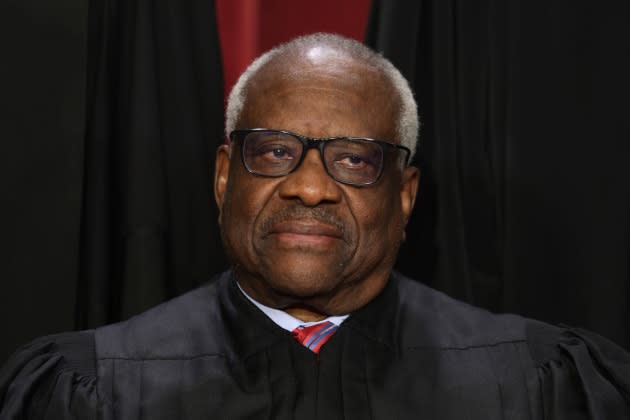

More Irregularities Uncovered in Clarence Thomas’ Financial Disclosures: Report

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

Supreme Court Justice Clarence Thomas has for more than a decade claimed on mandatory financial disclosure forms that he received significant income from a defunct real estate firm, Ginger, Ltd., Partnership, that has been shuttered since 2006.

This news comes only 10 days after ProPublica reported that the justice has received — but failed to disclose — hundreds of thousands of dollars’ worth of gifted vacations from conservative billionaire and Nazi enthusiast Harlan Crow. The billionaire also owns the home where Thomas’ mother lives, which Crow purchased from Thomas and members of his family before embarking on major renovations to the property. Thomas failed to disclose the sale of the home on financial forms, leaving blank the field for reporting the identity of a buyer in any private transactions above $1,000, including real estate. The revelations have led some to question whether Thomas was intentionally hiding his financial relationship with Crow.

More from Rolling Stone

On Sunday, The Washington Post revealed that in addition to not disclosing luxurious vacations and the real estate deal involving Crow, Thomas also erroneously reported hundreds of thousands of dollars in rental income from property that his wife Ginni Thomas’ parents developed in Nebraska. In financial disclosures, Thomas reported the rental income as coming from a real estate firm called “Ginger, Ltd., Partnership.” But that firm has not existed since March 2006 when it was dissolved and its leases for upwards of 200 residential lots were transferred to Ginger Holdings, LLC. Ginni Thomas’ sister, Joanne K. Elliot, is listed as manager of the Ginger Holdings, LLC, but Ginni is not listed in the LLC’s state incorporation records.

The recent news surrounding Thomas’ financial disclosures has spurred Democrats to call on the policymaking body for the federal courts, the Judicial Conference, to refer Thomas to the attorney general’s office to investigate whether the justice ran afoul of federal ethics law. In a letter signed by Democratic leaders of the House and Senate Judiciary Committees, Democrats accused Thomas of an “apparent pattern of noncompliance with disclosure requirements” and noted that in 2011, Thomas admitted he had not correctly disclosed his wife’s income for a number of years. Thomas claimed at the time that his failure to disclose was due to a “a misunderstanding of the filing instructions.” But Democrats pointed out that Thomas had “accurately fil[ed] disclosure forms regarding his spouse’s employment for as many as 10 years beginning in 1987.”

Responding to the allegations that he did not report the vacations funded by Crow, Thomas said he was not aware he had to disclose “this sort of personal hospitality” but said he would follow the Judicial Conference’s guidelines moving forward.

All of these irregularities in the justice’s financial disclosures, combined with his wife’s close involvement in Donald Trump’s attempts to overturn the 2020 election have led many to question Thomas’ dedication to ethics.

“Any presumption in favor of Thomas’s integrity and commitment to comply with the law is gone. His assurances and promises cannot be trusted. Is there more? What’s the whole story? The nation needs to know,” Stephen Gillers, a New York University legal ethics expert, told the Post.

Best of Rolling Stone