2018, the Santa Monica, California-based company said. Since inception, it has seen more than 430 million job applications through the platform.

ZipRecruiter earns the bulk of its revenue by offering subscriptions to employers listing openings, or services to enterprise customers who pay for traffic on a pay-per-click or pay-per-applicant basis. ZipRecruiter has been profitable since before the latest round of funding, the company said.

Ian Siegel, co-founder and CEO of ZipRecruiter, said he created the platform after becoming fed up with the hassle of having to post job openings to multiple boards to reach candidates.

“I always wished for a magic button I could push that would send my job to all job boards and have all the candidates come into one list, so I just built it,” Siegel said in an interview with Yahoo Finance.

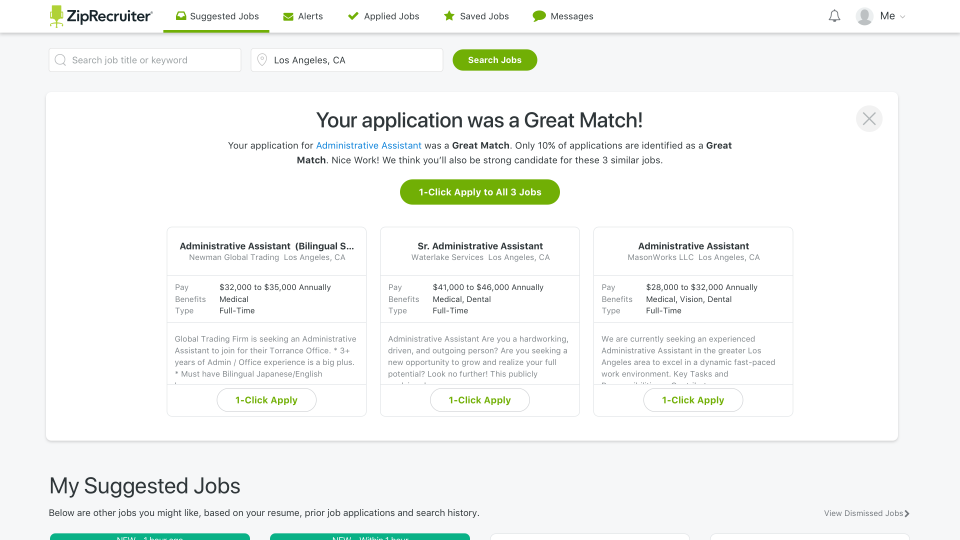

ZipRecruiter, which began primarily as a job listing distribution platform when it first launched in 2010, has since built out its machine learning and artificial intelligence capabilities to match candidates with job openings based on relevant skills and experience, Siegel said. The company noted that job seekers applying to AI-recommended jobs on the platform are twice as likely to move forward in the hiring process.

ZipRecruiter focuses on building out a positive user experience for job seekers, Siegel said, but employers have also gained from the service — especially given the current economic landscape. With unemployment holding at a low 3.9% rate as of August, employers “are starved for talent,” Siegel said.

“We have changed the job experience for both sides of the marketplace from waiting for serendipity to bring them together — meaning like an employer posts a job and hopes the right candidate applies for that job — to a matching exercise,” Siegel said. “That’s really what we do: We’re in the matchmaking business.”

ZipRecruiter operates within a crowded industry for human resources and employment search services — and one that has been ripe with M&A action and soaring valuations. Professional social networking site LinkedIn was acquired by software giant Microsoft for $26.2 billion in 2016, and Glassdoor was purchased by Japan-headquartered Recruit Holdings for $1.2 billion earlier this year.

Recently, Upwork (UPWK), an online platform connecting freelancers with clients, made its public debut on Wednesday. Its initial public offering raised $187 million at an about $1.5 billion valuation, and the company’s stock surged more than 40% at the close of its first day of trading on the Nasdaq.

As for ZipRecruiter, “it’s not our ambition to be acquired,” Siegel said. While he didn’t disclose any plans for a near-term IPO, he added, “it’s definitely a possibility and one of the many great options that we have in front of us.”

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Read more from Emily:

Bernie Sanders on Amazon: ‘I want to give credit where credit is due’

Analyst: ‘Tesla is set up to run away’ from competitors

Weed stock Tilray is sending investors on an incredible ride

Tilray shares jump as company says it’s exporting cannabis to sick children in Australia

A trade war won’t rattle the ‘white hot’ US economy

White House economist: Tariffs are hurting China much more than the US