Top Cheap Stocks To Buy Now

Companies, such as China Greenfresh Group, trading at a market price below their true values are considered to be undervalued. Investors can determine how much a company is worth based on how much money they are expected to make in the future, or compared to the value of their peers. The list I’ve put together below are of stocks that compare favourably on all criteria, which potentially makes them good investments if you believe the price should eventually reflect the stock’s actual value.

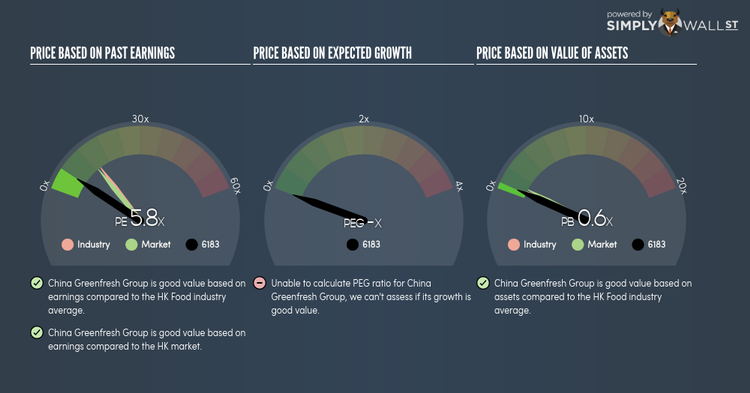

China Greenfresh Group Co., Ltd. (SEHK:6183)

China GreenFresh Group Co., Ltd. engages in the cultivation and sale of fresh edible fungi products; and manufacture and sale of processed edible fungi products in the People’s Republic of China, Europe, North America, South America, rest of Asia, and Africa. Established in 1995, and headed by CEO Songhui Zheng, the company provides employment to 641 people and with the stock’s market cap sitting at HKD HK$1.38B, it comes under the small-cap stocks category.

6183’s stock is now floating at around -70% lower than its intrinsic level of ¥4.1, at a price tag of HK$1.24, based on my discounted cash flow model. The mismatch signals a potential chance to invest in 6183 at a discounted price. In terms of relative valuation, 6183’s PE ratio is trading at around 5.77x against its its Food peer level of, 14.2x meaning that relative to other stocks in the industry, you can purchase 6183’s stock for a lower price right now. 6183 is also robust in terms of financial health, with current assets covering liabilities in the near term and over the long run. 6183 also has a miniscule amount of debt on its balance sheet, which gives it headroom to grow and financial flexibility. More on China Greenfresh Group here.

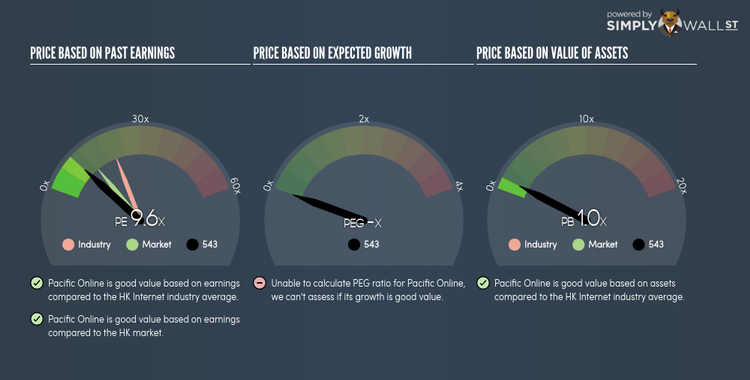

Pacific Online Limited (SEHK:543)

Pacific Online Limited, an investment holding company, provides Internet advertising services in the People’s Republic of China. Started in 2007, and currently lead by Wai Yan Lam, the company size now stands at 1,369 people and with the market cap of HKD HK$1.23B, it falls under the small-cap stocks category.

543’s shares are currently floating at around -47% beneath its real value of ¥2.1, at a price of HK$1.12, according to my discounted cash flow model. This discrepancy gives us a chance to invest in 543 at a discount. Also, 543’s PE ratio is trading at around 9.64x relative to its Internet peer level of, 21.03x suggesting that relative to its competitors, 543’s stock can be bought at a cheaper price. 543 is also in good financial health, with near-term assets able to cover upcoming and long-term liabilities. 543 has zero debt on its books as well, meaning it has no long term debt obligations to worry about. Continue research on Pacific Online here.

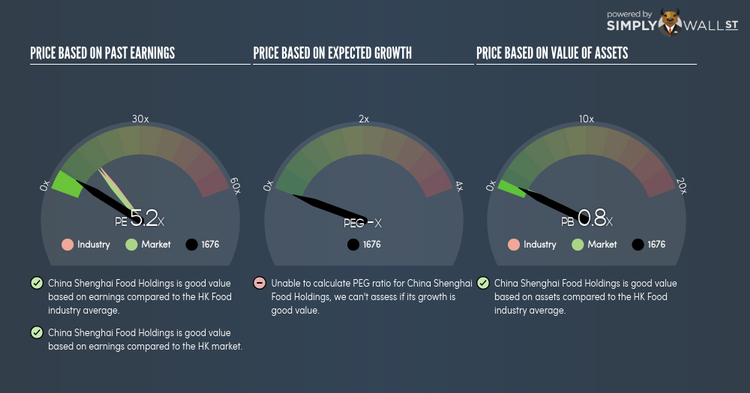

China Shenghai Food Holdings Company Limited (SEHK:1676)

China Shenghai Food Holdings Company Limited, an investment holding company, engages in the packaging and sale of seafood products in the Peoples’ Republic of China. Founded in 2005, and currently headed by CEO Dehua Jiang, the company provides employment to 424 people and with the stock’s market cap sitting at HKD HK$530.00M, it comes under the small-cap stocks category.

1676’s stock is now hovering at around -62% under its true value of ¥1.41, at a price of HK$0.53, according to my discounted cash flow model. signalling an opportunity to buy the stock at a low price. Also, 1676’s PE ratio is currently around 5.22x against its its Food peer level of, 14.2x indicating that relative to its competitors, we can buy 1676’s stock at a cheaper price today. 1676 is also a financially robust company, as current assets can cover liabilities in the near term and over the long run. 1676 has zero debt on its books as well, meaning it has no long term debt obligations to worry about. More on China Shenghai Food Holdings here.

For more financially sound, undervalued companies to add to your portfolio, explore this interactive list of undervalued stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.