Tesla reportedly asked suppliers for a refund as it looks to turn a profit (TSLA)

Tesla

Tesla asked suppliers for a refund in order to help it become profitable, the Wall Street Journal reported Sunday.

Shares fell more than 4% after the report.

Tesla has asked some of its suppliers for refunds in order to help it reach its profitability goal, the Wall Street Journal reported over the weekend, citing a memo sent to a supplier last week.

The memo, from a global supply manager, said the cash back was "essential to Tesla’s continued operation," the WSJ said, telling the supplier to consider the refund an investment in the company’s long-term health.

Shares of the company fell more than 4% in early trading Monday following the report.

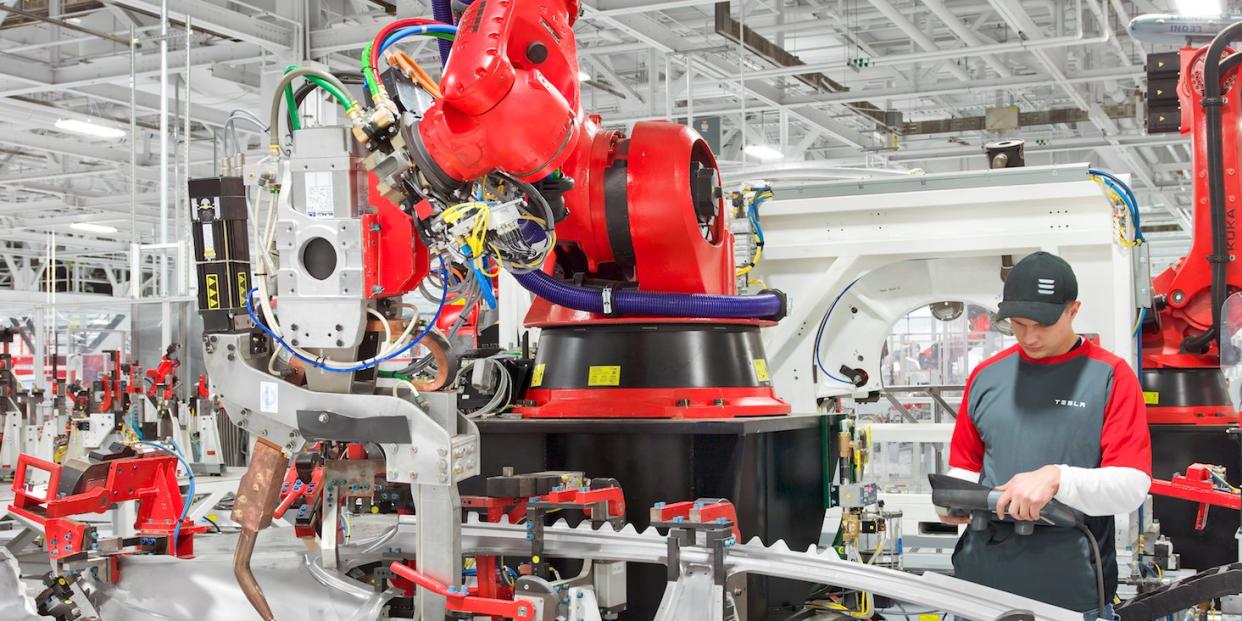

Tesla's cash position is front of mind for investors right now. Tesla has repeatedly said it will become profitable by the end of 2018, but has struggled amid production issues that have plagued its Fremont, California assembly line. On July 1, the company said it reached its goal of producing 5,000 Model 3 sedans — its newest vehicle — just hours after its self-imposed deadline, making it a "real car company," according to CEO Elon Musk.

If sustained, that production rate could lead to a healthy earnings report when Tesla releases its second-quarter results on August 1. The electric-car maker has vowed to turn a profit by the end of the year.

Still, many Wall Street analysts remain unconvinced that profitability will come by the stated deadline, and have factored in a capital raise into their models.

After the publication of this article, a Tesla spokesperson told Business Insider that the memo, sent to fewer than 10 suppliers, was part standard procurement procedures.

"Negotiation is a standard part of the procurement process, and now that we’re in a stronger position with Model 3 production ramping, it is a good time to improve our competitive advantage in this area," the spokesperson said.

"We asked fewer than 10 suppliers for a reduction in total capex project spend for long-term projects that began in 2016 but are still not complete, and any changes with these suppliers would improve our future cash flows, but not impact our ability to achieve profitability in Q3. The remainder of our discussions with suppliers are entirely focused on future parts price and design or process changes that will help us lower fundamental costs rather than prior period adjustments of capex projects. This is the right thing to do.”

Tesla is down about 5% this year.

Read the full Wall Street Journal report here>>

NOW WATCH: North Korean defector: Kim Jong Un 'is a terrorist'

See Also:

SEE ALSO: CITI: A 'full-on global bear market' is coming — here's where to put your money until it arrives