State Street CEO on US Fed's U-turn: 'At best a hammer on the pause button'

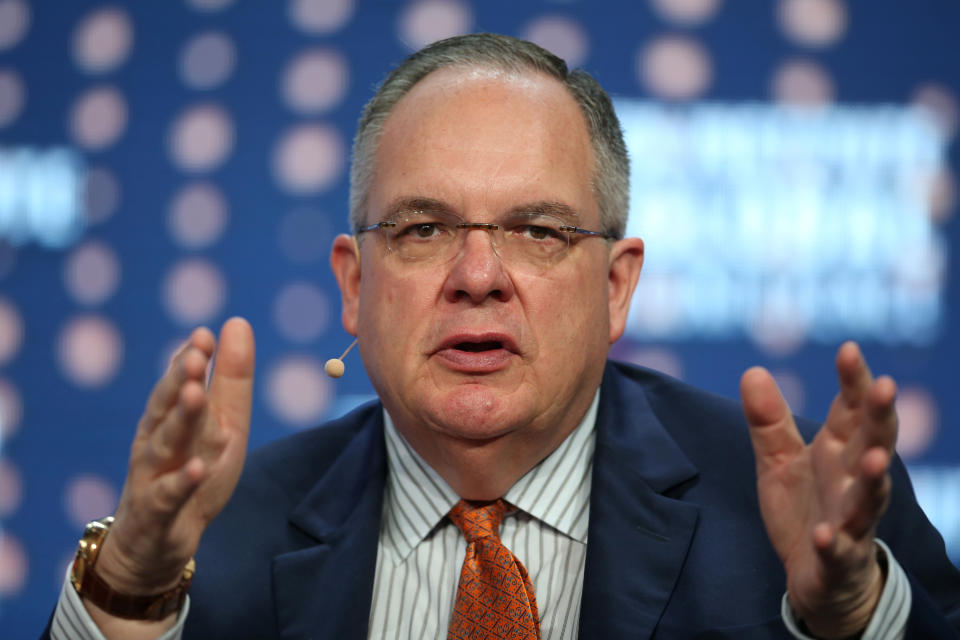

State Street (STT) CEO Ronald P O’Hanley on Wednesday said that the US Federal Reserve’s sharp shift in policy in January was “at best a hammer on the pause button and at worst an admission of defeat.”

The Fed last month jolted global markets when it said it would put interest rate hikes on hold, citing rising risks to US growth in the coming months.

Many traders had begun pricing in further gradual rate increases for 2019.

“I would submit that the Federal Reserve’s dramatic U-turn at the end of last month on both rate hikes and balance sheet reduction was at best a hammer on the pause button and at worst an admission of defeat,” O’Hanley said.

The State Street chief noted that the market downturn in 2018 signalled where the global economy was. “Even modest moves towards higher rates and balance sheet normalisation were too much for what is apparently a weak system,” he said.

The global economy has not reached “escape velocity” yet, he warned, indicating that he thought the “glimmer of hope” seen in 2017 and 2018 was now in the rear-view mirror.

“Unlike typical cyclical downturns, which have been nudged into positive territory by fiscal and monetary action, even with the extraordinary actions of quantitative easing, we haven’t gotten to that point.”

More than 10 years from the financial crisis, he said that there was “an awful lot of uncertainty,” pointing to Brexit and trade tensions.

While the Fed last month held its benchmark interest rate steady, as was widely expected, investors by and large thought that the Fed’s march towards higher interest rates would continue.

Just six weeks earlier, the central bank had raised rates and signalled that it would do so another two times in 2019.

But the policy shift in January also helped stall and even partly reverse the late 2018 stock sell-off, and emerging markets have benefitted significantly.

O’Hanley, who was speaking at the European Financial Forum in Dublin, pointed to ageing workforces, weak global demand and productivity, widespread overcapacity and a global savings glut as factors contributing to the “great deflation.”

The forum was organised by the Financial Times and IDA Ireland.

Yahoo Finance

Yahoo Finance