Uber, Lyft: Gig economy employees are facing a heightened retirement crisis

Americans are increasingly falling behind on their retirement savings, and it could be even worse for the millions working in the gig economy.

Despite the overall gig economy booming with companies like Lyft (LYFT) and Uber (UBER) going public, the companies’ staunch resistance to meet drivers’ demands for full-time employment and benefits “has the potential” to worsen the retirement crisis, Chad Parks, Founder and CEO of Ubiquity Retirement + Savings told Yahoo Finance.

“To the best of our knowledge, ride-share companies have not formalized retirement savings options for their drivers,” Parks explained. And “in today’s world where most companies have abandoned pension plans and Social Security provides a very small portion of your retirement income, it puts the onus squarely on you to save for your future. It’s unfortunate, but this is the reality.”

‘This is a sick joke right?’

There are nearly 16 million workers in the gig economy, according to a report by MBO Partners. Most are part-timers who freelance on the side to supplement their paychecks. For example, during the government shutdown, many federal workers actually took on driver jobs to keep themselves adrift while their paychecks were suspended.

But for those who drive for Lyft or Uber full-time, the lack of proper health insurance or retirement savings plan — on top of dealing with an average hourly wage of $9.21 — is a big pain point.

“Unfortunately, like a lot of other Americans, drivers are not thinking about retirement as much as they should,” TheRideshareGuy.com Founder Harry Campbell told Yahoo Finance. “But this is also a function of the fact that nearly all of their pay is going to cover the day-to-day expenses.”

To be fair, Uber has been offering some sort of retirement savings option for drivers with a partnership with a robo-advisor called Betterment. But skepticism is rampant.

“I wouldn't involve Lyft or Uber with my retirement planning,” one driver wrote on Uberpeople, an online forum for Uber drivers. “Odds are you're not going to be working for them for very long, at least in the present form.”

Another wrote: “This is a sick joke right?”

Campbell sided with the drivers.

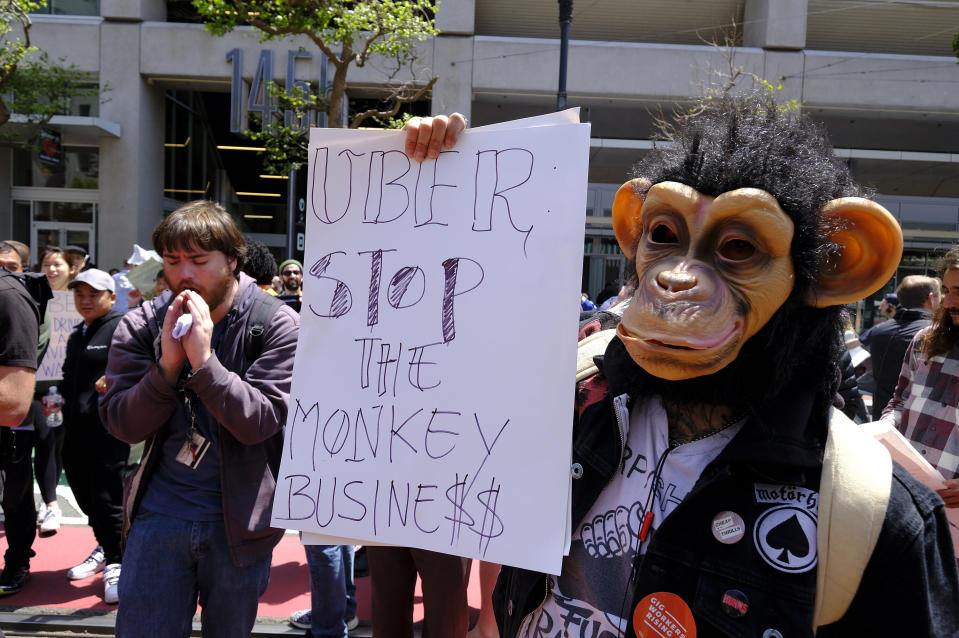

“The betterment partnership was a lot more fluff than substance in my opinion seeing as Uber didn’t contribute any money to the plan,” said Campbell. “A lot of drivers are struggling to get by as evidenced by the recent strikes and protests against Uber, so unfortunately saving for retirement is the last thing on their mind.”

‘Financial services industry is misaligned with the realities of the modern workplace’

And, unfortunately, the existing system also doesn’t do much for gig workers since they don’t have an established employer.

“The financial services industry is misaligned with the realities of the modern workplace, such as companies like Uber with a strong force of independent contract workers,” said Parks. “You can’t rely upon the government or your employer to take care of your retirement savings.”

Parks, the Ubiquity Retirement + Savings CEO, did offer three solutions for gig workers looking for a retirement savings vehicle: a traditional IRA plan, a Roth IRA plan, and an individual 401(K) plan.

The first one was good for those over 40, while Roth IRA was better for those under 40, he added. Both of those would be tax-deferred. And the individual 401(K) plan is “especially attractive for higher earners,” he added.

Aarthi is a writer for Yahoo Finance. Follow her on Twitter @aarthiswami.

READ MORE:

How Uber's largest shareholder is shaping the global ride-sharing market

Early Uber investor sees 'the same kind of situation' as Tesla

Here are all of Uber's worldwide competitors as it prepares for its IPO

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn,YouTube, and reddit.