Tesla stock: Barclays revisits 'the red pill/blue pill debate'

Tesla (TSLA) may have a cult-like following, but investors who previously swallowed a “blue pill” may have made the wrong decision, according to a recent note from Barclays.

Using the red pill/blue pill analogy popularized in “The Matrix”, the analysts explained that the red pill in this case refers to reality “as it is” and the blue pill as constructed reality that investors seem to be happy living in — or “ignorant bliss.”

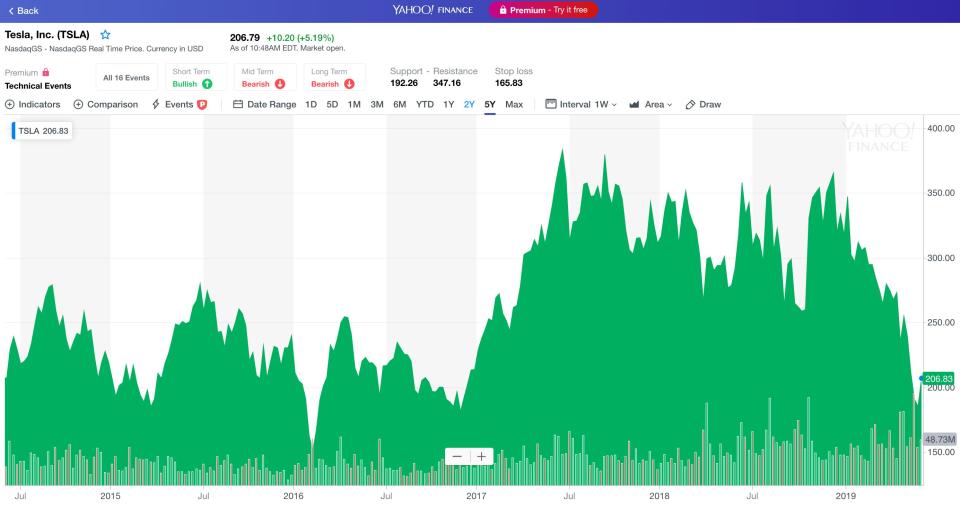

The Barclays analysts — who said that they went against the crowd when they called out Tesla two years ago — outlined why they disagreed with the optimistic dreams of Tesla admirers and highlighted “stagnating demand.” They reiterated that they saw Tesla stock as overvalued and claimed that now “market participants are coming around” to the view that the carmaker’s “blue pill” seems “far out of the money.”

They cut the stock’s price target and wrote last week:

“On Tesla, we think many investors had initially taken the blue pill, while we remained suddenly in the red pill camp. ... We expect more investors to gravitate back to Tesla’s near-term fundamentals of demand, profitability, and cash generation, areas that are now more exposed as the blue pill thesis washes away.”

The analysts added that ultimately there was a “higher probability of [Tesla] stalling as a niche automaker.”

Tesla stock is in a ‘code red situation’

Tesla has been struggling with hitting production quotas and is also facing weak demand, according to other analysts, who have been shedding some of their optimism.

Wedbush Analyst Dan Ives said that the company faces a “Kilimanjaro-like uphill climb” to hit its profitability targets in the second half of the year and is in a “code red situation,” adding that he the once-bullish analyst now had “major concerns around the trajectory of Tesla’s growth prospects.”

The company only delivered 63,000 cars in the first quarter but is now expected to bring that number up to 90,000-100,000 in the second quarter and up to 400,000 in the third quarter.

And Tesla CEO Elon Musk has come under fire for other reasons. He was caught in the crosshairs of the Securities and Exchange Commission for a tweet about taking Tesla private — which has now been resolved — and also faces a defamation suit by a British diver whom he called a pedophile.

‘There's this idea that demand for Tesla is gone. And to us, that seems really silly’

Barclays said that the “‘cult’ stock appeal around Tesla revolves around, in our view, the science fiction-like future envisioned by Tesla CEO Elon Musk. Supported by Mr. Musk’s side ventures in rockets to Mars (SpaceX), hyperloops, advanced tunnelling, and even brain-computer implants, Tesla investors and car buyers are deeply attached to the notion that they're not buying a regular financial instrument, but instead a ticket to the future that some bulls expect to go to $4000 or more someday.”

One of those $4,000 bulls is ARK Invest. The company just upped their bull case for Tesla to $6,106. (Their valuation model can be found here).

"There's this idea that demand for Tesla is gone. And to us, that seems really silly,” ARK Invest’s Tasha Keeney told Yahoo Finance.

At the other end of the universe, Morgan Stanley’s Adam Jonas also dropped his bear case to $10.

Jonas said that the demand for Tesla’s products, its cash flow generation, and access to capital markets have driven the stock over the last couple of years, but those factors have been anemic of late — hence his extreme scenario.

Barclays echoed that call, adding that they “believe the stock is not accounting for the risks and challenges inherent in Tesla’s lofty growth ambitions.”

New York University Professor Aswath Damodaran, who is an expert on valuation, recently tweeted that while “there is a high value story in the company,” it is “obscured with distractions and self-inflicted wounds.”

As $TSLA stock price tests lows, I revisit my Tesla valuation. There is a high value story in the company, but it is obscured with distractions and self-inflicted wounds. In the corporate life cycle, Tesla is a teenager, risking it all for very little. https://t.co/BjUuaMxEJV pic.twitter.com/tmefFulCAd

— Aswath Damodaran (@AswathDamodaran) June 3, 2019

Overall, according to Barclays, Tesla investors are facing a choice one again.

“You take the blue pill, the story ends. You wake up in your bed and believe whatever you want believe,” Morpheus tells Neo. “You take the red pill, you stay in Wonderland. And I show you how deep the rabbit hole goes.”

Aarthi is a writer for Yahoo Finance. Follow her on Twitter @aarthiswami.

Read more:

Americans — particularly millennials — are alarmingly late on car payments

Tesla short-seller: Musk is a 'lying magician' who people have stopped believing

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.