American farmer on trade war: 'I don’t see a positive fix'

The U.S.-China trade war has had a major effect on American farmers since the Trump administration began taking action against Beijing in March 2018.

Things got worse recently when President Trump announced on Friday that the U.S. will be implementing 25% tariffs on Chinese goods. China responded on Monday by stating that starting on June 1, it will impose its own 25% tariffs on a portion of $60 billion worth of U.S. goods. Reports that Trump and China’s President Xi would be meeting in June at the G20 also surfaced, sparking hopes that the two sides might reconcile.

In the meantime, American farmers have had to deal with losing China as a major trading partner.

So what exactly would be a trade war win for farmers?

“We need to get back all of the [market] share we had prior — anything else less than won’t bring demand back to the marketplace,” Mark Watne, a farm owner and president of the North Dakota Farmers Union, told Yahoo Finance. “Then, if you take it to a win, we should actually see some increases of sales into China, over what we got prior to the announcement of the trade war.”

But “the fact is, we’re no longer a good trading partner in the sense of being reliable,” Watne explained. “So China is now looking at ways to produce their own food faster than they were in the past. I don’t see a positive fix on this thing very likely. My hope is to get back what we had before.”

Blake Hurst, a soybean farmer and president of the Missouri Farm Bureau, agreed that American farmers have already lost ground.

“I’m very disappointed that ... the negotiations fell apart last week, “Hurst told Yahoo Finance. “We have been assured time and time again that progress was being made. We’ve yet to see any improvement. ...

“There’s a little bit of movement around in the markets but no, we don’t get [market share] back. They developed the habit of buying from Brazil. They’ve developed confidence in Brazil as suppliers. It’ll take a generation for us to restore that.”

Asked about how farmers could adapt, Hurst replied: “I talked to a neighbor of mine that said his farm has been in his family for 116 years. He’s afraid he’s going to become the generation to lose it. That’s how serious it’s become in the Midwest.“

Farmers ‘alarmed by signs that the administration would accept ...’

While farmers are generally supportive of the Trump administration, Watne and Hurst aren’t alone in their concerns. Other farmers are worried that even if President Trump were to reach some sort of deal with China, agriculture could be left worse than before.

Bloomberg recently reported that “many producers are alarmed by signs that the administration would accept Chinese purchase target pledges for commodities like soybeans and pork without a promise to lift retaliatory tariffs.”

The USDA has doled out billions of dollars in aid to farmers to offset the effects of the tariffs — and Trump just promised billions more — but that money only mitigates the disruption of an entire industry.

“The reality is when the government causes the problem by creating a trade war … that’s something we can’t control,” Watne said. “And a good, stable food supply is in the interest of the consumer, so they should come out here and make us whole. The president actually said that — he said he was going to hold the farmers harmless, but we’re seriously being harmed right now.”

Past-due agricultural loans were up 287% in 2018, according to Bloomberg, and farm bankruptcies are seeing a steady increase as well.

“People outside of farming don’t understand how easy our economy can get harmed,” Ken McCauley, a corn and soybean farmer, told Yahoo Finance. “If you look at it that way, it’s probably the biggest frustration I’ve ever had in all of my farming career of 47 years, because people think that it’s just a handout because farmers whine a lot, and that’s not the case. It’s the fact that so many things can change our life and our livelihood, just overnight.”

He continued: “Almost everybody else is a non-farmer. They see these government aids to help agriculture and they think it’s just a handout. Well, it’s not just a handout because the government can change things so easy on our income. And since we’re a minority in the whole country, it’s easy to do that.”

‘Potentially isn’t going to make us any money’

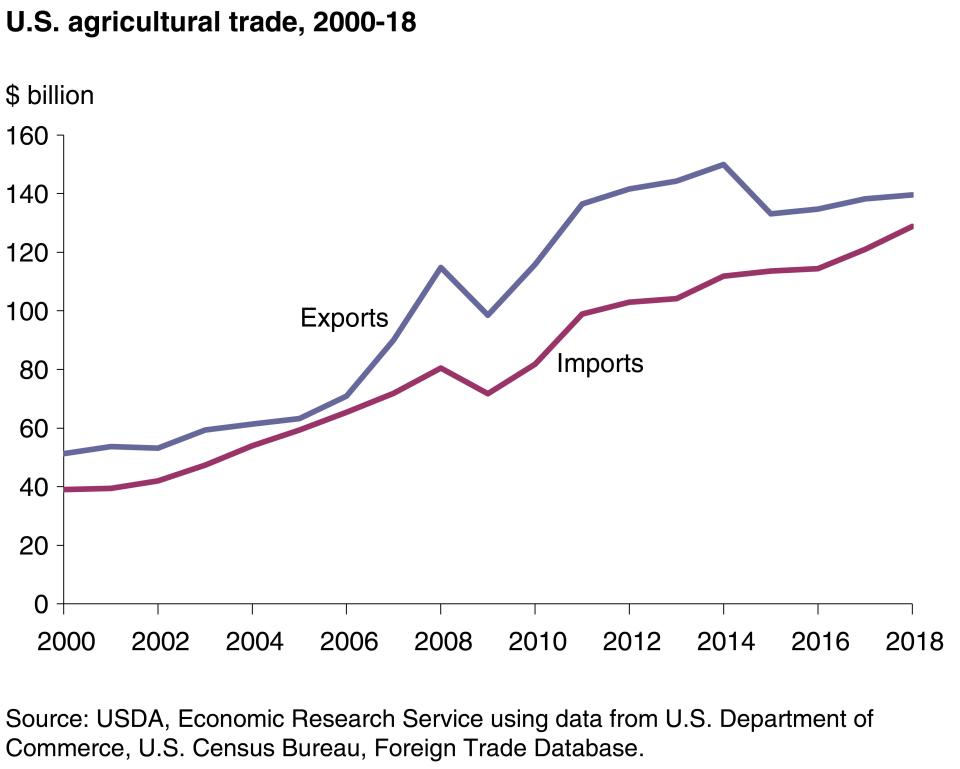

Last year, amid reduced exports to China, the U.S. saw the smallest agricultural trade surplus ($10.9 billion) since 2006. According to the USDA, exports were valued at $140 billion, only a 1% increase from 2017. And on Monday, soybean futures fell to the lowest level in a decade.

On top of the ongoing trade tensions, farmers are currently struggling amid major flooding through the midwest.

“We’re at levels at nearly every crop where we can’t make any money,” Watne said. “We’re plotting to do our planting here very soon, and we’ll know that we’re seeding a crop that potentially isn’t going to make us any money.”

The trade war and the lower commodity prices are “totally related,” Watne said. “We just took a big chunk of demand out of the marketplace, and when you start messing with a major crop like soybeans, what it does is drag the prices down on everything else.”

He explained that there is an “inner working relationship between all the commodities that make them move together. We’re looking at less than 50% income that we had in 2013, and there’s no projection out there showing we’re going to get these prices to move up dramatically in the next five years.”

In December 2018, the U.S. soybean inventory was projected to reach an estimated 955 million bushels in 2019, nearly doubling the 2018 stockpile. That projected number decreased to 910 million bushels in February 2019.

“The existing farmers or the ones just getting started are going into the bank, and they’re actually having to either extend their bushels they think they’ll get or they’ve got to convince the bank to put a little bit higher price on things,” Watne said. “And that’s all wonderful if something happens in the fall that makes it work, but we could be in a real serious crisis come next fall.”

READ MORE:

The growing U.S. soybean stockpile could come back to haunt Trump

Expert: 'We are worse off as a world' amid Trump's trade war

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.