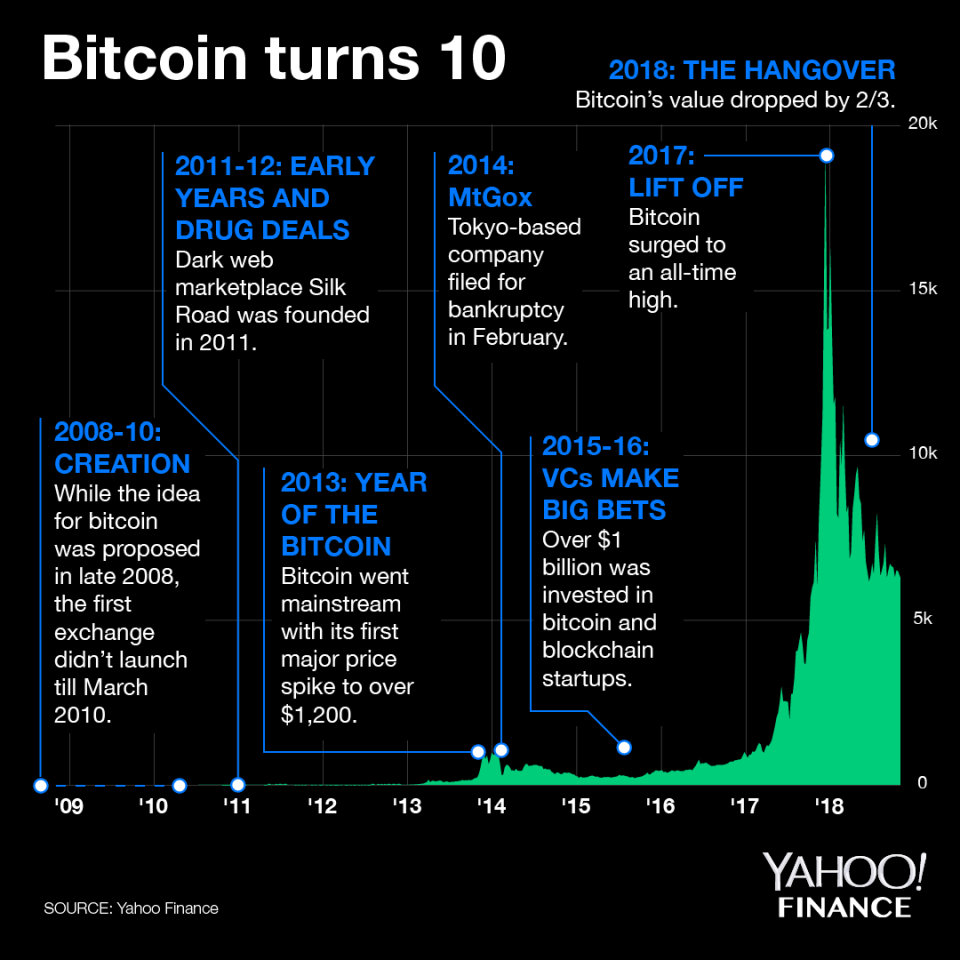

Bitcoin turns 10: An annotated timeline

This post has been updated.

Wednesday marks 10 years since the white paper “Bitcoin: A Peer-to-Peer Electronic Cash System” was posted to a cryptographic mailing list, sparking one of the biggest flurries of tech innovation in a decade.

The paper, by the still-unknown Satoshi Nakamoto, led to the creation of bitcoin, the first cryptocurrency. There are now over 2,000 cryptocurrencies in circulation and the entire industry is worth over $200 billion.

For those who haven’t been following bitcoin closely, below is a rundown of the story of the asset thus far:

2008-2010: Year dot

Although the initial idea for bitcoin was first proposed in late 2008, it wasn’t until January 2009 that the bitcoin network was first created. Even then, there were no bitcoin exchanges for the first year, meaning there was no quoted price for bitcoin. The first exchange — the now defunct BitcoinMarkets.com — launched in March 2010. The first real-world bitcoin transaction took place a few months later when Laszlo Hanyecz bought two pizzas for 10,000 BTC in Florida. The highest price for bitcoin across 2010 was $0.39.

2011-2012: Early years and drug deals

Over the next few years bitcoin slowly began to creep into mainstream consciousness but, unfortunately, for the wrong reasons.

One of the first people to grasp the radical possibilities of an anonymous online currency was Ross Ulbricht, aka Dread Pirate Roberts, who founded dark web marketplace Silk Road in 2011. The infamous online site was dominated by drug sales and used bitcoin as its currency. An estimated $1 billion-worth of bitcoin changed hands over the site before it was shut down by the FBI in 2013.

2013: Year of the bitcoin

Bitcoin went properly mainstream in 2013 with increasing media mentions, growing numbers of new bitcoin companies popping up, and big businesses such as Baidu and Overstock agreeing to accept bitcoin.

In early 2013, leading exchange Coinbase said it had sold over $1m-worth of bitcoin in a month for the first time, a sign that the market was growing. Indeed, bitcoin experienced its first major price spike in 2013, rising to over $1,200 by the end of the year. A Forbes article in December declared 2013 the “Year of the Bitcoin.” However, the Chinese government banned bitcoin at the end of the year, causing the price to drop.

2014: MtGox

Bitcoin was dealt a major blow in 2014 with the collapse of bitcoin exchange MtGox, which was by far the largest cryptocurrency exchange globally at the time. Tokyo-based MtGox filed for bankruptcy in February 2014 after suffering a major hack that it initially thought cost it 850,000 bitcoin.

The collapse of MtGox coincided with some of the air coming out of the bitcoin price bubble that had inflated in 2013. After starting the year at close to $1,000, bitcoin finished 2014 nearer $300.

2015-16: VCs make big bets on crypto and blockchain

Despite retail investors getting their fingers burned by MtGox, venture capital firms were beginning to wake up to the potential of bitcoin, cryptocurrencies, and blockchain, which is the cryptographic database technology underpinning virtual currencies. Over $1 billion was invested in bitcoin and blockchain startups across 2015 and 2016, according to CB Insights. That’s more than double what was invested across the prior three years.

Banks, which had long dismissed and derided bitcoin, also began to look at blockchain (although not cryptocurrencies). A report from Santander in 2015 estimated that banks could save $20 billion a year in back office costs by moving to the new technology.

Bitcoin’s price remained stuck in a range while all this was going on, failing to beat the price high it recorded in 2014.

2017: Liftoff

Bitcoin finally passed its 2014 price peak in 2017 — and then some. The price exploded in 2017 as interest in cryptocurrencies surged. It coincided with a slew of new cryptocurrencies being launched, which attracted huge amounts of retail investment.

Bitcoin surged to a high of over $20,000 by the end of 2017, with daily price spikes of more than 10% not unusual. As the price rocketed, more mainstream financial firms began to look at the asset. Exchange operators CBOE and CME Group both launched bitcoin futures in December.

However, the surge appeared to be driven by investors piling in looking for short-term returns. By the end of the year, analysts were warning about a bubble.

2018 The hangover

Bitcoin and other cryptocurrencies crashed back down to earth in 2018 as people began to realise that 2017 price rise was largely driven by hopes of short term gains rather than any fundamentals. Bitcoin dropped sharply during the first three months of the year but has now been stuck in a range around the $6,200 mark for the past two months. This has coincided with a period of unusually low volatility of the cryptocurrency.

In October the Financial Action Task Force (FATF), the Paris-based global money-laundering watchdog, announced that it would establish rules for governments to oversee cryptocurrencies. Also in October, the Securities and Exchange Commission (SEC) widened its crackdown on certain parts of the crypto market.

READ MORE: What crypto investment firms are telling clients during a bear market

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.