Stocks rebound, crude oil prices rise

Stocks climbed after Friday’s equity slide capped off an abbreviated week of wobbly trading.

The S&P 500 (^GSPC) rose 1.55%, or 40.89 points, as of market close. The Dow (^DJI) rose 1.46%, or 354.29 points. The Nasdaq (^IXIC) advanced 2.06%, or 142.87 points.

Last week marked the worst Thanksgiving week for the stock market since 1939, when the holiday was first moved to the third Thursday in November. Each of the three major indices stumbled by about 4% for the week.

Crude oil prices (CL=F) on Monday rose after falling to their lowest levels in more than a year on Friday. Prices for U.S. West Texas intermediate crude settled higher by 2.4%, to $51.63 per barrel. The commodity had slipped about 7% on Friday, posting its seventh consecutive weekly drop. Brent crude (BZ=F), the international benchmark, remained about $60 per barrel, after falling 6% on Friday.

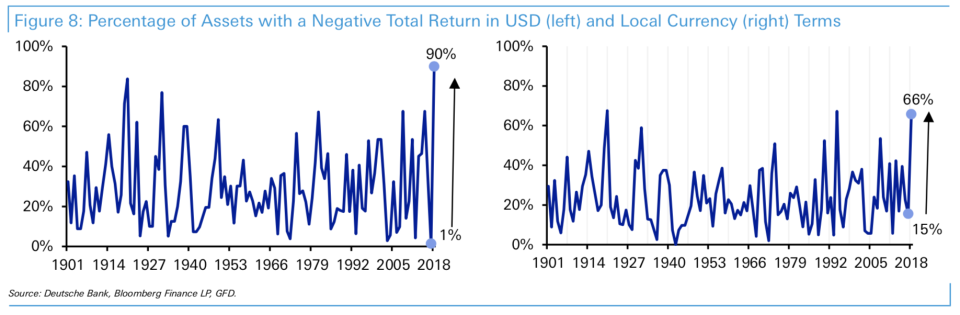

Monday’s rebound comes amid a crushing fourth quarter for assets across the board. The recent pullback in markets has been broad-based, hitting global equities as well as commodities from crude oil to copper to bitcoin. For the year through mid-November, 90% of the 70 assets tracked by Deutsche Bank posted negative returns on a dollar-adjusted basis, whereas only 1 out of 72 assets had posted a negative return in dollar terms in 2017. On a local currency basis, 66% of assets generated a negative return as of November 16, up from 15% last year.

The fourth-quarter swoon follows a sunsetting era from between 2010 and 2017 marked by loose monetary policy, high levels of quantitative easing from central banks and low volatility, which had helped feed above-average returns.

“2018 has shown signs of a reversal of this era with volatility increases and asset prices struggling in unison even with DM economies growing above trend,” Reid said. “This perhaps hints at how much global QE elevated ALL asset prices and overpowered the traditional relationship where bonds and equities move in opposite directions.”

Some analysts view the equity market rout as a readjustment following the stimulus-driven surge.

“While investors have celebrated recent U.S. profit and economic strength, above-trend growth rates are unsustainable,” Credit Suisse analyst Jonathan Golub wrote in a note. “2018’s 23% EPS and 2.9% GDP growth are skewed by tax changes, government stimulus, and other non-recurring items. Importantly, a renormalization in growth to 7-8% EPS and 2.6% GDP should be more than sufficient to fuel a market advance.”

Investors will look for signs of the 2019 interest rate outlook from Federal Reserve speeches this week by Fed Vice Chairman Rich Clarida on Tuesday and Fed Chair Jerome Powell on Wednesday. Later, the closely watched G-20 summit will take place in Argentina from Thursday to Saturday, where President Xi Jinping and Donald Trump will meet ahead of the next scheduled increases on products made in China.

NEWS: Cyber Monday expected to bring in a record $7.8 billion in sales

Cyber Monday kicked off on the heels of a record-breaking Black Friday online shopping spree, according to data from Adobe Analytics. Online sales on Black Friday advanced 23.6% from last year, totaling $6.22 billion. This Black Friday was the first time in history more than $2 billion in sales originated from smartphone purchases, Adobe noted. Shoppers chose mobile over the malls this year, with in-store traffic down 1.7% on Thanksgiving and Black Friday compared to last year, according to data from ShopperTrak. Likewise, Salesforce Commerce Cloud reported 13% year-over-year growth on Black Friday, with mobile devices accounting for 67% of digital traffic.

“E-commerce sales as reported by numerous sources indicate solid holiday sales for the Thanksgiving weekend and holiday season to date and we remain comfortable with our expectation for mid-teens e-commerce holiday season growth,” said Aaron Kessler, an analyst with Raymond James. Based on the data skewing toward digital sales, he retains a “positive bias on Amazon and Google shares,” Kessler added.

Cyber Monday sales are expected to climb more than 18% over last year and hit a new record of $7.8 billion, according to Adobe estimates. The holiday season to date has generated $44.2 billion in online sales, up 19.2% over last year.

STOCKS: General Motors said it plans to slash salaried workforce by 15% and cut production at some plants

General Motors (GM) said it is planning a massive overhaul that will involve a 15% reduction of its salaried workforce and a restructuring that could cost up to $3.8 billion. The changes also include a targeted 25% reduction of its executive staff. Factories in Detroit, Ohio, Michigan, Maryland and Ontario, Canada will be “unallocated” in 2019. The company expects that its actions will increase annual adjusted automotive free cash flow by $6 billion by the end of 2020 on a run-rate basis.

“The actions we are taking today continue our transformation to be highly agile, resilient and profitable, while giving us the flexibility to invest in the future,” Mary Barra, CEO and chair of GM, said in a statement. “We recognize the need to stay in front of changing market conditions and customer preferences to position our company for long-term success.”

GM share prices jumped after trading was halted on the stock. Shares closed higher by 4.81% to $37.66 each as of market close.

Credit Suisse initiated coverage of Nvidia (NVDA) with an Outperform rating and a price target of $225. The analysts noted that although the company’s guidance for the first quarter of 2019 disappointed, the about 50% decline in share prices over the past two months has provided “an extremely compelling entry point.” Shares of Nvidia rose 5.55% to $153.05 each as of market close.

American Eagle Outfitters (AEO) was upgraded to Buy from Hold by Deutsche Bank analysts, while its price target was left unchanged at $24. Analyst Tiffany Kanaga noted that clothing company’s current share prices have created a buying opportunity, and added that she believes the company will be able to exceed guidance in the third quarter. American Eagle reports third-quarter results on December 5. Shares of American Eagle rose 5.53% to $20.62 each as of market close Monday.

RBC Capital analyst Ross MacMillan upgraded Intuit (INTU) to Outperform from Sector Perform and raised his price target for the stock to $242 from $234. Intuit, the developer of TurboTax, will likely see wider use as the number of do-it-yourself tax filers grows, leading to higher average revenue per user and an increase in unit growth, MacMillan said. Intuit’s stock rose 2.22% to $201.42 per share as of market close.

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Read more from Emily:

Netflix user growth beats expectations, shares spike

Now is a ‘once-in-a-lifetime chance’ to invest in US pot companies, investor says

There are ‘4 headwinds’ facing markets rights now