Taxes, cereal, housing — What you need to know on Wednesday

Tax reform is getting there.

Slowly.

On Tuesday, the House of Representatives passed the unified tax bill drafted by Republican lawmakers. And then around 5:00 p.m. ET, reports indicated that the House would have re-vote on the measure after hitting a procedural snag, with the Senate changing what Bloomberg called “relatively minor” aspects of the bill that didn’t meet Senate budget standards.

Markets, which have rallied in recent weeks as investors begin to price in some of the benefits corporations could enjoy with lower tax rates, were lower but little-changed on Tuesday following the news.

On Wednesday, investors will have a slower calendar of economic data and corporate earnings to contend with, as General Mills (GIS) earnings will be the headliner and existing home sales the most notable report on the economic calendar. Other earnings set for release Wednesday include results from Herman Miller (MLHR) and Winnebago Industries (WGO).

And while stock markets may have been muted on Tuesday, there was certainly some action in the bond markets as yields pushed higher for longer-dated U.S. Treasuries, with the 10-year settling near 2.47% and the 30-year moving to 2.82%.

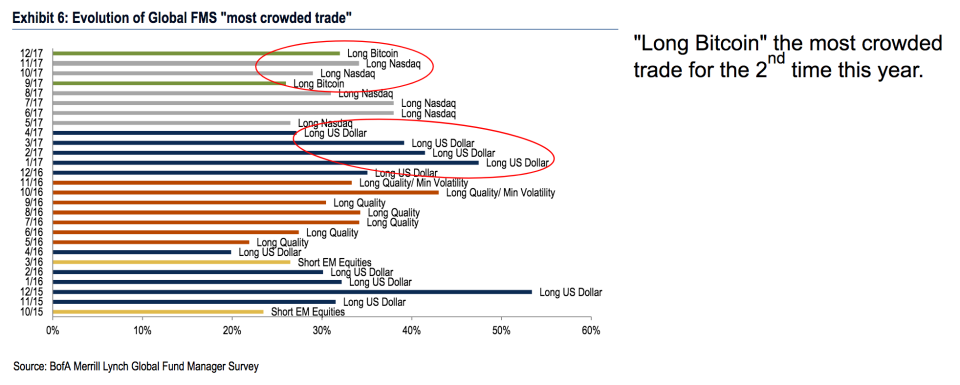

The most crowded trade in the world

It’s bitcoin (BTC-USD).

According to Bank of America Merrill Lynch’s latest fund manager survey — which polls over 200 fund managers controlling about $560 billion in assets — bitcoin is the most crowded trade in the world, with 32% of respondents pointing to the digital currency as the market’s most overheated trade.

Notably, this is the second time in four months that bitcoin has been flagged by this group as the world’s most crowded trade.

In September, the first time fund managers said bitcoin was too crowded, bitcoin traded at about $4,000 a coin; on Tuesday, prices were hovering near $18,000.

So given that the price of bitcoin has quadrupled since the first time Wall Street saw the trade as too crowded, there a few different reads one could have on this data.

Some could argue that there is a kind of bitterness towards bitcoin being expressed by the mainstream investment community that is trying to generate outsized returns amid an environment of low interest rates and near-record stock valuations and yet is barred from investing in an asset that seems to go up every day.

A more likely explanation comes from seeing the characterization of “crowded trade” as euphemism for a trade full of investors who don’t understand what they’re buying. And given the disparaging commentary about bitcoin that has come from many high-ranking members of the Wall Street community, it’s safe to say that many investors don’t know what they don’t know about bitcoin.

It is, in that sense, a total mystery. And yet clients, one imagines, are calling to ask about bitcoin all the time. And with inquiries flooding into the office about bitcoin it would then seem the only reasonable response to a question about which trade is most crowded would be to pick the one you keep getting asked about even when you have nothing to say about it.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: