Stocks close higher, led by surging JPMorgan and Disney

Stocks ended sharply higher on Friday, as investors cheered bullish developments from Dow components JPMorgan Chase and Disney, which helped sparked a broad rally.

As of the market’s close, the S&P 500 (^GSPC) was up 0.60%, or around 19 points, while the Dow (^DJI) jumped more than 260 points, or around 1%. The Nasdaq (^IXIC) rose 0.40%, up nearly 37 points.

JPMorgan Chase (JPM) was the first big bank out of the gate to report first-quarter earnings. The banking giant beat on both the top and bottom lines, which sent its stock soaring nearly 5% to above $111.

During the first quarter, JPMorgan earned $2.65 per share on $29.9 billion in revenue. Analysts surveyed by Bloomberg were expecting the bank to report earnings of $2.35 per share on $28.36 billion in revenue.

“Even amid some global geopolitical uncertainty, the U.S. economy continues to grow, employment and wages are going up, inflation is moderate, financial markets are healthy and consumer and business confidence remains strong,” CEO Jamie Dimon said in a statement.

[Read more: JPMorgan earnings beat expectations, stock jumps]

Wells Fargo (WFC) also reported better-than-expected first-quarter earnings, but its stock fell 3% on Friday. The bank reported earnings of $1.20 per share on $21.61 billion in revenue. Analysts were predicting earnings of $1.09 per share on $21.01 billion of revenue.

In the media space, Disney officially unveiled its new streaming service, Disney+ at the media giants investors day Thursday. Shares of the company rose 10%, hitting all-time highs as investors bet the entertainment giant would mount a strong challenge to market leader Netflix.

Available November 12 for $6.99 per month( $69.99 per year) Disney’s service will house all of the classic Disney, Marvel and Lucasfilm favorites as well as original content.

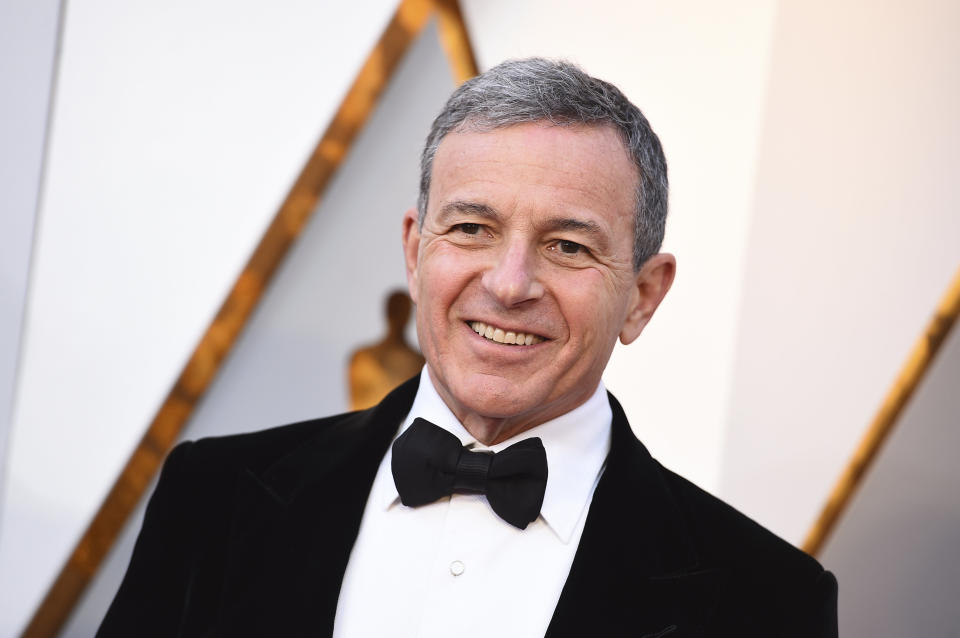

Disney said it will be investing about $1 billion in 2020 and $2 billion by 2024 on original content. In addition to the drop of Disney+, CEO Bob Iger told investors that he would finally be stepping down from his role as CEO when his contract expires in 2021.

During his time at Disney, Iger has extended his contract two times as suitable successors were not lined up. However, Iger revealed that a succession plan is in the works for a smooth transition.

[Read more: Disney unveils its Netflix streaming rival Disney+]

Meanwhile, Lyft (LYFT) shares tumbled nearly 3% after rival Uber officially filed for its IPO Thursday evening, just two weeks after Lyft debuted on the public market. The ride-sharing giant will list under the New York Stock Exchange under the ticker “UBER.” Uber reported $11.27 billion in revenue last year. Though the company reported profit of $997 million in 2018, it also had an EBITDA loss of $1.85 billion. Uber had about 91 million “monthly active platform consumers” in the fourth quarter of last year.

[Read more: Uber officially files paperwork for IPO]

And big news in the energy sector Friday. Integrated oil giant Chevron (CVX) announced that it will be buying oil and gas exploration company Anadarko Petroleum (APC) in a $33 billion cash and stock deal. The announcement sent shares of Anadarko soaring 33%, but Chevron shares sank nearly 5%. The deal is expected to close in the second half of this year.

“This transaction builds strength on strength for Chevron,” Chevron CEO, Michael Wirth, said in a statement. “The combination of Anadarko’s premier, high-quality assets with our advantaged portfolio strengthens our leading position in the Permian, builds on our deepwater Gulf of Mexico capabilities and will grow our LNG business.”

—

Heidi Chung is a reporter at Yahoo Finance. Follow her on Twitter: @heidi_chung.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

More from Heidi:

The U.S. economy adds 196,000 jobs, beating expectations

Key factors to consider before jumping into hot IPOs, according to UBS