It's been one year since bitcoin was interesting

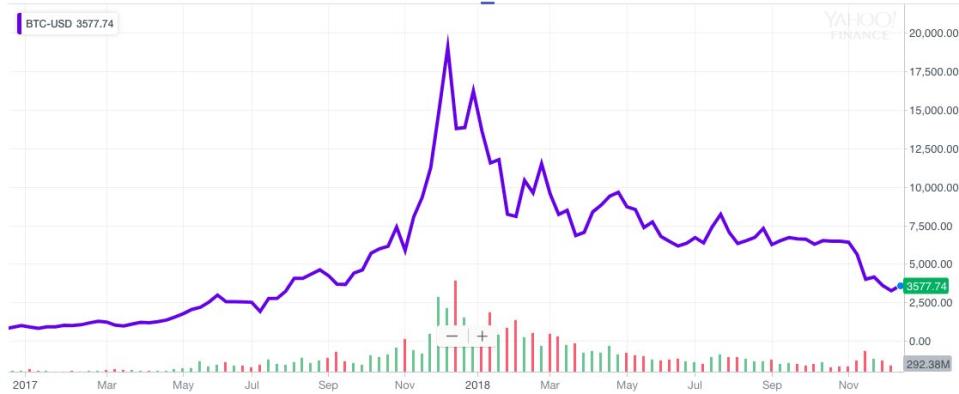

Congratulations bitcoin bulls. It was exactly one year ago today — December 17, 2017 — that the price of bitcoin hit a record high of $20,000 per bitcoin.

That was also the last time bitcoin was really interesting.

As of Monday afternoon, the price of bitcoin was sitting just above $3,500, good for a nearly 10% pop on the day and a roughly 82% drop over the last year. Measured from its most recent low on Saturday, bitcoin prices dropped 84% from their peak last December 17.

Back when bitcoin prices and other cryptocurrencies were going to the moon, stocks were near record highs and finishing off one of the least-volatile years on record. In the end, 2017 was a great time to be invested in the stock market but it was a very boring time to be talking about investing in the stock market.

Crypto filled that void admirably.

But right now, stocks are getting rocked and the drumbeat of strategists calling the current environment a bear market is growing louder. Investors are concerned about the Federal Reserve, the end of the economic cycle, and Trump’s trade war with China among other things.

Following the stock market and financial markets in 2018 is fun. Following the crypto market is not.

Throughout the popping of the 2017-18 cryptocurrency bubble, defenders of the space have taken up a number of positions to justify why digital assets are here to say, with many simply arguing that prices don’t matter.

But as layoffs have started hitting the cryptocurrency space it is hard to argue that prices are just a cosmetic distraction true believers can freely ignore. The price of any financial asset always matters — arguing otherwise is to simply deny reality.

And as Bloomberg’s Joe Weisenthal wrote Monday, price is the most important part of the bitcoin story. Higher prices for bitcoin and other digital assets motivate the miners creating these new assets to continue their work. Lower prices make mining less economically viable, potentially stunting the expansion of the network or rendering the network’s existence obsolete. Or as Weisenthal writes, making crypto nothing more than “a neat science project.”

Bitcoin historians will note that this is only the third-worst drop in the history of bitcoin — in 2011 and in 2013, bitcoin dropped more than 90% from peak to trough. But the public mania that accompanied the 2017 frenzy and 2018 crash in the price of bitcoin and other cryptocurrencies certainly makes this the most notable drawdown we’ve seen in the bitcoin space.

And while we were promised lots of things during the most manic days of the cryptocurrency frenzy that broke out in the middle of 2017, the only story that ended up being really interesting was the price.

At the end of 2017, we wrote that “if 2017 was about the mania in price with investors expressing regret for having missed this rally, 2018 might be the year that markets start figuring out just what all of these things are for.”

Investors are still figuring out what exactly cryptocurrencies and the blockchain are really for. It seems like every big company is “exploring” blockchain technology, but it isn’t clear what that technology would actually do for their business.

The entire point of a bank, for example, is to keep a centralized ledger of transactions and keep track of who has money to do what, while the entire point of the blockchain is to decentralize ownership.

But even discussing examples of how blockchain applications might fail or succeed in a large corporate setting is so 2017. The decline in price of these assets and the loss of value from the space tell you more about the viability of these applications than any consultant’s pitch deck will.

Bitcoin and cryptocurrencies and blockchain were supposed to usher in a new digital revolution. Instead it was just another asset bubble. And it popped one year ago.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland