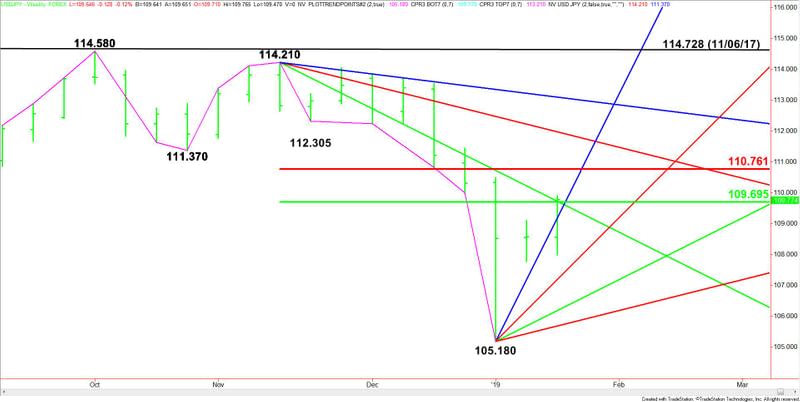

USD/JPY Forex Technical Analysis – Key Level to Overcome This Week for Bullish Traders is 109.695

The Dollar/Yen closed higher last week. The buying was driven by a rise in U.S. Treasury yields. Despite the Federal Reserve saying it would take a cautious approach toward raising rates. The market, which is represented by Treasury yields, sees the economy as strengthening amid the news that the U.S and China may be moving closer toward a trade deal.

Last week, the USD/JPY settled at 109.774, up 1.212 or +1.12%.

Weekly Technical Analysis

The main trend is down according to the weekly swing chart. A trade through 114.210 will change the main trend to up. A trade through 105.180 will signal a resumption of the downtrend.

The main range is 114.210 to 105.180. Its retracement zone at 109.695 to 110.760 is controlling the near-term direction of the Forex pair. The USD/JPY closed inside this zone last week.

Weekly Technical Forecast

Based on last week’s close at 109.774, the direction of the USD/JPY this week is likely to be determined by trader reaction to the main 50% level at 109.695.

Bullish Scenario

A sustained move over 109.695 will indicate the presence of buyers. If this can create enough upside momentum then look for a rally into the main Fibonacci level at 110.761.

Overtaking 110.761 will indicate the buying is getting stronger. This could drive the USD/JPY into a steep uptrending Gann angle at 111.180. Overcoming this angle will put the Forex pair in a bullish position with the downtrending Gann angle at 111.710 the next potential upside target.

Bearish Scenario

A sustained move under 109.695 will signal the presence of sellers. Crossing to the bearish side of the downtrending Gann angle at 109.210 will put the USD/JPY in a bearish position. This could lead to a test of the uptrending Gann angle at 108.180.

Essentially, buyers need to hold above 109.695 then take out 110.761 with conviction in order to shift weekly momentum to the upside.

This article was originally posted on FX Empire