Senators want to roll back tax cuts to create jobs for long-term unemployed

Two Democratic senators want to claw back some of the Republican tax law, to create jobs for people who have been unemployed for a long period of time.

Senators Ron Wyden (D-OR) and Chris Van Hollen (D-MD) introduced the Long-Term Unemployment Act on Thursday. The bill would create a federal program designed to generate jobs for people who have been out of work for at least six months.

The bill complements — and could eventually merge with — Wyden’s ELEVATE Act, which they say also aims to eliminate barriers to the labor market.

The senators’ plan would subsidize a job for up to one year for long-term unemployed workers — with the option to extend an additional year if the employee is working toward an additional credential or new skills.

“These proposals are designed to get people back on their feet and back in the workforce and just help lift them up,” said Van Hollen.

The senators told reporters that under this legislation, when the unemployment rate is below 5%, the federal government would provide two-thirds of the cost of wages and benefits. In the second year, the government would cover 50% of the cost. When the unemployment rate is higher, the federal contribution goes up to 100%.

‘A persistent structural, problem’

Van Hollen said the wage would be based on the poverty level for a family of four, which is about $25,750 — plus benefits. If the state minimum wage is higher, then the wage would be pegged to the state minimum.

“What this is a guaranteed strategy for a new, winning partnership between employers and workers for a unique time. A partnership that gets unemployed workers good-paying jobs and employers the skilled workers they need,” said Wyden.

In May, 1.3 million people fell into the “long-term unemployed” category, which the Bureau of Labor Statistics defines as being jobless for 27 weeks or more. BLS said this group made up 22.4% of the unemployed. That doesn’t include people who have given up on their job search.

“This is a persistent, structural problem in our economy,” said Van Hollen.

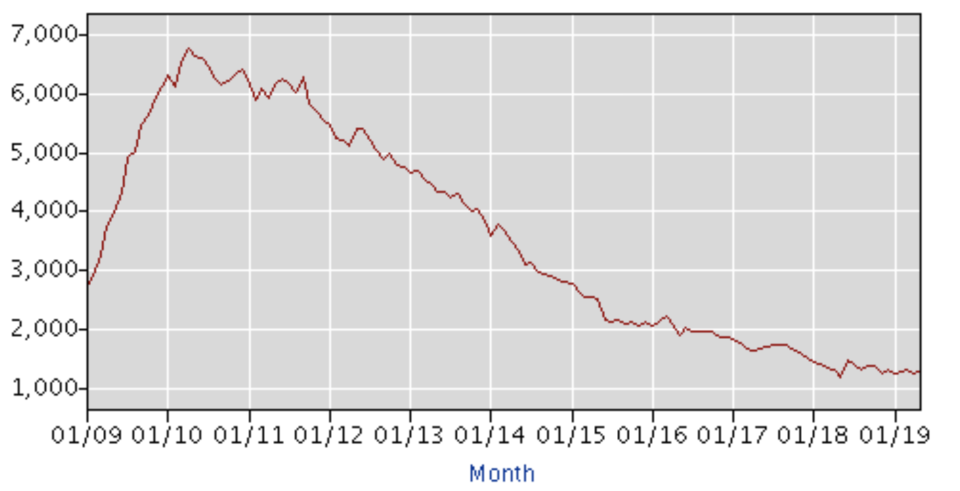

While the number of long-term unemployed has not changed much over the past year, it has been on the decline for the past decade.

“We’re seeing the combination of the tax cuts and the administration’s deregulatory agenda be one of the better things for wage increases in employment that we’ve seen in a long time,” said Adam Michel, a tax expert with the Heritage Foundation, a conservative think tank.

“If the concern is providing more jobs to people, it seems to me we should be doubling down on the agenda of pro-growth reforms, rather than rolling it back,” he added.

Michel argues because there are more job openings than people looking for work, employers will find ways to close the skills gap, without the government stepping in to help.

“The private sector has an incentive to train people and help direct people into those areas where they’re seeking, and we’re seeing the private sector do that,” said Michel.

How do you pay for it?

“Sen. Van Hollen and I are going to be working together to shave some of those tax windfalls in the horribly flawed 2017 tax bill in order to pay for it,” said Wyden.

The senators want to raise taxes on foreign profits by changing the Republican tax, which they argue encourages companies to do business overseas.

“You gotta look for concrete revenue. The tax bill is a badly flawed giveaway and there’s money there that ought to be taken from where it is now and moved to this kind of effort in order to make it easier for companies to compete and workers to have good jobs,” Wyden said.

In an interview with Yahoo Finance, Michel defended the Republican tax cuts, and said cutting the corporate rate to 21% made the United States more competitive.

“The bickering around the marginal effects in that new 21% corporate tax rate world are important, but not as important as that lower rate overall,” said Michel.

The senators suggested several ways to roll back the Republican tax law, including No Tax Breaks for Outsourcing Act, and Removing Incentives for Outsourcing Act, both of which Van Hollen has cosponsored. The senators also pointed to former President Obama’s minimum tax proposal as a possibility.

“We’re going to be going through the tax code with a fine-tooth comb and, in effect, looking at those parts of the tax bill, which in many respects probably make us less competitive in terms of actually creating red, white and blue jobs,” said Wyden.

Kyle Pomerleau, chief economist at the Tax Foundation, disagreed that taxing foreign profits at a higher rate would spur job creation in the U.S. “It may, at the margin, change a company’s decision to enter a foreign market, but it’s not going to change the costs or the benefits of investing the United States. It’s not going to boost employment here by taxing foreign activity,” said Pomerleau.

Pomerleau told Yahoo Finance instead of punishing foreign investments, lawmakers should lower the cost of investment in the United States.

“Increase the amount companies can deduct when they invest here,” he said. “Expanding that or making that permanent would have an effect on investment here.”

Addressing cries of ‘socialism’

The senators said they’ve talked to several 2020 Democratic presidential campaigns that are interested in the proposal, but they’ve yet to pitch their plan to Republican colleagues.

“Our goal is to get this into the political bloodstream,” said Van Hollen.

Though Republicans will surely resist the idea of scaling back their tax cuts, senators say they hope eventually members of the GOP will get on board.

“We have a broken system when there are individuals who —even in an economy that’s doing pretty well overall — are out of work for six months and looking for a job for six months. And if you believe in the dignity of work, you would hope that those Republicans would join us in this effort,” said Van Hollen.

When pressed about the idea that critics will likely slam the bill as the Democratic party’s latest move toward socialism, the senators pushed back.

“Our argument is going to be: This is key to making markets work — the two of us are market-oriented Democrats,” said Wyden. “The very first thing that employers tell me…is they cannot find enough workers with the skills they need to tap the markets of a global economy.”

“In a market system, it’s a market failure if people who want to work can’t find a job. It’s immoral to punish people for not working when those same people want to work but can’t find a job,” said Van Hollen.

Jessica Smith is a reporter for Yahoo Finance based in Washington, D.C. Follow her on Twitter at @JessicaASmith8.

Republican senator: Facebook is 'expanding their monopoly' with Libra

Businesses head to DC to make their case against tariffs

CEOs say trade uncertainty is biggest concern for US economy

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn,YouTube, and reddit.