This chart shows all the bad news may already be priced into the market

Earnings season kicks into high gear this week, led by big banks releasing their Q4 results. However, recent analysts’ revisions to their earnings forecasts suggest a lot of companies will be announcing a lot bad news in the coming weeks.

And more bad news could mean even more negative revisions to earnings forecasts, potentially sending stock prices back to their December lows.

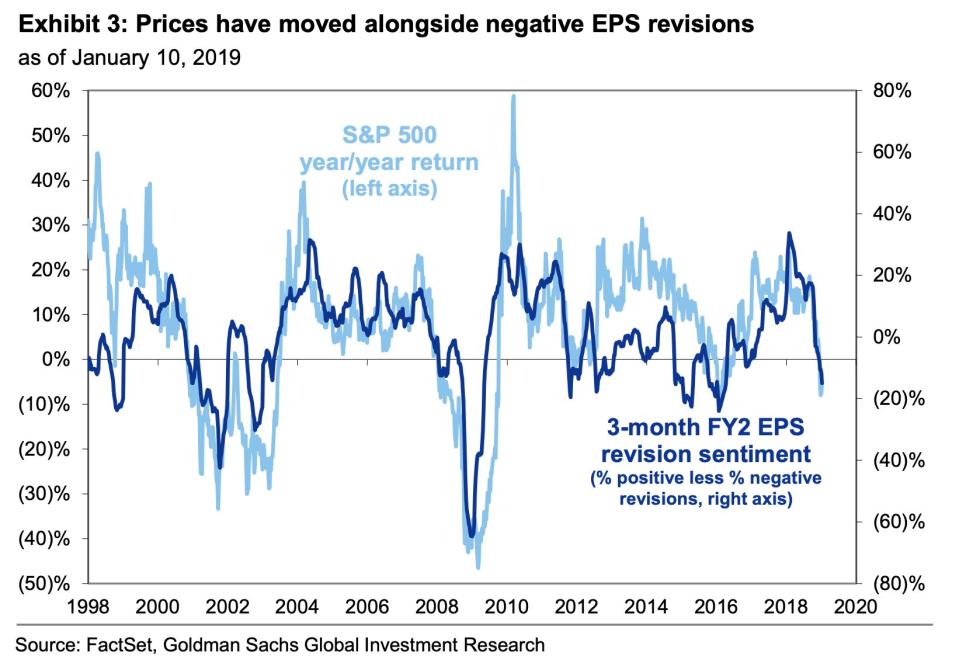

“Equity prices have tracked negative earnings revisions, but earnings season will represent an important litmus test for the near-term path of the S&P 500,” Goldman Sachs’s chief U.S. equity strategist David Kostin wrote in a note to clients over the weekend. “[T]he number of negative EPS as a share of total revisions, has slipped into negative territory. The path of S&P 500 returns has generally tracked this revision sentiment.”

December was a crushing month for U.S. equities. A confluence of bad news, such as fears of a global economic slowdown, an intensifying trade war between the U.S. and China, and concerns regarding the Federal Reserve’s future monetary policy path rocked the markets. Companies with significant exposure to China, such as Apple (AAPL), FedEx (FDX), American Airlines (AAL) and Delta Air Lines (DAL) have issued warnings and lowered revenue guidance for Q4 amid a flurry of concerns regarding the negative impact of slowing global growth.

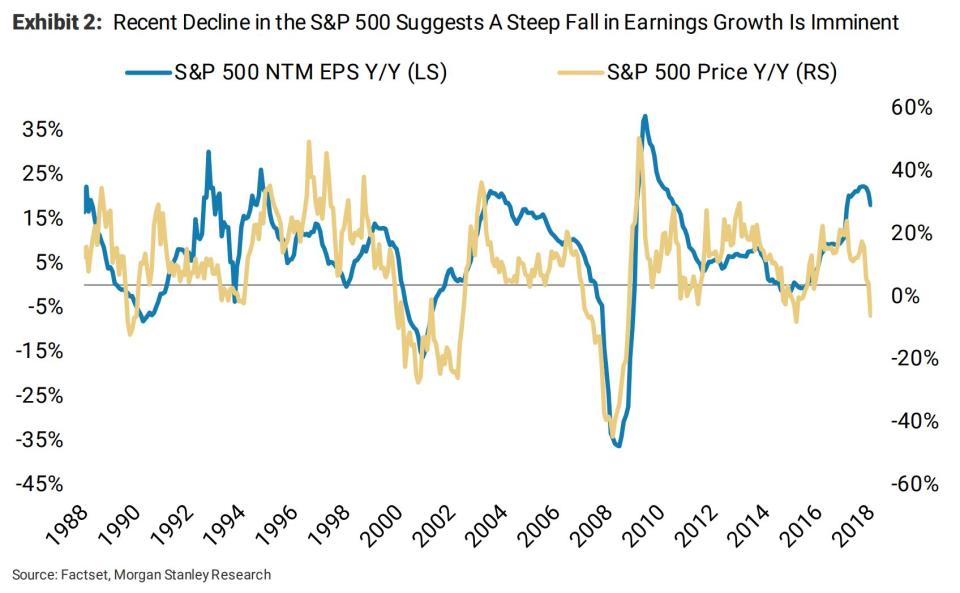

The S&P 500 (^GSPC) tumbled 10% year over year, which only happens when there is either an earnings or economic recession, according Michael Wilson, Morgan Stanley’s chief U.S. equity strategist.

Due to that massive selloff, Wilson explained that he believes that the markets have already priced in a recession.

“We think the market completed its de-risking of our concerns late last year; specifically, tighter financial conditions and an earnings recession in 2019. Some sectors and stocks have even discounted a full blown economic recession, in our view,” Wilson said in a note to clients on Monday.

Nevertheless, Wilson explained that another sell-off during this earnings season could be an opportunity for investors sitting on some cash.

“We suspect such rapid decline in forward earnings will provide a reason for stocks to revisit the December lows, but of course, that's the trap and the time to buy, not sell,” Wilson said.

Analysts polled by FactSet expect S&P 500 earnings to have climbed by 10.6% year-over-year during the period.

Heidi Chung is a reporter at Yahoo Finance. Follow her on Twitter: @heidi_chung.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

More from Heidi:

Roku CEO responds to short-seller's tweet about Apple and Samsung

CPI, Powell, Clarida — What to know in the week ahead

Why 2019 could be a stellar year for gold

Facebook and PayPal are a match made in heaven, according to MoffettNathanson