Wells Fargo economist: It's time to abandon the yield curve

Maybe an inverting yield curve isn’t the best bellwether of a recession — that’s according to one economist who says he has a better model that is predicting a recession in 2019.

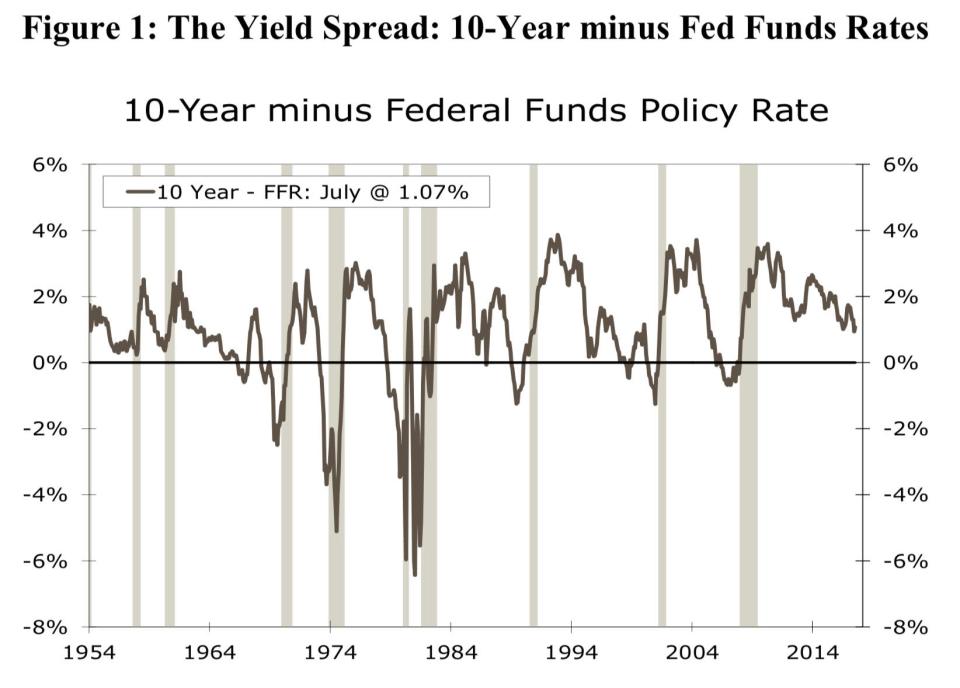

Azhar Iqbal, director and econometrician at Wells Fargo Securities, writes in a paper that an inverting yield curve has predicted all recessions since the 1969 recession. But the yield curve notably did not invert between 1954 and 1965, during which there were two recessions (in 1957 and then in 1960).

At the American Economic Association conference in Atlanta Friday, Iqbal told Yahoo Finance that monetary conditions are now looking similar to the 1950s and ‘60s and has a bold call: that the yield curve will fail to predict the next recession.

“All signs are coming,” Iqbal said. “And it’s already the second longest expansion.”

Iqbal, who co-wrote the piece along with Wells Fargo’s Sam Bullard and Shannon Seery, writes that one major similarity is that the central bank is in the process of trying to elevate the federal funds rate from the zero-bound — its lowest level since July 1958, when the benchmark interest rate was at 0.68%.

The paper notes that historically low rates make it more difficult for the yield curve to invert because Treasury rates themselves are also low. In April 1954, the 10-year yield was at 2.29%. In the current post-crisis period, the 10-year has been as low as 1.98% — that was in September 2011.

“We may not see the inversion point,” Iqbal told Yahoo Finance of the current cycle.

A new framework for predicting recessions

Instead, Iqbal proposes a new framework for predicting recessions: the spread between the 10-year Treasury and the federal funds rate. The paper notes that this model is better than the yield curve because it factors in both monetary policy and market expectations.

In short, in a rising rate environment, when the fed funds rate crosses or touches the lowest level of the 10-year yield in that cycle, the model will predict a recession with an average lead time of 17 months.

The trend shows that the 10-year is headed toward the current federal funds rate. At close on Friday, the 10-year Treasury was at 2.659% and the fed funds rate target range is between 2.25% and 2.50%.

His paper has a clear warning: “decision makers should be watching 2019 for a potential recession,” adding that the White House’s trade war “may favor the 2019 recession call.”

The model has predicted all recessions since 1954 but the paper notes that it also called recessions four times in instances where there weren’t any. The paper says in all four cases, the Fed dramatically changed its monetary policy stance by shifting from raising rates to cutting interest rates.

“[A] reason not to declare these four calls as false positives is that, during long economic expansions, the Fed has reduced interest rates to ‘boost’ the economy from a ‘mid-cycle slowdown,’” the paper reads.

As of Friday afternoon, fed funds futures contracts are pricing a 0.5% chance that the Fed cuts target range for interest rates by 25 basis points in its January 30 policy-setting meeting.

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

Read more:

Fed Chair Powell communicates that monetary policy is not on autopilot

Warren turns up rhetoric against Wall Street in 2020 bid

Leveraged loans aren't as attractive as they used to be

Banks wave off Mnuchin's concerns over liquidity

Congress may have accidentally freed nearly all banks from the Volcker Rule