Portmeirion Group And Other Top Dividend Stocks

Portmeirion Group is one of the companies that can help improve your portfolio income through large dividend payouts. Great dividend payers create a safe bet to increase investors’ portfolio value as payouts provide steady income and cushion against market risks. Dividends play a key role in compounding returns over time and can form a large part of our portfolio return. Below are more huge dividend-paying stocks that continues to add value to my portfolio holdings.

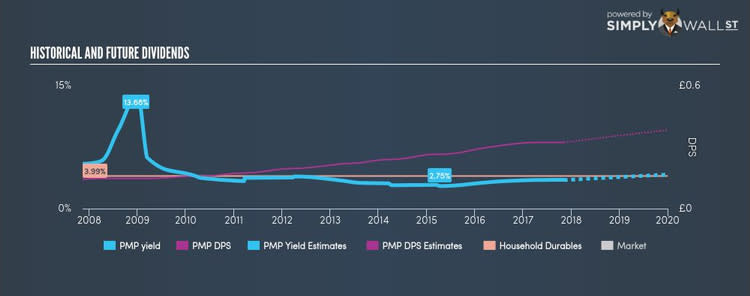

Portmeirion Group plc (AIM:PMP)

Portmeirion Group PLC manufactures, markets, and distributes ceramics, home fragrances, and associated homeware products in the United Kingdom, the United States, South Korea, and rest of the world. Founded in 1912, and headed by CEO Lawrence Bryan, the company size now stands at 788 people and with the company’s market cap sitting at GBP £99.00M, it falls under the small-cap group.

PMP has a nice dividend yield of 3.53% and is currently distributing 53.01% of profits to shareholders . PMP’s last dividend payment was £0.3225, up from it’s payment 10 years ago of £0.1425. They have been consistent too, not missing a payment during this 10 year period.

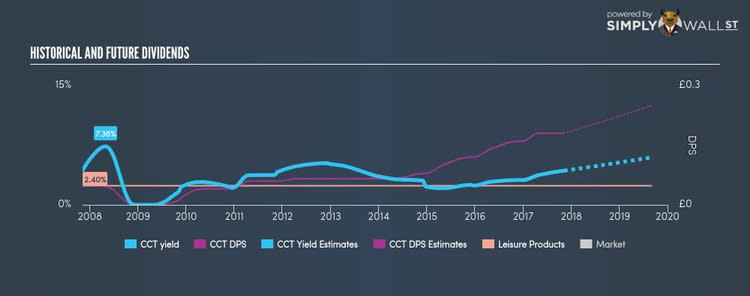

The Character Group plc (AIM:CCT)

The Character Group plc designs, develops, and distributes toys, games, and giftware in the United Kingdom and internationally. Started in 1991, and now led by CEO Kirankumar Shah, the company size now stands at 194 people and with the company’s market capitalisation at GBP £87.50M, we can put it in the small-cap stocks category.

CCT has a large dividend yield of 4.30% and their current payout ratio is 39.93% , with the expected payout in three years being 53.08%. Although investors would have seen a few years of reduced payments, it has so far always picked up again, with dividends increasing from £0.048 to £0.18 over the past 10 years. Character Group seems reasonably priced when looking at its PE ratio (9.8). The industry average suggests that Global Leisure Products companies are more expensive on average 18.1.

NWF Group plc (AIM:NWF)

NWF Group plc, together with its subsidiaries, operates as an agricultural and distribution business that delivers feed, food, and fuel in the United Kingdom. Established in 1871, and currently lead by Richard Whiting, the company size now stands at 901 people and with the company’s market capitalisation at GBP £79.05M, we can put it in the small-cap category.

NWF has a sizeable dividend yield of 3.69% and distributes 53.04% of its earnings to shareholders as dividends . The company’s dividends per share have risen from £0.0388 to £0.06 since it started paying dividends 10 years ago. They have been consistent too, not missing a payment during this 10 year period.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.