How to play The China Syndrome

The China Syndrome was a 1979 movie thriller starring Jane Fonda that was prescient in that the Three Mile Island occurred 12 days after the movie was released. Although the movie disaster was averted, there was much stress and potential disaster; we think the corollary could be the current trade war with China.

We will present a handful of ideas to make money on the short side to hedge your portfolio during this "War" that could play out a bit longer than most expect.

Since the total amount of direct impact on GDP if U.S./ China trade went to zero would be about 1 to 2% on each economy, we believe the real risk here is overstated. We will also place our chips on the U.S. to win this battle as Trump is a very experienced negotiator and businessman and could be successful in rallying the rest of the world against China. In fact, he just held out an olive branch to Canada and Mexico to mend the fences and close the recent trade proposal, the USMCA, with both countries. The other fact that supports our belief is that China has much more to lose then the US when we ponder the trade gap and imbalance that currently exists.

Here are the trades that we feel are most exposed to this ongoing drama.

Apple Inc.: (AAPL)

One of the most exposed US companies, Apple, currently derives nearly 20% of its revenue from China and much of its expected future growth. Apple already is burdened by higher prices, potential market saturation, an ongoing trade war with China, will not help. Analysts estimate Apple earnings will decline 4% in 2019 and then rebound 11% in 2020 to nearly $13 a share. Should the trade war persist combined with these other negative elements, Apple earnings may go flat or possibly declined further. The mean Apple Wall Street estimate is $11.49 for 2019 Furthermore; it is likely that a protracted trade war with these higher-risk elements will compress the Apple PE ratio another 5-10% to the 14 to 15 area providing further downside to the $140- $150 level. Since trade war rumblings reemerged from the Trump tweet last week, Apple has declined approximately 8%. To throw more gasoline on the fire, the technical picture has turned ugly with the stock breaking down through 50-day moving average and 200-day moving averages on huge spikes in volume.

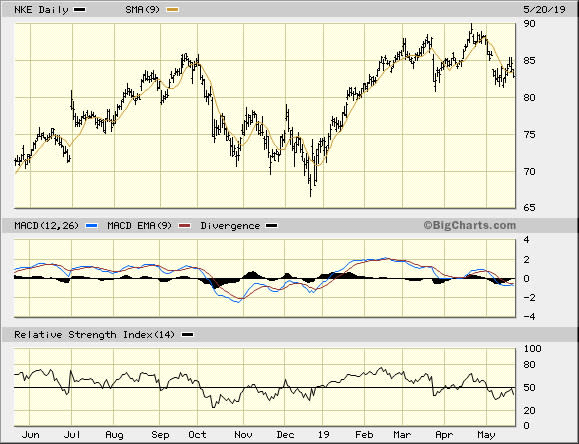

Nike Inc. Cl B: (NKE)

China is Nike's most important growth opportunity and revenues have been increasing 20% to 25% as of late. Although sales have held up recently, this may not persist with another 10% to 20%price markup due to the trade war. Nike may be particularly vulnerable to a sell-off since it trades at a lofty PE ratio of 33 times earnings and it's even higher PEG ratio of 5.5 times 2019 earnings growth. While Nike (NKE) has gone to great lengths to reduce its manufacturing and distribution exposure from China, it may have the greatest downside due to its high valuations. A couple of consecutive negative surprises may cause a compression in the PE multiple and a reduction in earnings growth expectations. If, hypothetically, Nike earnings were to go flat in 2019 and it traded down to its historic PE multiple, a 20% premium to the S&P 500, that would collapse Nike stock to trade at 24 x $2.40 per share earnings per share. That would render a price target of $50. From a technical perspective, should Nike close below $80.50 per share on high volume this would penetrate the 200-day moving average and show the formation of a head and shoulders top.

Now we present two ETF 's that should provide a One-Stop click to diversified exposure and hedged risk from the China syndrome:

Direxion Daily FTSE China Bear 3X Shares (ETF): (Yang)

On the possibility of a continued and even heightened global trade war versus China, YANG has jumped higher. This targeted ETF provides ample exposure with 3x leverage on the FTSE China 50 index. YANG is up over 11% since the Trump tweet.

Direxion Daily Emerging Markets Bear 3x Shares (ETF): (EDZ)

One strategy that China utilizes to offset tariffs is to devalue their currency. Since the 10% tariffs were imposed by the U.S. , China's currency has been depreciated 8%, nearly offsetting the difference. The side effect of this currency manipulation is increased strength of the dollar which places an extra heavy burden on emerging market economies that are financed by U.S. dollars and are heavily indebted. The 3x leveraged emerging markets inverse ETF is up 14% since the Trump tweet.

Next report: longs that benefit from the trade war fears.

Commentary & Strategy by:

Robert Maltbie, CFA

President - Singular Research

LinkedIn