This week in Trumponomics: Markets like the midterm outcome

President Trump warned of a “socialist nightmare” if Democrats gained power in this year’s midterm elections. Well, Democrats gained some power, and there’s no sign at all that markets are worried about it.

Democrats won control of the House of Representatives in the Nov. 6 midterms, while Republicans retained control of the Senate. The split Congress means Republican plans to cut taxes further, try another Obamacare repeal and continue deregulatory rollbacks are effectively stalled. On the surface, this might sound like modestly bad news for the corporate sector. But markets indicated otherwise, with the S&P 500 staging an impressive 2.1% rally the day after the elections, and the Nasdaq up 2.6%.

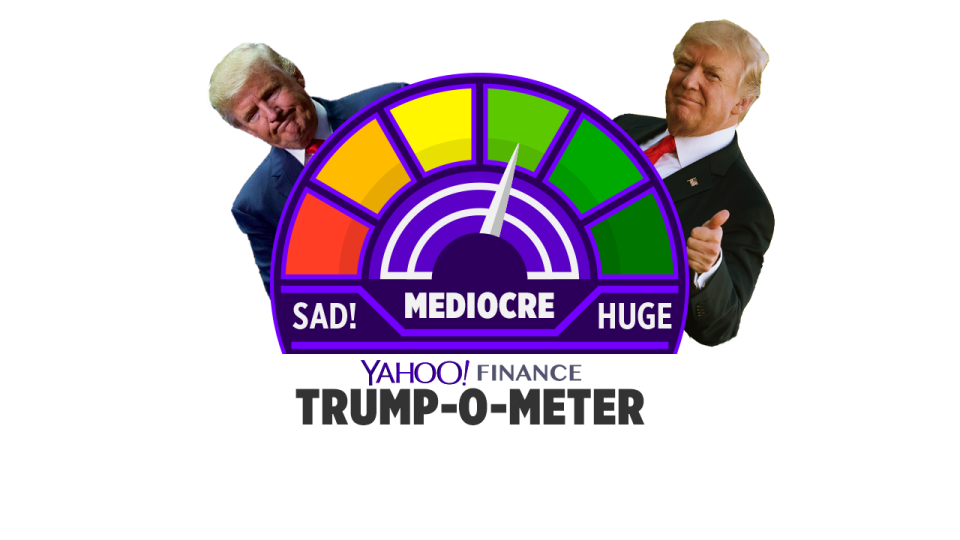

With the elections finally over, and markets seemingly content, this week’s Trump-o-meter reads MEDIOCRE, our third-highest reading.

Trump himself didn’t have anything to do with the post-election rally, of course. That’s okay, because our Trump-o-meter is meant to measure the most significant weekly developments in the Trump economy. And the elections were clearly momentous. Democrats didn’t crush Trumpism, as some liberals hoped. But they clawed back enough of a toehold on power to check many Trump policies and offer voters an alternative vision of government as they contemplate the 2020 presidential election.

[Check out Trump’s grade on our Trumponomics Report Card.]

The market reaction to the midterms also reveals an intriguing concern about Republican economic policies. Congressional Republicans had drafted a modest tax cut, dubbed Tax Cut 2.0, that would have filled in some gaps in the huge package of tax cuts they passed last year. Trump added to that with an ad hoc plan to cut “middle-class” taxes by 10%, though he didn’t define middle class. Both might have passed if Republicans retained control of both houses.

Post-election rally

Markets normally like tax cuts, because they give businesses and consumers more disposable income and typically boost spending and corporate profits. But markets seem a bit relieved there won’t be any further GOP tax cuts. In a note to clients, Goldman Sachs called the possibility of further tax cuts an “expansionary tail risk” and said the elimination of this risk “should be positive for markets.”

Here’s why: Tax cuts reduce federal revenue, forcing the Treasury to borrow more to maintain Congressionally authorized spending levels. The additional borrowing tends to push up interest rates, since a growing supply of Treasury debt forces the issuer—Uncle Sam—to pay more via higher rates to attract buyers. Higher rates are generally a negative for corporate earnings since they equate to higher borrowing costs. More tax cuts also would have amounted to an economic stimulus that might trigger more aggressive monetary tightening by the Federal Reserve, also a possible negative for stocks. So taking tax cuts off the table might be a good thing.

The post-election relief rally could turn out to be short-lived. Stocks drifted back down after the one-day rally, as investors went back to assessing earnings and economic data. Earnings still look good, but there are mounting warnings of a global economic slowdown underway. “The global expansion has passed its peak for this cycle,” Moody’s Analytics declared in a research note three days after the elections. A recession isn’t imminent, but “heightened downside risks threaten to deliver a faster-than-forecast downturn in global activity.”

One of those risks: Trump’s trade war with China. Markets have more or less digested Trump’s trade actions so far, including tariffs on half of all Chinese imports to the United States, and retaliatory measures by China. But the stakes are set to go higher, with the tariff rate set to rise from 10% to 25% on Jan. 1. And Trump may soon impose tariffs on the other 50% of Chinese imports, which would include thousands of consumer goods. Markets may get indigestion yet.

Confidential tip line: rickjnewman@yahoo.com. Click here to get Rick’s stories by email.

Read more:

Rick Newman is the author of four books, including “Rebounders: How Winners Pivot from Setback to Success.” Follow him on Twitter: @rickjnewman