Top Dividend Paying Companies

Dividend stocks such as CLP Holdings and Hang Seng Bank can help diversify the constant stream of cash flows generated by your portfolio. These stocks are a safe bet to increase your portfolio value as they provide both steady income and cushion against market risks. Dividends can be underrated but they form a large part of investment returns, playing an important role in compounding returns in the long run. As a long term investor, I favour these great dividend-paying stocks that continues to add value to my portfolio.

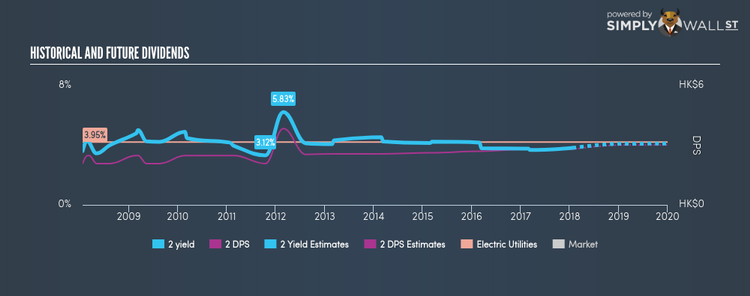

CLP Holdings Limited (SEHK:2)

CLP Holdings Limited, an investment holding company, invests in, generates, transmits, and distributes electricity in Hong Kong, Mainland China, India, Southeast Asia, Taiwan, and Australia. Formed in 1901, and currently run by Richard Lancaster, the company currently employs 7,433 people and with the market cap of HKD HK$197.57B, it falls under the large-cap group.

2 has a decent dividend yield of 3.58% and is distributing 57.42% of earnings as dividends , with the expected payout in three years being 60.00%. Although there has been some volatility in the company’s dividend yield, the DPS over a 10 year period has increased from $2.08 to $2.8. Interested in CLP Holdings? Find out more here.

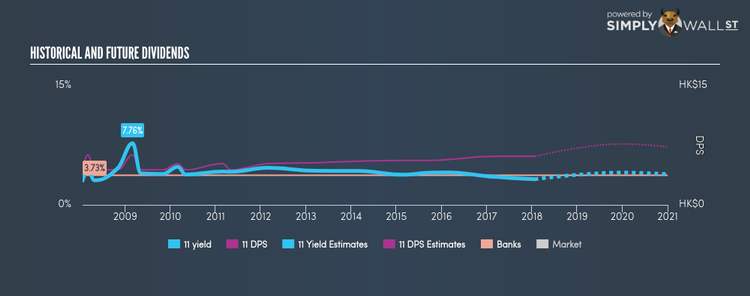

Hang Seng Bank Limited (SEHK:11)

Hang Seng Bank Limited, together with its subsidiaries, provides various banking and related financial services to individual, corporate, commercial, SME, and institutional customers in Hong Kong, Mainland China, and internationally. Founded in 1933, and currently lead by Wai Wan Cheang, the company size now stands at 9,456 people and with the company’s market capitalisation at HKD HK$361.15B, we can put it in the large-cap category.

11 has a good-sized dividend yield of 3.23% and is currently distributing 68.05% of profits to shareholders . Although there has been some volatility in the company’s dividend yield, the DPS over a 10 year period has increased from $4.4 to $6.1. Continue research on Hang Seng Bank here.

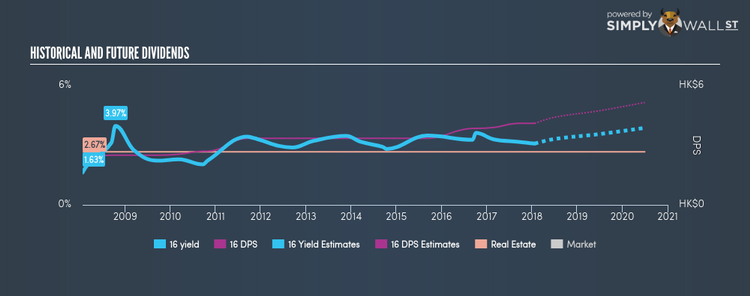

Sun Hung Kai Properties Limited (SEHK:16)

Sun Hung Kai Properties Limited develops, sells, and rents real estate properties in Hong Kong, Mainland China, and Singapore. Started in 1972, and now run by Ping-Luen Kwok, the company employs 37,000 people and has a market cap of HKD HK$385.27B, putting it in the large-cap stocks category.

16 has a solid dividend yield of 3.08% and pays out 28.40% of its profit as dividends , with the expected payout in three years hitting 41.53%. The company’s dividends per share have risen from $2.3 to $4.1 over the last 10 years. The company has been a dependable payer too, not missing a payment in this 10 year period. Sun Hung Kai Properties’s earnings growth over the past 12 months has exceeded the hk real estate industry, with the company reporting an EPS growth of 27.96% while the industry totaled 27.60%. Interested in Sun Hung Kai Properties? Find out more here.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.