A No-Drama Earnings Report Should Send General Electric Stock Soaring

What investors want from General Electric (NYSE:GE) right now is peace and quiet. No surprises. No more dividend cuts. No more shocking losses from previously thought sound business operations. Right now, no news is good news for GE stock.

Unfortunately, investors have an earnings report to deal with this Friday. General Electric is expected to post a profit of 18-cents-per-share, down from 28-cents-per-share in the same quarter last year. Revenue is expected to slip 1% year-over-year to $29.25 billion.

Investors across Wall Street will be hoping that the biggest surprise to come out of Friday’s report is that GE hits the whisper number of 20-cents-per-share. One can dream.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

There is quite a bit that could shake things up on Friday. After all, GE is in the midst of a considerable restructuring. It is spinning off its health care unit, ditching its 62.5% stake in Baker Hughes, selling its GE Transportation unit and shrinking its GE Capital business.

In the end, GE wants to be a lean high-tech industrial company centered on Aviation, Power and Renewable Energy. But there are still more bumps in the road to come, and some may emerge in this Friday’s quarterly report.

Despite GE’s efforts, market sentiment has not improved … it has worsened. According to Thomson/First Call, GE sports just seven “buy” ratings, six “holds” and four “sells.” During the past month, GE has lost one “buy” rating and gained a “sell” rating.

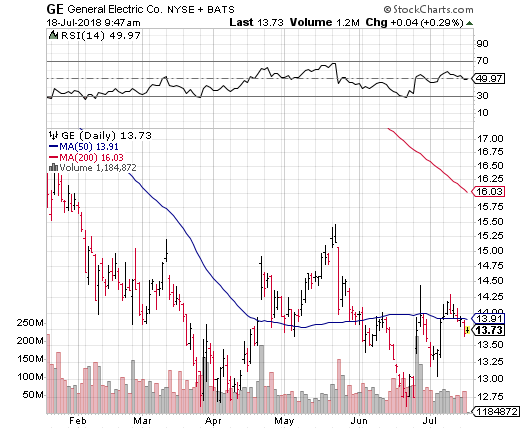

The result has been a tumultuous ride for GE stock. The shares topped out near $15.50 back in May, only to be hammered lower to $12.61 in less than a month. GE has since recovered, and is now facing resistance in the $14 region, which is home to the stock’s 50-day moving average. A breakout above this trendline could be a significant sentiment boost for technical traders.

GE options traders, meanwhile, aren’t holding their breath. Currently, the July put/call open interest ratio rests at 0.85. This reading is an improvement over a string of similar readings north of 1 in the past month. However, it still shows a bit of trepidation from the speculative crowd, which is to be expected.

Finally, July implied volatility is only pricing in a potential post-earnings move of about 4% for GE stock. Given the shares’ volatility over the past month, this seems rather low heading into earnings. The result is an upper bound for an expected move of about $14, with the lower bound resting at $13.

Two Trades for GE Stock

Bull Call Spread: I’m inclined to believe that the worst has already been priced into GE stock — barring any unforeseen surprises, that is. As such, GE stock clearly wants to rally, and any positive data out of Friday’s report should allow it to do just that.

Traders looking to capitalize on post-earnings rise might want to consider an Aug $14/$15 bull call spread. At last check, this spread was offered at 26 cents, or $26-per-pair-of-contracts. Breakeven lies at $14.26, while a maximum profit of 74 cents, or $74-per-pair-of-contracts — a potential return of 180% — is possible if GE closes at or above $15 when August options expire.

Bear Put Spread: If you are among the growing bearish contingent that believes the worst is not quite over for GE, then a bearish play on earnings may better fit your outlook.

Traders expecting a post-earnings decline might want to consider an Aug $12/$13 bear put spread. At last check, this spread was offered at 17 cents, or $17-per-pair-of-contracts.

Breakeven lies at $12.83, while a maximum profit of 83 cents, or $83-per-pair-of-contracts — a potential return of 388% — is possible if GE closes at or below $12 when August options expire.

As a side note, I wouldn’t expect GE to drop to $12 by August expiration, but selling the $12 put lowers breakeven on the trade and raises your chance of banking a larger profit. I would target a potential move to $12.60-$12.70 and take profits there.

As of this writing, Joseph Hargett was long GE stock.

More From InvestorPlace

The post A No-Drama Earnings Report Should Send General Electric Stock Soaring appeared first on InvestorPlace.