Why Altria possibly taking a stake in Juul is a smart move

Altria Group shares (MO) jumped more than 2% in morning trading after the Wall Street Journal reported Wednesday evening that the tobacco company was exploring taking a minority stake in the market dominating e-cigarette startup Juul Labs.

The move by Altria, one of the world’s largest tobacco companies that made its fortune through its traditional cigarette brands like Marlboro and Virginia Slims, would significantly bolster the company’s e-cigarette offerings. While Altria manufactures e-cigarettes and cig-a-like products, its offerings have paled in comparison to the rapid rise of Juul’s market leading e-cig that, for better or for worse, has attracted a cult-like following among younger customers.

Altria’s total e-cigarette sales, which topped $217 million in the 52-week period ending November 3, accounted for about 8% of the $2.74 billion e-cigarette market, according to Nielsen data compiled by Wells Fargo analyst Bonnie Herzog. To compare, Altria’s traditional cigarette revenue over the same period topped $33 billion. Market leading Juul notched nearly $1.7 billion in e-cigarette sales, accounting for over 60% of the total e-cig category over the same 52-week period. The startup is accelerating the rate at which it steals market share, however. Last month, Juul stretched to account for about 75% of total e-cig dollar sales.

Altria continues to lose market share in the e-cig category.

Commenting on the potential deal, Herzog applauded what both companies stand to gain. “We think this would be the absolute right decision for [Altria] given where we think the reduced risk industry is heading and because Juul is the ‘it’ brand,” she said, reiterating her Outperform rating on Altria stock. “Ultimately, we believe [Altria’s] stake in Juul will help to catapult Juul’s growth internationally.”

Juul has been testing lower nicotine pods ahead of plans to expand in the European Union where nicotine regulations require lower amounts than what Juul currently offers in its e-cig pods.

Both companies, however, have been facing increasing regulatory pressure from the Food & Drug Administration as FDA Commissioner Scott Gottlieb has repeatedly decried a rise in underage e-cigarette use. The FDA gave top manufacturers 60 days to come up with plans to curtail underage use earlier this summer. Altria responded by offering to pull its MarkTen e-cigarettes from the market and limiting flavors in its cig-a-like products that were said to appeal to teens. Earlier this month, Juul announced it was shutting down its social media accounts and also halting the sale of its flavored e-cigarette pods at retail locations.

Altria is still awaiting FDA approval of the heat-not-burn IQOS vaping device from sister company Philip Morris that Altria plans to distribute in the U.S. Investing in Juul could be a hedge against the success of IQOS, as much as it is a bet on a startup that has blown past big tobacco’s offerings in the e-cig market.

Juul is hot

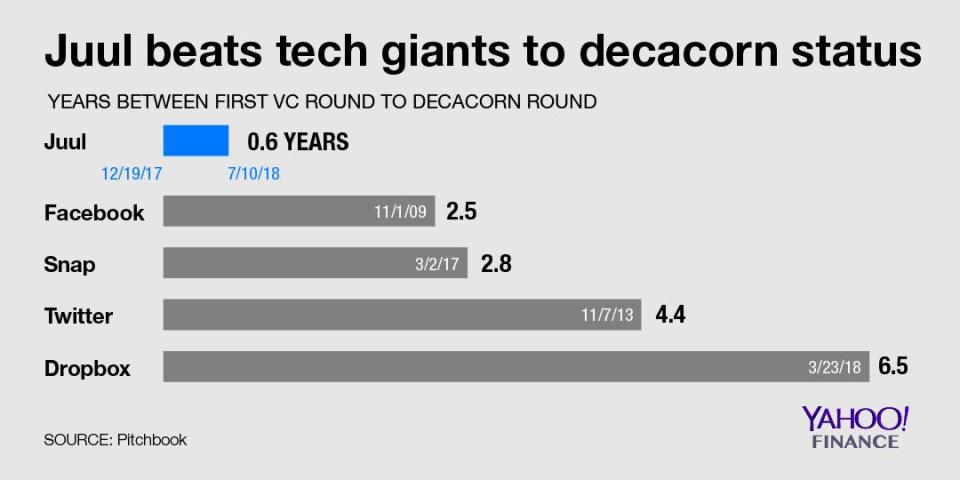

Since launching its e-cig, which looks like a USB drive, in 2015, Juul has enjoyed a meteoric rise. Sales have been growing exponentially for the past two years, and after raising $650 million from investment fund Tiger Global this summer, Juul became the quickest startup in history to reach a valuation of more than $10 billion just seven months after its first fundraising round.

Leading e-cigarette maker Juul Labs was able to go from first VC round to a valuation of over $10 billion in the record time of just seven months.

With a nearly $16 billion valuation attached to Juul’s last fundraising round, Altria would likely have to pay a dollar figure in the low billions to take a significant stake in the startup, but Herzog believes it would still be money well spent.

“From a balance sheet standpoint, we think the investment would be entirely ‘do-able’ for [Altria] given its very low leverage… and excellent cash flow,” she wrote. “While we assume [Altria] would pay a fairly rich multiple to acquire its Juul stake, we think this would be the absolute right decision…”

A Juul spokesperson declined to comment on the reported Altria deal talks.

Zack Guzman is a senior writer and on-air reporter covering entrepreneurship, startups, and breaking news at Yahoo Finance. Follow him on Twitter @zGuz.

Read more:

Juul surpasses Facebook as fastest startup to reach decacorn status

How Juul became the FDA’s latest target

Joe Camel illustrator: E-cig maker Juul’s marketing ‘seems more egregious’