Stocks are at an all-time high, but CFO optimism is fading

The Dow Jones Industrial Average closed at an all-time high Friday — marking the 101st record close since President Donald Trump was elected. But CFOs aren’t as optimistic as they should be, given the bull run.

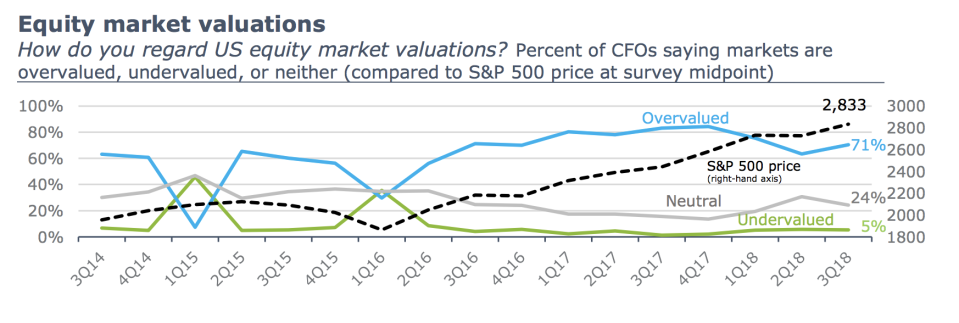

Deloitte, which released its quarterly sentiment survey of chief financial officers, found that optimism may be retreating amid concerns over trade and the challenge of identifying and training talent. CFOs are also now more likely to say equity markets are overvalued, with 71% who believe this, a reversal from the past two quarters.

According to the CFO Signals survey, the net optimism index fell to 36, the lowest level in eight quarters. In the third quarter, 12% of CFOs expressed declining optimism, up from 9% last quarter, while those who expressed rising optimism was unchanged at 48%.

When CFOs were asked what worried them most, trade policy was the biggest concern. They said corporate performance could be affected by the possibility of more tariffs and escalating trade tensions, a sentiment highlighted in the responses given for the different global regions.

CFOs’ view on current conditions in China is on the decline compared to the previous quarter. Those who believe conditions are good dropped 18 percentage points to 37% and those who expect better conditions in a year was down to 27% from 31%.

For economic conditions in Europe, CFO sentiment is also considerably lower. CFOs who believe conditions are good dropped to 32% from 47%, while those who expected better conditions in a year dropped to 23% from 36%.

Here in North America, CFOs who believe economic conditions are good fell 5 percentage points to 89% from an all time high of 94% last quarter and 45% expect better conditions in a year — the lowest point in two years.

Key growth metrics also took a hit in the third quarter. Revenue growth expectations declined 20 basis points to 6.1%, although remaining at the highest levels in the last four years. Earnings growth expectations declined from 10.3% to 8.1%. Capex expectations dropped 1 percentage point to 9.4%, remaining above a two-year average. Dividend growth was a bright spot, sentiment rose sharply to its highest level in eight years to 7.4% from 4.8% the previous quarter.

Preparing for a downturn

Deloitte Global CFO Program Leader Sandy Cockrell said this quarter’s CFO Signals survey hints to the challenges CFOs may face in the near future. “While this is not a predictor for a slowdown, it is indicative of pressure from external forces weighing on the minds of the CFOs we surveyed.”

In fact, Cathy Engelbert, Deloitte CEO, said at Yahoo Finance All Markets Summit she was pretty upbeat on sentiment. “I think people feel really good about the next 18 months,” said Engelbert, adding that she has seen the reports that over 50% of leading economists are predicting a downturn by 2020.

She focused on the importance of preparing for the next downturn. “I think scenario planning is one of the most important things I think companies can engage in, because there has to be some non-negotiables,” she said, adding that companies should not stop investing in technology and their talent during the down years.

“We’ve embarked on our economic downturn scenario planning,” said Englebert. “We had a playbook, deployed it in 2007, 2008, learned a few things, because it’s never exactly as you predict, and you don’t know how long you’re going to be in it.”

Maylan Studart is a reporter at Yahoo Finance.

Read more from Maylan

5 things you need to know about the hottest weed stock

This brain cancer drug stock has been on a tear