There's a bearish myth going around about earnings season

With the S&P 500 (^GSPC) closing in the red for three-quarters of October’s trading sessions so far, the prevailing narrative is bleak: third quarter earnings season has been a flop for markets.

Disappointing quarterly results from big-ticker companies including Amazon (AMZN), Alphabet (GOOGL) and Caterpillar (CAT) have especially hampered investor sentiment. But these results obscure the fact that many companies are still delivering upbeat forecasts, some analysts said.

In other words, the idea that Q3 financial results and forward guidance has been unusually disappointing is a myth.

Earnings are as expected, and guidance is overall positive

“It is of course wrong to just pick out certain stocks but the headlines always tend to be dominated by certain favored groups,” Sean Darby, chief global equity strategist for Jefferies, wrote in a note Monday. “The bottom line is that the 3Q results season is panning out largely as expected. Guidance has been an issue but it is by no means ubiquitous.”

About 60% of S&P 500 companies have now reported quarterly results, and a torrential one-third of companies reported just last week. Between company releases and earnings calls, management is still largely guiding above analysts’ forecasts, even in the wake of uncertainty around tariffs, trade and global growth.

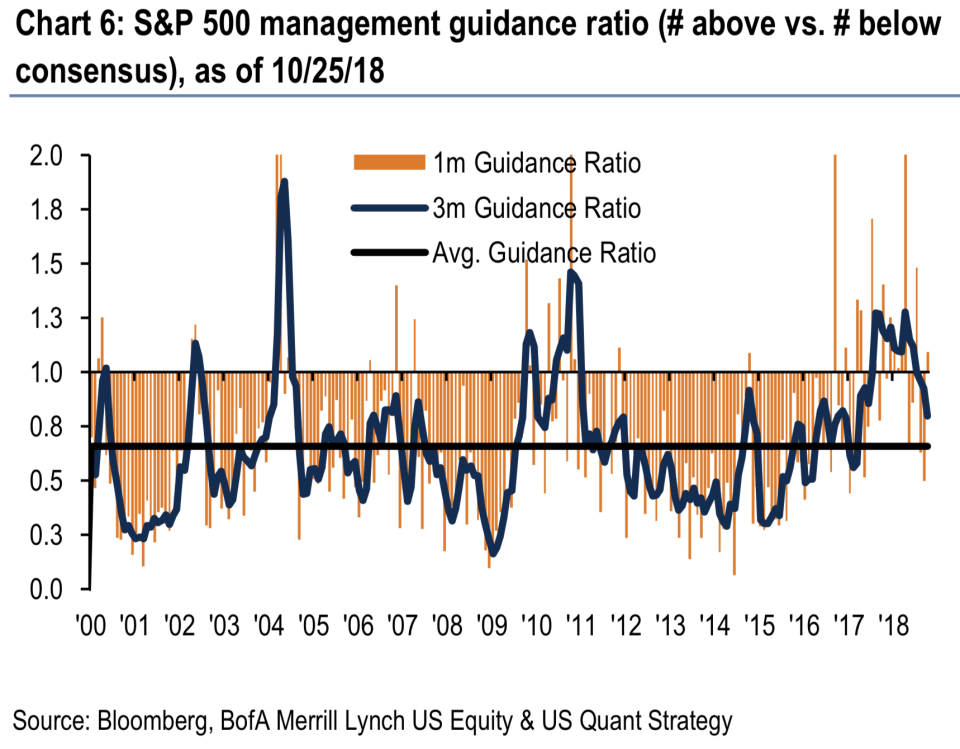

“It may not feel like it, but guidance is above consensus,” Bank of America analyst Savita Subramanian wrote in a note.

The one-month ratio of above- versus below-consensus guidance is tracking at 1.1x for October, exceeding the long-term monthly average of 0.7x and the October average of 0.8x, Subramanian said. Third-quarter earnings per share have so far come in 3% above analysts’ forecasts, and sales have slightly beat expectations. Guidance trends have been most positive in technology and real estate sectors, and the most negative in staples and materials.

Numbers aside, executive commentary has “been mixed, but generally positive,” Subramanian added. Mentions of optimism on nearly half of earnings calls came in above average and are at a seven-quarter high.

Scott Krisiloff, CEO of Avondale Asset Management, agreed that “sentiment has been pretty positive about the underlying economy” this earnings season so far. That’s been the case for the past four to six quarters, driven largely by stimulus from the Trump administration’s corporate tax cuts implemented last year. But as the tax code reform approaches its one-year anniversary, that kind of growth can’t be expected to be long-term sustainable.

“The difference this quarter is kind of like that that optimism is taken for granted at this point rather than a surprise,” Krisiloff said. “We’re at a point where it’s a tipping point, where you’re looking 12 to 24 months out and you’re not going to have that boost from tax reform anymore because you already had that.”

The gloomy narrative is “out of sync with facts”

Last week’s reports from large-cap companies dragged on markets. Manufacturing bellwether Caterpillar failed to raise its full-year adjusted earnings guidance as the Street had expected, sending shares sinking and the industrial-heavy Dow into a nosedive. Amazon’s stock plummeted by double-digit percentages after posting weaker-than-expected guidance for its critical holiday season, overshadowing a beat on earnings per share. The e-commerce giant’s guidance – coupled with a revenue miss from Alphabet – sent the tech-heavy Nasdaq into a tailspin.

The macroeconomic landscape is partly to blame for the sell-off that ensued from these results, Krisiloff said.

“Rising interest rates and global economic growth are negatives especially for high growth companies with high multiples, and so little hiccups in expectations of growth can be magnified around earnings,” Krisiloff said. “Tech companies are the forefront of being the highest beta of the bull market are experiencing the brunt of that regardless of how they’re reporting earnings.”

There have been blowout earnings beats this reporting season. Aerospace manufacturer Boeing (BA) pointed toward record full-year revenue for 2018 on top of exceeding expectations for third-quarter results. Shares of Intel (INTC) surged Thursday after the chipmaker posted an earnings beat and raised its fourth-year guidance.

Negative revisions in guidance have otherwise been largely confined to sectors with high economic sensitivity, including autos and materials, Credit Suisse analyst Jonathan Golub wrote in a note. For the rest, profits overall “look intact.”

“The consensus narrative describes earnings season as problematic, particularly around corporate guidance,” Golub said. “However, this appears out of sync with the facts.”

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Read more from Emily:

Netflix user growth beats expectations, shares spike

Now is a ‘once-in-a-lifetime chance’ to invest in US pot companies, investor says

There are ‘4 headwinds’ facing markets rights now