How Snap can finally break through to users over 34

Snap (SNAP) has a serious user growth problem, and the company doesn’t seem to know how to fix it.

On the company’s Q3 2018 earnings call on Thursday, Snap CEO Evan Spiegel said Snapchat’s inability to meaningfully grow users ages 34 and over — what Spiegel calls the “34+” demographic — is a “challenge” to be dealt with by the company’s marketing and communications departments.

But Spiegel’s argument is flawed. He’s blaming Snapchat’s inability to substantially grow in the “34+” demographic on marketing and communications issues instead of conceding the Snapchat product has some growing up to do.

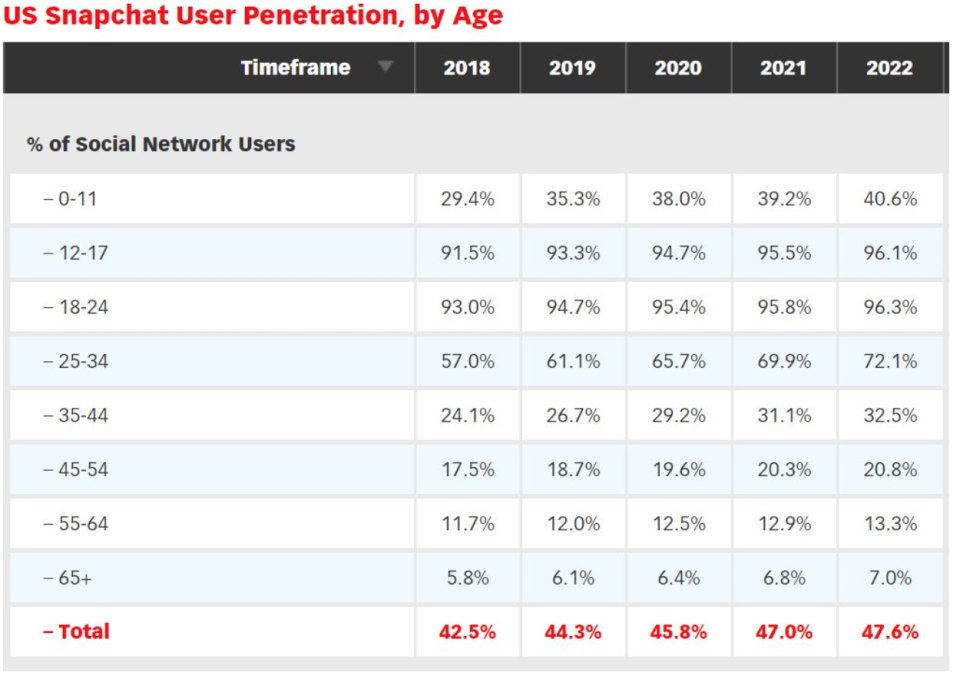

According to eMarketer, 24.1% of all social network users in the U.S. ages 35-44 use Snapchat. That’s significantly less than the market penetration among younger social network users in the U.S. Indeed, 93% of all social network users in the U.S. ages 18-24 use the messaging app, while 57% of all social network users in the U.S ages 25-34 also use the app.

“If you look at the reason social platforms grow, marketing and comms almost have nothing to do with it — the growth of these platforms happen before they have a marketing/comms plan,” Altimeter Group analyst Omar Akhtar explains, referring to more mature platforms like Facebook (FB) and Twitter (TWTR).

Broadening Snap’s appeal

For Snap to partly offset its declines in daily active users, it must broaden its appeal beyond the core, younger audience it’s traditionally appealed to by offering more compelling content people “34+” set will read and watch, as well as doubling down on its ephemeral messaging features — an area that has been neglected as Snap’s ambitions have grown.

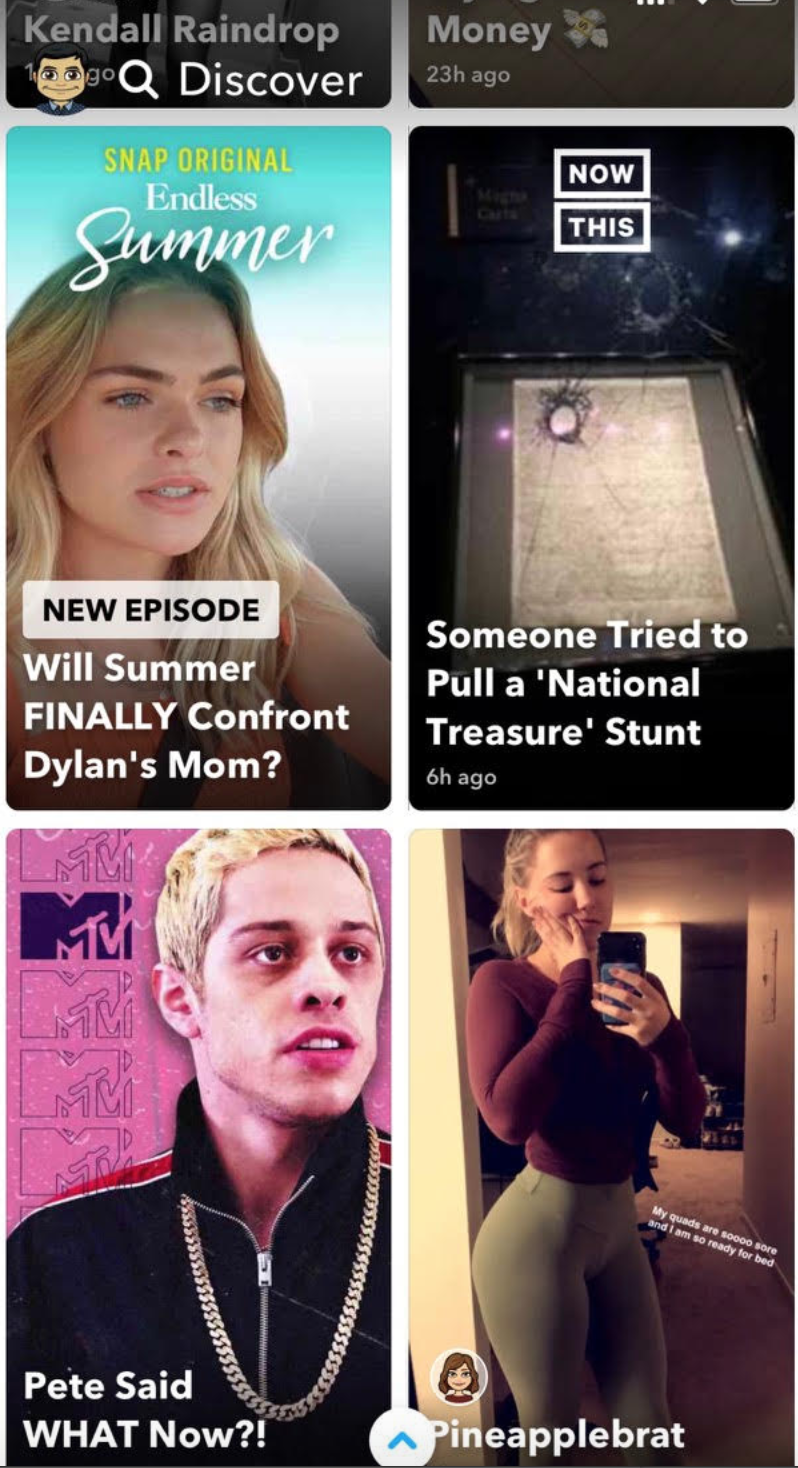

One of Snap’s problems? Snapchat’s Discover section, focuses on the younger set. Skim Discover for a minute, and it’s clear the vast majority of content is geared towards the younger folks.

There’s also Snap’s push into original content. While the company’s efforts there are hardly unique — it’s another way for platforms to keep users coming back — Snapchat’s original programming is one of the least diverse of platforms that include Facebook, Netflix (NFLX) and Hulu.

For evidence, look no further than the fall slate of original programming announced this October: a dozen new shows with plots featuring younger actors and younger characters, such as “Endless Summer,” a docuseries about “rising stars” in Laguna Beach or “Class of Lies,” a crime series featuring college roommates who crack cold cases on their true-crime podcast. Needless to say, Snap’s content could use some diversifying, taking a page from Netflix, which has found success with projects aimed at the 34+ set, including “House of Cards,” “The Crown,” “Ozark, and “Grace and Frankie.”

“I think to attract the 34+ crowd, Snap is going to have to focus more on content than on marketing,” explains Mark Mahaney, managing director at RBC Capital Markets. “I think some of their sports content, however, would be highly appreciated by the 34+ crowd. I have long thought of the ESPN channel on Snap as Top Ten Highlights, but on steroids.”

Lack of focus

Snap’s other issue with failing to grow older users: a lack of focus, contends Akhtar. Snap originally carved out a following for being a sort of anti-Facebook and focusing on ephemeral messaging. Yet as Snap has grown in more recent years, so has its ambitions. It wants to be a “camera company” and has released its camera-equipped Spectacles. And just last week, it launched the Snap Camera app, which brings its lenses and filters to desktop users — a product that seems far-flung from its core Snapchat app. Meanwhile its core messaging product has taken a back seat and fallen behind competition like WhatsApp and Facebook Messenger.

“They’ve been very unfocused in what they want to do in and what they want to be,” says Akhtar. “The one thing that worked for Snapchat is vanishing messages. That was the key thing that made them so popular. And because they’re trying too many things at the same time, the interface is less intuitive than it should be. They can’t go to market with something janky and try to fix it as you go. They’re too big.”

Even Spiegel has acknowledged Snap lost its focus, conceding in a company memo this October leaked to Cheddar that the company “lost the core of what made Snapchat the fastest way to communicate.”

Even if Snapchat is able to double-down in the coming months on its core product and — yes — market and communicate the value of its messaging product to users, it’s unclear Snap can appreciably grow its 34+ users.

“It’s a generational thing,” contends Michael Pachter, managing director of equity research for Wedbush Securities. “Our kids grew up with smartphones, and their first photo taken was on a phone. Chatting with images (Snaps) is second nature to them, and is generally foreign to anyone 34 or older. I’m not sure Snap will ever succeed in deeply penetrating the older demographic, because we don’t really think that we have to ‘talk’ with one another via pictures. The concept “Snap – chat” is odd to oldsters, and perfectly natural to youngsters. Maybe Snap will figure out how to get us hooked the way Facebook did (you had to be there because all your friends were there) and can skew older because users talked their parents into joining. But I’m not sure this will ever work the way Facebook did.”

Finding a way to better emulate Facebook? Given Snap’s tangled history with the social network, those are words Spiegel likely doesn’t want to hear.

—

JP Mangalindan is the Chief Tech Correspondent for Yahoo Finance covering the intersection of tech and business. Email story tips and musings to jpm@oath.com. Follow him on Twitter or Facebook.

More from JP: