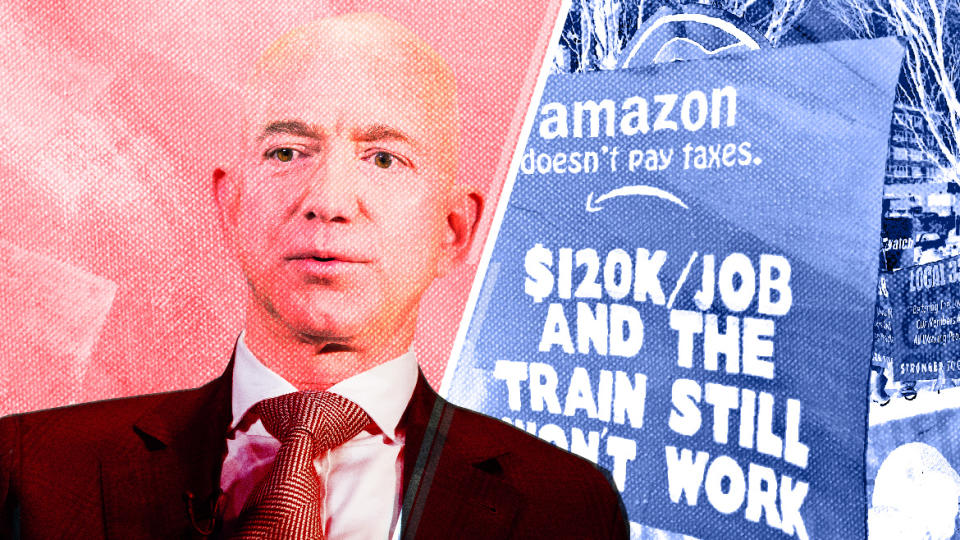

The new treasurer of America’s most populous state is taking on Amazon

On Jan. 7, a certified public accountant named Fiona Ma will take office as California’s state treasurer, and she has a big task on the top of her to-do list: Get Amazon to collect taxes for its billions of third-party sales.

The e-commerce giant has already been collecting sales tax for its own products in all 45 states with such tax. However, in most states, it doesn’t collect sales tax for third-party sellers on its marketplace — which account for over half of Amazon’s sales.

“They should be doing the right thing,” Ma told Yahoo Finance. “We have asked them to do it but they don’t want to do it. So we’re going to compel them next year.”

California has tried to make Amazon do the “right thing” before. In 2011, the state passed a law requiring internet retailers like Amazon to collect state sales tax on items purchased by California residents. More recently, California has been pressuring the e-commerce giant to provide tax information for third-party sellers — ostensibly, so the state can make sure those businesses are collecting sales tax, too.

However, Ma says that collecting taxes would be a burden for third-party sellers. That’s why she’s pushing for a state law that would put the burden on powerful e-commerce giants like Amazon to collect taxes on behalf of third-party sellers who sell on their platforms.

“You know your customer. You’re collecting the payment. You’re shipping it to them. You’re taking the returns. You’re refunding them. Why can’t you collect taxes?” Ma said of Amazon.

A request that raised concerns among Amazon’s third-party sellers

In late October, some sellers received an email from Amazon saying the e-commerce giant planned to disclose the sellers’ contact information and U.S. taxpayer identification number to the California Department of Tax and Fee Administration.

This letter, which could mean more taxes for third-party sellers, raised alarms among Amazon’s third-party sellers. For individual sellers who want to charge state and local taxes, it can be difficult to comply. California alone levies distinct taxes in 24 districts, ranging from 7.25% to 10.25%. Many sellers say that buying new software and hiring extra people to file taxes could burden their small businesses.

Amazon, on the other hand, has the resources to collect sales tax on behalf of third-party sellers, but it says it can’t collect taxes until states pass legislation to require it to do so.

In June, the Supreme Court ruled that states can in fact require online retailers to collect sales tax — even if they have no brick-and-mortar presence in those states. The decision is a win for physical stores, which are arguably at a disadvantage because they do have to collect tax. It’s also a victory for states that can get more tax revenue from online retailers.

The Supreme Court left it up to states and local governments to decide how they want to collect taxes on online sales. Since the Supreme Court handed down its ruling, only Washington, Pennsylvania, and Minnesota had passed laws requiring marketplace facilitators like Amazon to collect sales tax for third-party transactions. This provides some relief to third-party sellers, which don’t have to spend resources collecting taxes.

Other states will likely follow suit with similar laws in the wake of the Supreme Court ruling. Until then, Amazon maintains a competitive advantage on price over local retailers that must collect taxes.

‘Amazon won’t do it voluntarily’

The California Board of Equalization, which Ma has served on since 2015, estimates that the state’s revenue loss related to all remote online sellers for both businesses and household consumers was about $1.5 billion in the fiscal year 2016-17. Amazon captures about half of the online sales in the U.S. With one of the highest sales tax rates in the country, California could stand to gain significant revenues from Amazon’s third-party sellers.

Much of the debate now about whether Amazon must collect those taxes centers around whether Amazon is a retailer — or whether it purely acts as a platform facilitating a transaction.

Critics of Amazon emphasize its role in the transaction rather than just a platform. An increasing number of merchants on Amazon are using Fulfilled by Amazon (FBA) service, by which they pay Amazon to pack, ship, and provide customer service for their products. It has become an engine of the titan’s business revenue. Still, Amazon might balk at collecting taxes on third-party products, even those that use this service.

“This is like Target suddenly telling P&G that it’s their responsibility to collect tax on Gillette Razors,” Paul Rafelson, a state tax attorney who founded the Online Merchants Guild argued. “Amazon won’t do it voluntarily because Amazon benefits from avoiding the tax and everyone blames merchants.”

If other states can force Amazon to collect taxes, Ma believes California, the nation’s largest economy and one of the biggest markets for Amazon, could do it, too. During her tenure at Board of Equalization, the state’s elected tax commission, she sent a letter to Governor Edmund Brown’s office in August 2017 to urge him to push Amazon to collect taxes for third-party sales. Her efforts did not pay off.

A complicated relationship with Amazon

That was not the first time Ma tried to confront Amazon on tax issues. When she was a state lawmaker, she played a role in the 2011 legislation that required Amazon to collect sales tax on items purchased by California residents. However, that law didn’t require Amazon to collect taxes on items bought by third-party sellers — a loophole made possible because the e-commerce giant neglected to disclose the indispensable role of third-party sellers on its platform, according to Ma. Seven years later, she aims to close the loophole and use it as a new source of revenue.

Of course, Ma recognizes how hard it is to take on Amazon. She traveled to Seattle to talk to Amazon’s VP of States Tax in January 2017 and realized it won’t voluntarily collect sales taxes from third parties until new legislation passes.

“If we are going to address some of the ongoing unfunded liabilities and infrastructure costs, we’re going to have to find more money,” Ma told Yahoo Finance. “Since I’m on the tax board, it’s been a priority to generate more revenues that they should pay legally.”

Amazon has a complicated relationship with state governments. States have complained about tax issues — South Carolina, for example, is suing Amazon for uncollected taxes, interests, and penalties related to marketplace sellers. At the same time, states have been trying to court Amazon to build fulfillment centers and create job opportunities.

This year, in particular, state and local governments wooed Amazon as they vied to become the location of its second headquarters. The winners of the year-long bidding war were revealed this month — Crystal City in Virginia and Long Island City in New York plans to offer $4.2 billion in tax incentives in total. New York Governor Andrew Cuomo notoriously said he’d change his name to “Amazon Cuomo” if the e-commerce giant opened headquarters in the Empire State.

Inside government agencies, there are also divergent attitudes towards Amazon. Ma says the Chamber of Commerce and some Republican legislators are eager to maintain an anti-tax and pro-business image. She also thinks regulators in California are too cautious about regulating big tech companies.

“Because a lot of customers are using it. They like it cause it’s convenient. And so it’s always a big fight trying to regulate something that is very popular for people,” said Ma.

During the midterm elections, Democrats had a sweeping victory in California, now controlling more than two-thirds of sitting state legislators. In the first week of January, Ma plans to have Sen. Mike McGuire act as the author of a bill specifically requiring Amazon to collect sales tax for third-party purchases, while she will be legislation’s principal sponsor.

Ma says the proceeds could fuel the infrastructure needs in California, from hospitals to schools. And this could have big implications for other states fighting with Amazon over sales tax.

An Amazon spokesperson says it will carefully consider legislation in California and around the country, and the company “looks forward to the opportunity to work with Fiona Ma.”

“I hope they will support my bill,” Ma said, referring to Amazon.

Krystal Hu covers technology and economy for Yahoo Finance. Follow her on Twitter.

Read more:

Why an Amazon job costs New York more than Virginia

Amazon bought Whole Foods a year ago. Here’s what has changed

We entered the multi-million dollar business behind your Amazon returns