How one company profited from the daily fantasy sports boom — without the legal risks

If you are a sports fan, even if you don’t play fantasy football, you are likely aware of DraftKings and FanDuel, the two leading private tech startups offering daily fantasy sports (DFS). The companies, each recently valued at $1.2 billion, flooded NFL viewers two seasons ago with TV ads, mostly about all the money you can make entering their games. So you’d be excused for assuming that the companies are making big money.

But in fact, neither one is profitable yet.

Eilers & Krejcik Gaming, in a January report on the size of the DFS industry, estimated that DFS companies brought in $3.2 billion in entry fees in 2016 — but that was just “handle,” the money that they took in; their actual revenue was closer to just 10% of that (around $300 million) once you subtract the prize money they paid out. And they are spending big on marketing costs. And in 2015, they spent a great deal on legal fees, fighting politicians who wanted them banned.

One DFS company that did turn a profit during this time, without offering any DFS contests at all, was the content site RotoGrinders.com.

RotoGrinders, which is like a Reddit for daily fantasy sports, launched seven years ago, in the early days of DFS. (FanDuel launched in 2009, DraftKings in 2012.) The company is private, so it will not share financials, but says it is profitable. RotoGrinders has 28 full-time employees and attracts about 11 million monthly pageviews.

How RotoGrinders found a niche

After Congress passed the Unlawful Internet Gaming Enforcement Act (UIGEA) in 2006, crippling online poker in the US, Cal Spears sold off his poker rankings site, PocketFives.com, in 2007 (the site still exists today). Soon, he saw a new niche in daily fantasy sports, where he could create a similar business.

“It was like the second ‘opportunity of a lifetime’ for me,” Spears says. “I got back together with some of the original guys from PocketFives, and we did it all over again — we created a content/rankings/community site. It started with ranking the guys who are playing daily fantasy sports.”

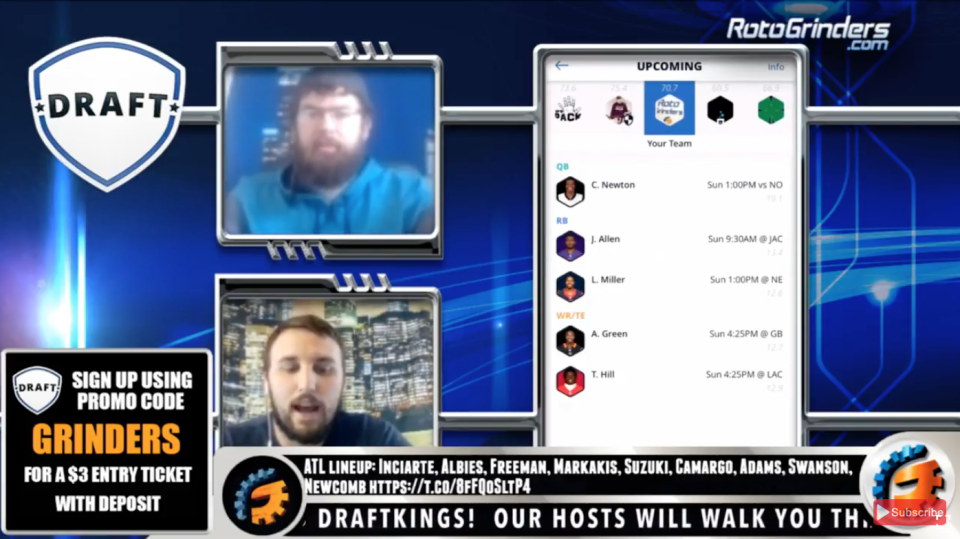

Today, RotoGrinders has a lot more than rankings of the top DFS players. It offers news and forums; live daily web shows with tips and analysis for creating your lineup on sites like DraftKings, FanDuel, Draft, and FantasyDraft; alerts about open spots in the biggest guaranteed prize pools; interviews with executives from DFS companies; and even a daily show on Sirius XM Radio.

The site calls itself, “the daily fantasy sports authority.”

It is an obvious place for DFS obsessives (the “grinders”) but also, Spears hopes, for newbies. Attracting new users to the site is the same hurdle DFS companies themselves have faced: Nearly 60 million Americans play fantasy sports, but only 3 million actively play daily fantasy sports, the companies estimate. “It’s a game where you have to wake up in the morning and like the idea of solving this new puzzle,” Spears says. “But that doesn’t mean you’re a professional player. They are intense games of skill, but also they’re going in the direction of simplifying.”

Content as a safer model than contests

The success of RotoGrinders is a reminder of a lesson in digital content: Sometimes providing original content around an industry is a better proposition, operationally and financially, than offering the products or services of that industry itself. (Think of sites that track airfare deals as another example.)

Understandably, RotoGrinders will now push premium content (for a fee) as a new revenue stream; in the past, it made much of its money through referring readers to DFS sites in exchange for a fee from those sites.

“There is an avid user base of players and they will pay for premium content,” Spears says. “And the sites will also pay sites like mine for referrals. So whenever they’re in a heavy acquisition mode, which was especially true in 2014 and 2015, my business was very focused on sending referrals. And now, as the industry matures, we’re focusing a lot more on premium content — selling subscription products and advanced tools to the avid players.”

[For more on fantasy football and its impact on the NFL, listen to Episode 4 of our Sportsbook podcast on the business of football. You can listen on iTunes or below.]

—

Daniel Roberts is the sports business writer at Yahoo Finance. Follow him on Twitter at @readDanwrite.

Read more:

The daily fantasy sports market has a demographic problem

Why the island of Malta is so important for DraftKings

The fantasy sports business has changed drastically in just 1 year

Here’s where every state now stands on daily fantasy sports legality