Marriages are crumbling under student loan debt

The average outstanding balance for student loan borrowers is $34,144. The average student loan debt for the class that graduated from college in 2017 was about $39,400.

And over time, the resultant stress takes a toll on relationships.

“According to a study by Student Loan Hero, a website for managing education debt, more than a third of borrowers said college loans and other money factors contributed to their divorce,” Jen Rogers explained on the Final Round. “In fact, 13% of divorcees blamed student loans, specifically, for ending their relationship.”

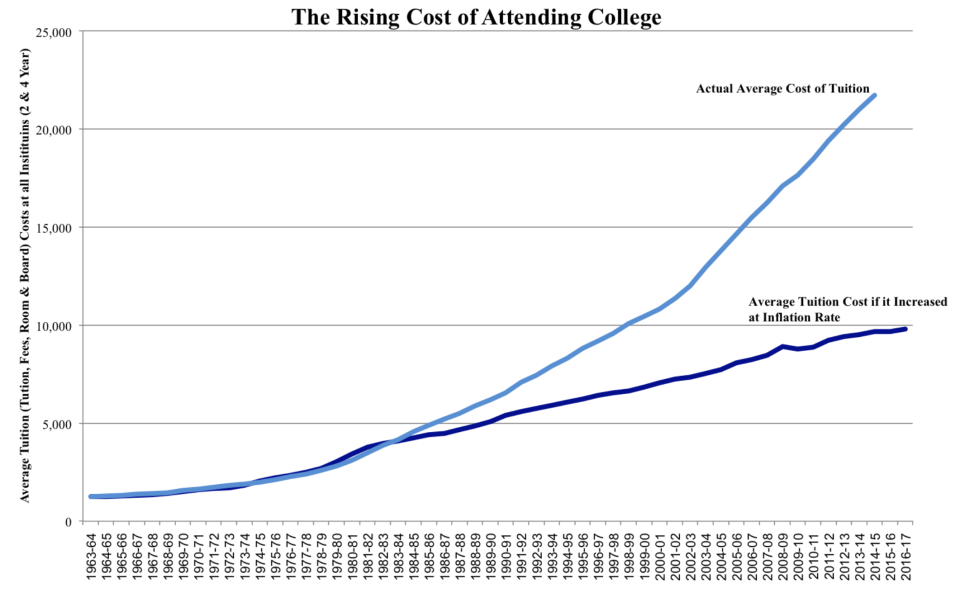

“I’m surprised it’s not higher,” Jared Blikre responded. “Because when I looked into this report, it’s amazing. It says the average outstanding balance is currently $34,000. That’s up 62% over the last decade. In addition, the percentage of borrowers who owe $50,000 or more has tripled over the same period. The cost of college is just out of control.”

A previous survey of more than 1,000 borrowers founds that 43 percent of respondents said they fight about money “somewhat often” with their partner. Others take a nondisclosure route: 24 percent of those surveyed said they’ve kept their student loans a secret from their partner, and 18 percent said it’s okay to lie to a partner about money.

Divorce adds to debt

Ironically, borrowers who do end up taking the divorce route end up incurring more debt to cover the costs.

The average cost of a divorce is between $12,500 and $19,200 as proceedings can include fees for lawyers, appraisals, custody assessments, and courts.

And those who are saddled with student loans can end up paying about $2,000 more than their loan-free counterparts.

Millennials, in particular, are struggling

As Yahoo Finance previously reported, only 50 percent of millennials are expected to earn more than their parents (with that number trending downward).

Considering that only 22 percent of millennials are debt-free, according to NBC News, the financial mobility enjoyed by previous generations is becoming less and less likely for Gen Y.

Along with getting married later than previous generations, millennials are also forgoing homeownership. According to Student Loan Hero, 41 percent of millennials would buy a home if not for their debt.

Vacationing was the next highest aspiration, with 35 percent of respondents saying they would travel more if they weren’t dealing with debt.

Overall, 39 percent of millennials recently surveyed said too much debt is their No. 1 source of stress.

READ MORE:

How fake student loan expert Drew Cloud fooled real people