SoftBank defends Saudi partnership as Vision Fund gains jump

Speaking on his first earnings call since the killing of Saudi journalist Jamal Khashoggi, SoftBank founder Masayoshi Son reiterated his support for sticking with the Saudi leaders who have contributed nearly half of the $100 billion for his tech-focused Vision Fund.

Questions arose over what kind of impact Khashoggi’s death would have on SoftBank’s relationship with Saudi leadership after big-name investors, including Son, decided to drop out of the kingdom’s investment conference last month (Vision Fund Managing Partner Saleh Romeih still attended.) Despite rebuking the killing, Son made it clear it would be business as usual moving forward.

“As horrible as this event was, we cannot turn our backs on the Saudi people as we work to help them in their continued efforts to reform and modernize their society,” he said. “We hope and want to see those responsible held accountable.”

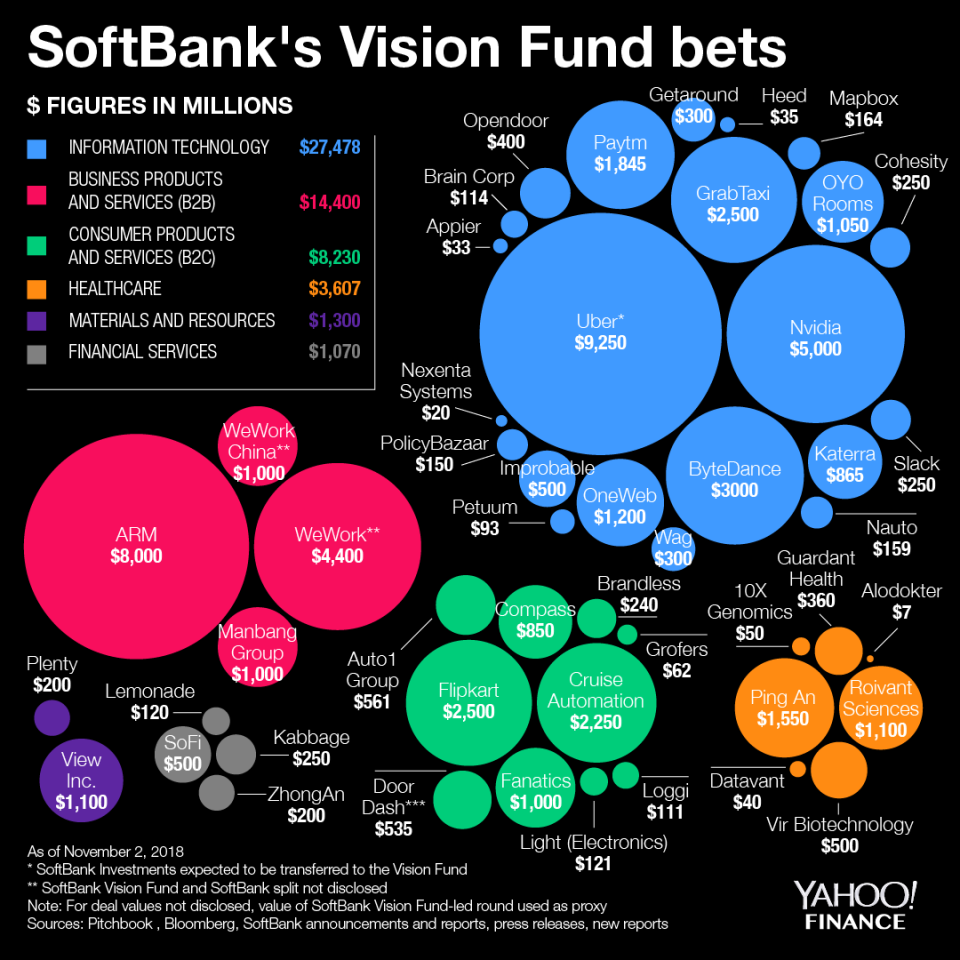

Since launching in 2017, Son’s Vision Fund has put its capital to quick use. A deeper look by Yahoo Finance ahead of SoftBank’s earnings call revealed the fund has invested in everything from sports memorabilia retailer Fanatics to China’s “Uber for trucking” startup Manbang Group.

The company’s latest earnings report showed a 233% jump in gains on Vision Fund investments over the same period last year. Investment gains increased to about $5.7 billion for the six-month period ended September 30, topping the $1.7 billion posted last year, thanks in large part to the sale of its stake in India’s Amazon challenger Flipkart. SoftBank agreed to sell its 20% stake in the company to Walmart for $4 billion after holding its position in the startup for just eight months.

Pause on Vision Fund II

During the company’s earnings call, Son also addressed concerns that SoftBank’s connection with Saudi money might impact deals with startups moving forward, saying that he hadn’t heard of pushback from any companies about taking Vision Fund dollars since the news surfaced. He did, however, note that it might slow progress on creating a second Vision Fund.

“I think it is still too early to go ahead with Vision Fund II,” he said. “For new cases or new projects… we would like to carefully watch the outcome of the [Khashoggi] case. And once the explanation is fully made, then we will think about it once again.”

Notably, Tesla CEO Elon Musk, who infamously tweeted about a deal mentioning Saudi funding that would have taken Tesla private at $420 a share, expressed last week that following Khashoggi’s killing he would now think twice about accepting money from the country. Responding to a Recode interview question over taking money from Saudi investors now, Musk said, “I think we probably would not.”

If the latest Vision Fund deal is any indication, Musk’s souring on Saudi money or concerns over startups accepting Vision Fund backing is clearly not an issue. Last week, Son’s Vision Fund completed a $1.1 billion investment in Silicon Valley-based smart glass maker View, according to Bloomberg. View did say, however, that the deal with the Vision Fund had been in the works weeks before Khashoggi’s death.

Zack Guzman is a senior writer and on-air reporter covering entrepreneurship, startups, and breaking news at Yahoo Finance. Follow him on Twitter @zGuz.

Read more:

Where SoftBank’s Vision Fund is deploying its $100 billion

How Juul became the FDA’s latest target

Juul surpasses Facebook as fastest startup to reach decacorn status