Uber shares start trading – What to know in markets Friday

The public is about to get a piece of Uber.

The ride-sharing company is set to begin trading on the New York Stock Exchange on Friday, under the symbol “UBER.” The offering gives retail investors their first chance to buy shares of the ride-hailing market’s leader.

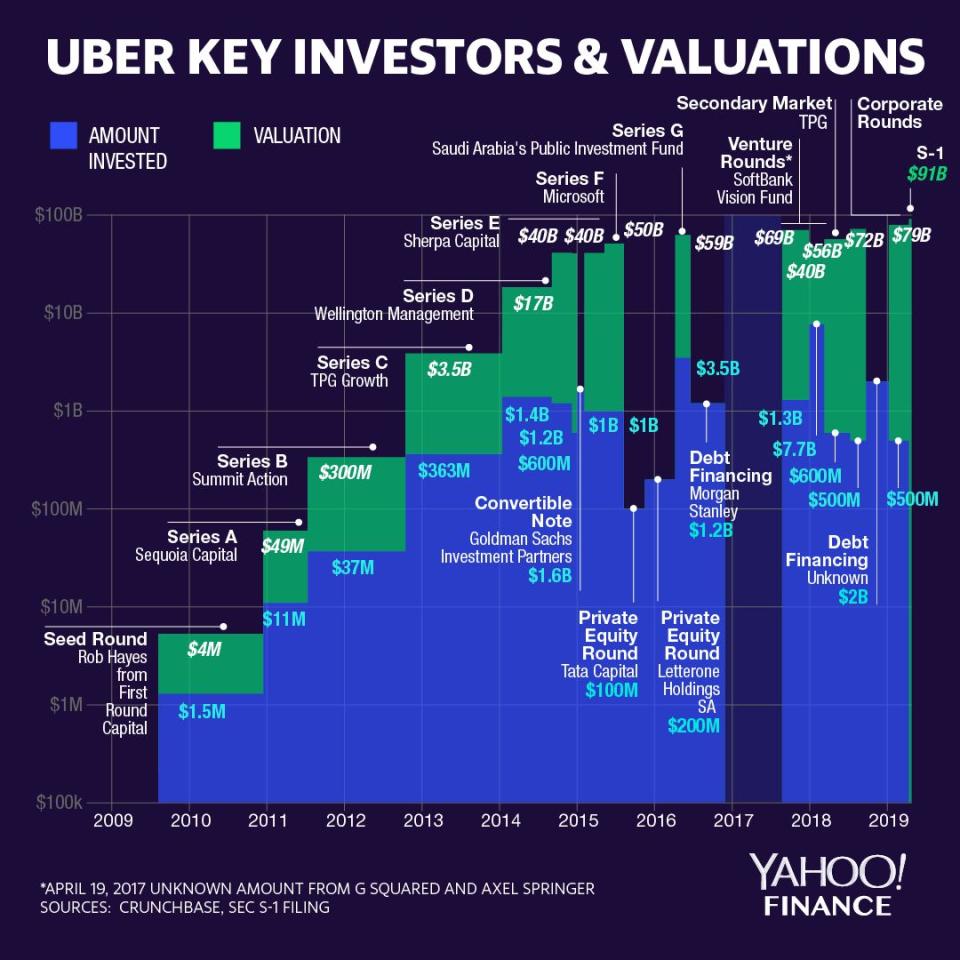

On Thursday, Uber priced its initial public offering at $45 per share, at the low end of its targeted range of between $44 and $50 per share. This implies a market valuation of about $82.4 billion on a fully diluted basis. However, it’s down sharply from the as much as $120 billion valuation reportedly floated earlier as the company sought a public listing.

Uber’s offering has arguably been the most hotly anticipated in this year’s wave of major tech IPOs – but it’s also been one of the most divisive.

To naysayers, Uber is a company fraught with years’ worth of public relations nightmares, and a questionable path to profitability. But to others, it’s a company leading the next wave of tech revolution, on par with some of corporate America’s biggest disruptive forces.

Recently, Uber’s woes have been magnified amid the lackluster performance of Lyft, its peer ride-sharing company, and a stock market that’s fallen 2.5% this week alone. Those factors were speculated to have undermined Uber’s IPO pricing.

Over the past month and a half, Uber employees, as well as existing and potential investors, have watched Lyft (LYFT) fall flat in its own public debut. Its stock has fallen 23.4% from its IPO price through market close Thursday— and hit its lowest level Wednesday after reporting first-quarter results just the day prior.

‘One trick pony’

Many investors have looked to Lyft’s stock as a proxy for Uber’s eventual performance, given the essential duopoly of the domestic ride-hailing market. As of April 29, Uber had 64% U.S. marketshare of ride share, in terms of customer spend, versus Lyft’s 36%, according to a report from research firm Edison Trends.

But as many analysts are quick to point out, the two companies have embraced very different business strategies, making conflation of the two a futile task.

Whereas Lyft has been focusing more on capturing the North American market through a pure-play “transportation as a service” (TaaS) directive, Uber’s ambitions have been wider-reaching. The company has dipped into freight and food delivery services, and has a credit card offering through issuing bank Barclays.

“We continue to view Lyft as a one-trick pony domestic ride sharing player and ‘little brother’ to Uber, which has clearly established itself as the clear #1 player and in our opinion is paving a similar road to what Amazon did to transform retail/e-commerce and Facebook did for social media,” Wedbush analyst Dan Ives wrote in a note Thursday.

But these additional business segments have required deeper investments on Uber’s part, and with that, steep losses. Uber reported an adjusted loss of $1.8 billion for 2018, narrower than the loss from the year earlier. Meanwhile, revenue in 2018 grew 42% from 2017 to $11.3 billion.

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Read more from Emily: