One of world's biggest banks says Brexit uncertainty is hitting business investment

HSBC (HSBA.L), one of the world’s largest banks, warned that Brexit uncertainty is hitting business investment amid reporting its results that missed expectations.

Executives at the London-based banking giant said on an earnings call that it saw “some softening” in its British business in January as clients were cautious about the “prolonged uncertainty” over what a Brexit deal — if there is one at all — will look like when Britain leaves the European Union on 29 March.

“Many of our UK customers are understandably cautious about the immediate future, given the prolonged uncertainty surrounding the UK’s exit from the EU,” said HSBC chairman Mark Tucker.

HSBC’s chief executive John Flint said that the bank is continuing to make preparations for Brexit and that its French division gives the lender a “major advantage” during the contingency plan process, before adding “our immediate priority is to help our customers manage the present uncertainty.”

He also said that the amount HSBC sets aside for loans going bad were high in 2018 due to “the uncertain economic outlook in the UK and heightened downside risks.”

HSBC’s comments follows neatly in line with the Royal Bank of Scotland’s (RBS.L) in which RBS’ CEO Ross McEwan warned on a call to reporters that “the area where we have seen a slowdown is in the large corporates. They are pausing investment and waiting to see what the outcome on Brexit will be.” He also sounded that alarm over the possible spike in bad loans from business failures that are a result of Brexit-induced economic uncertainty.

Today, HSBC reported a 16% rise in pre-tax profits to $19.9bn (£15.4bn) for 2018 but it missed analyst expectations of $21.3bn for the year. Revenue also increased by 5% to $53.8bn.

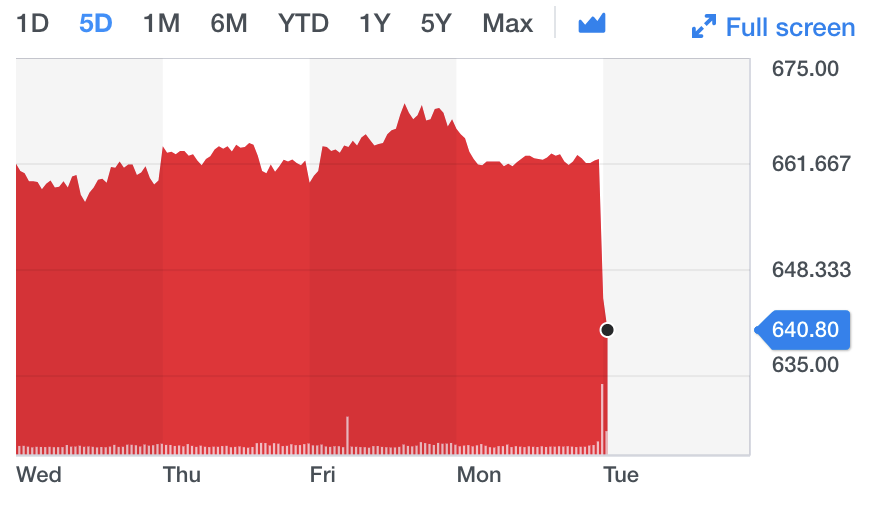

Shares dropped by over 3% in early trading on the results announcement.