The most liberal Democratic presidential candidates are also 1 percenters

There’s a bit of irony in the tax returns of the 7 Democratic presidential candidates we’ve seen so far. The three most liberal Democrats running for president—Bernie Sanders, Elizabeth Warren and Kamala Harris—have approached or eclipsed $1 million in earnings in recent years, making them wealthier than some of the more capitalist-minded candidates. If you’re feeling snide, you could say socialism pays.

Sanders, Warren and Harris rank farthest to the left on the Yahoo Finance socialist-capitalist index, which evaluates candidate positions on health care, climate change, trade and taxes. All three, for instance, favor Medicare for all, the government-run health plan that would replace all employer-based coverage. And all three support the Green New Deal, which would transform transportation, energy and other sectors of the economy through strict new forms of regulation.

Yet the private sector has been kind to these left-leaning candidates. Sen. Harris, a senator from California, enjoyed taxable income of nearly $2 million in 2018, with her lawyer husband earning about three-quarters of that. Harris herself earned about $320,000 in royalties from sales of her book, “The Truths We Hold,” and another $157,000 in senator’s pay. The couple fell into the highest marginal tax bracket — 37% – and paid $698,000 in taxes. After deductions, their effective tax rate was around 33%.

Sen. Elizabeth Warren and her husband Bruce Mann earned an average of $880,000 per year during the last three years, with gross income of $905,742 in 2018. Mann is a Harvard law professor who gets paid around $400,000 per year. Warren listed $325,000 in income from writing in 2018. She has authored and co-authored several popular books, including “This Fight is Our Fight,” her latest.

Sen. Bernie Sanders has a newfound taste of wealth. He and his wife Jane went from $241,000 in total income in 2015—about 18% of that in Social Security payments—to $1.06 million in 2016, $1.13 million in 2017 and $561,000 in 2018. The huge boost in income came from royalties on two best-sellers, “Our Revolution” and “Where We Go From Here.” Yes, Bernie Sanders now belongs to the 1% he bashes regularly. Revolution sounds about right.

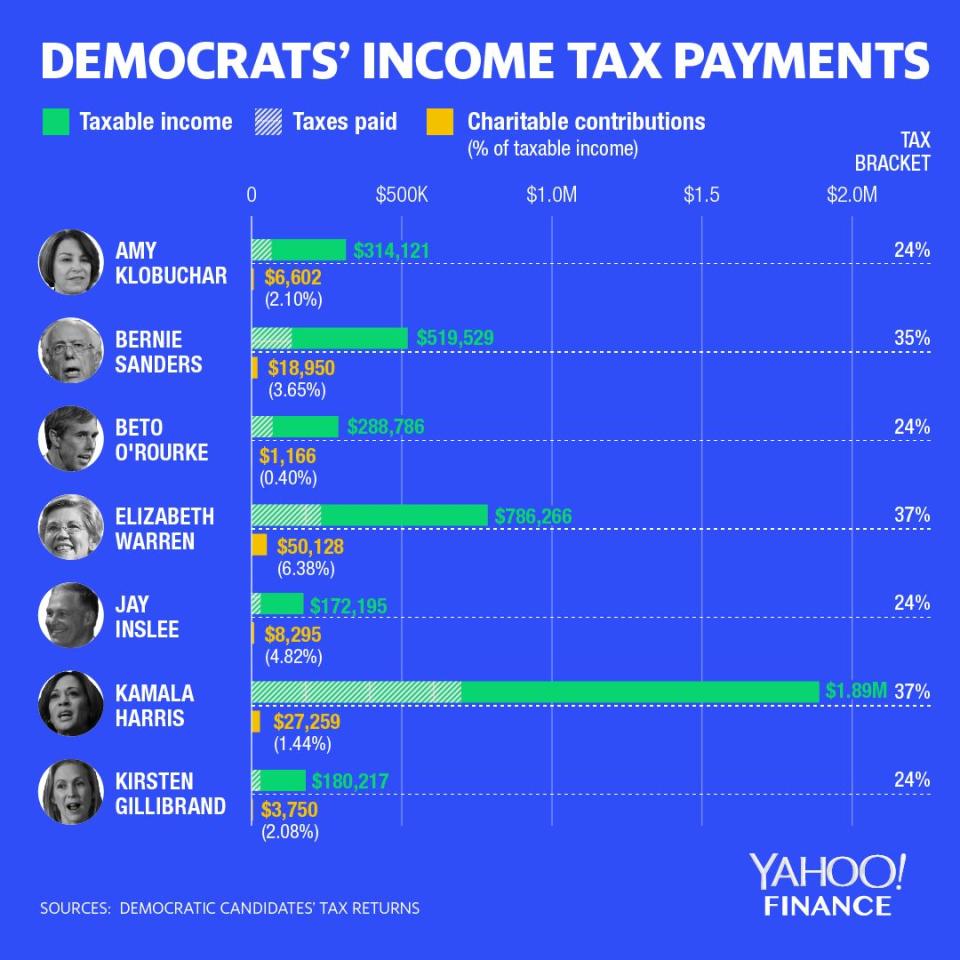

Warren, like Harris, lands in the top tax bracket of 37%. She and her husband paid $231,000 in federal taxes in 2018, for an effective tax rate of 27%. Sanders falls just below Warren, in the 35% bracket. His federal tax bill was $133,000 in 2018, for an effective tax rate of 23.5%. Since the income threshold for the top 1% of earners is around $480,000, Harris, Warren and Sanders are all 1 percenters.

Warren is the most generous of the 7 Democrats who have publicized their tax returns, with more than $50,000 in charitable donations in 2018. That’s 6.4% of her taxable income. Beto O’Rourke comes in last among the 7, with less than $1,200 in charitable donations, or 0.4% of his taxable income.

There’s still a lot we don’t know about Democratic presidential candidates and their finances. At least 11 prominent Democratic candidates haven’t released recent tax returns yet, including Sen. Cory Booker, rising star Pete Buttigieg and, assuming he runs, former vice president Joe Biden. And O’Rourke’s return is from 2017, suggesting his 2018 return isn’t ready yet.

On the Republican side, of course, President Trump refuses to release any tax returns. Democrats on the House Ways and Means Committee have given the IRS an April 23 deadline for turning over Trump’s returns, which the IRS almost certainly will not meet. The House will most likely sue, and Trump will fight, which means we’ll probably end up talking much more about the tax returns we haven’t seen than the ones we have.

Confidential tip line: rickjnewman@yahoo.com. Encrypted communication available. Click here to get Rick’s stories by email.

Read more:

Winter is coming for big business

Why Trump wants to manipulate the Federal Reserve

The Mueller probe was money well spent

Why voters will reject the "Green New Deal"

Voters are souring on “Medicare for all”

3 problems with Elizabeth Warren’s wealth tax

Rick Newman is the author of four books, including “Rebounders: How Winners Pivot from Setback to Success.” Follow him on Twitter: @rickjnewman