Now Is the Time to Act on Alibaba Stock After Its Historic Drubbing

Shares of Alibaba (NYSE:BABA) finally found their footing yesterday after a historic sell off. BABA has lost a third of its value over the past four months after making all-time highs at $210.86 on June 14. While some of the selling can rightfully be attributed to overvaluation, slowing growth and tariff fears, the recent carnage has become way overdone, which means now’s the time to buy Alibaba stock.

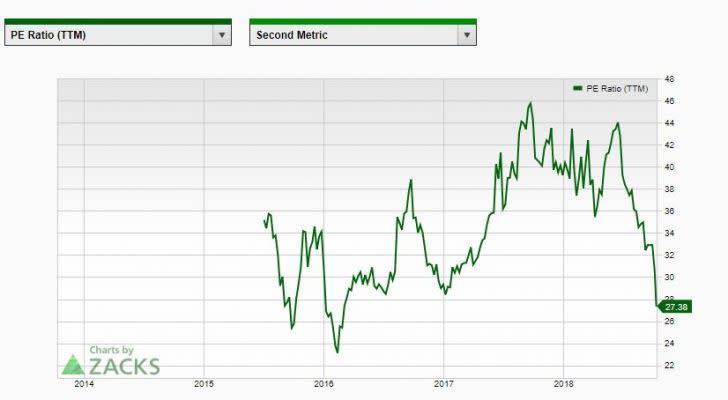

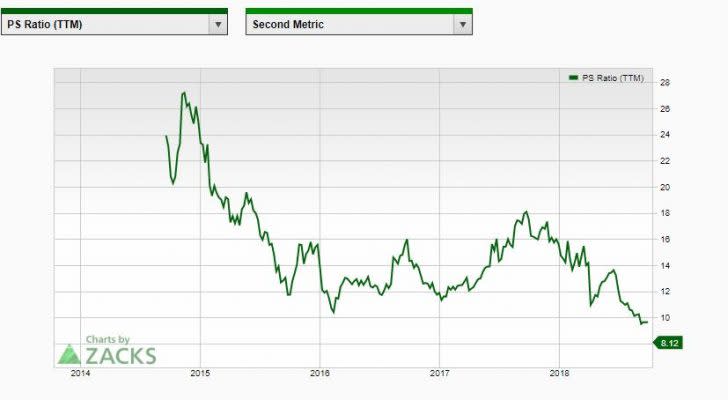

In a previous post on BABA stock from June 15, I had a decidedly bearish outlook for BABA based in part on valuations. Since that time, the fundamentals have most assuredly become more attractive. The P/E ratio has dropped from over 50 then to under 30 now. Price-to-sales has also followed a similar path, hammered from over 15 to just above 8 and at the lowest ratio ever. In the course of just four months, Alibaba has gone from richly priced to comparatively attractive.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Alibaba stock is also looking extremely attractive from a technical perspective. Its nine-day RSI shows BABA was the most oversold it has been over the past year with a reading below 20 before rebounding yesterday. Previous times that Alibaba was this oversold marked significant short-term lows. Shares are also trading at a massive discount to the 100-day moving average, which has led to a reversion in the past. Bollinger Band Percent B also turned negative, which is yet another bullish sign.

Most importantly, BABA stock had a key reversal day yesterday. Shares opened at new lows only to immediately rally and close higher on the day. This type of price action indicates that the sellers may finally be exhausted, especially after such an unrelenting drop.

Implied volatility (IV) in BABA options is at an extreme, to say the least. The current IV percentile of 100% means option prices are at the highest prices in the past year. This definitely favors option selling strategies when constructing trades. It is also another reliable indication that the selling has reached an extreme.

So, to position for the selling in Alibaba stock to stop, a bullish put credit spread makes sense. Earnings are due in early November, so we want the expiration date to be before the release to avoid any earnings-related risk.

Alibaba Stock Trading Idea

Buy BABA Oct $135 puts and sell BABA Oct $138 puts for a 40 cents net credit.

Maximum gain on the trade is $40 per spread with maximum risk of $260 per spread. Return on risk is 15.38%. The short $138 strike price provides a 2.74% downside cushion to the $141.90 closing price of Alibaba stock.

Tim Biggam may hold some of the aforementioned securities in one or more of his newsletters. Anyone interested in finding out more about Tim and his option-based strategies can go to https://marketfy.com/item/options-and-volatility

More From InvestorPlace

The post Now Is the Time to Act on Alibaba Stock After Its Historic Drubbing appeared first on InvestorPlace.