Analyst says Chipotle cheese dip is flopping in note titled 'Worst queso scenario'

The restaurant sector analysts at RBC Capital have cut their price target for Chipotle Mexican Grill (CMG) to $330 from $400.

“We are lowering our price target and estimates based on our reduced sales outlook, higher labor costs, and elevated avocado prices,” analyst David Palmer said in a note titled “Worst queso scenario.”

Shares were last trading at around $326.

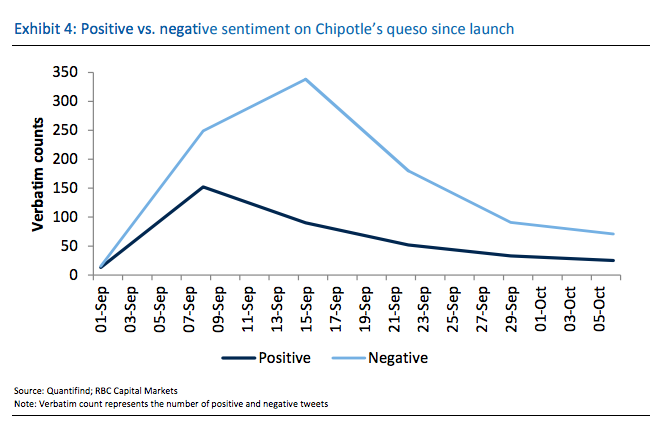

Palmer says that Chipotle’s new queso, which launched on Sept. 12, has been disappointing. The analysts reduced their same-store sales estimates after reviewing social media comments for the new menu offering. They found that negative tweets outnumbered positive tweets during the week following the launch.

While the sentiment has improved since the queso’s debut, it remains negative on social media.

According to Chipotle, queso had been the number one most requested item to add to the chain’s menu. But the company didn’t add it before because they wouldn’t use industrial additives found in most quesos.

“Additives make typical queso very consistent and predictable, but are not at all in keeping with our food culture,” founder and CEO Steve Ells said in a press release around the queso’s launch. “Our queso may vary slightly depending on the characteristics of the aged cheddar cheese used in each batch, but using only real ingredients is what makes our food so delicious.”

Here’s a sampling of how some customers feel about the queso according to Twitter users:

I decided to try the new Chipotle Queso. I did not think it could taste any worse than what I thought. Get rid of this. @ChipotleTweets pic.twitter.com/5F1C9R6k7p

— Courtney (@comradecourt) October 20, 2017

Tried to give the Chipotle queso a fair shake, but it was not good. Grainy, bland and goopy looking. $CMG pic.twitter.com/x0tOJJmETn

— Nicholas Upton (@NickWUpton) October 19, 2017

Chipotle. Listen. I like your food. But when It comes to the melted sharp cheddar and saw dust you call “queso”, it ain’t gonna work pic.twitter.com/ZCGTZumiOY

— Double A Ron (@a_jsock) October 16, 2017

#Chipotle queso is no bueno. Why is it so gritty and odd tasting, @ChipotleTweets? Won’t be ordering that again… pic.twitter.com/rCqkCYykje

— Kristina Nguyen (@kristinanoogen) October 9, 2017

But there were also fans.

Chipotle’s queso seems to be getting trashed a lot, but I think it’s pretty delicious. Pretty dang delicious.

— Andrew (@adcustom) October 3, 2017

Good news: Queso at Chipotle is delicious.

Bad news: I'm going to buy Queso at Chipotle all the time.— Tommy™ ✏ (@tommy_kayyy) September 28, 2017

Don’t need 280 characters to say this:

The queso from Chipotle is delicious and I don’t understand the hate @ChipotleTweets

— Eric M. Hammer (@TheEricHammer) September 27, 2017

“With 3Q results, we hope to learn: 1) whether queso still has potential to drive incremental trial and frequency; 2) whether adjustments to the product or its execution are necessary; and 3) about future sales and throughput initiatives, particularly if queso proves ineffective at stimulating trail and frequency,” the analyst writes.

Even with the negative reaction surrounding the queso dip, RBC believes that Chipotle will still raise prices by year-end in select markets. The company increased prices by 5% in early April in 440 stores, amounting to about 20% of their restaurants.

“Although Chipotle’s relationship with its customers has been fragile at times, the company believes its guests were generally accepting of the increase in those stores,” the analysts write. “We expect to see a similar level of pricing phased in beginning in late 2017 and through 2018, which could potentially result in an effective price increase of 2-3% next year. ”

RBC rated the stock “Sector Perform.”

—

Julia La Roche is a finance reporter at Yahoo Finance.

Read more: