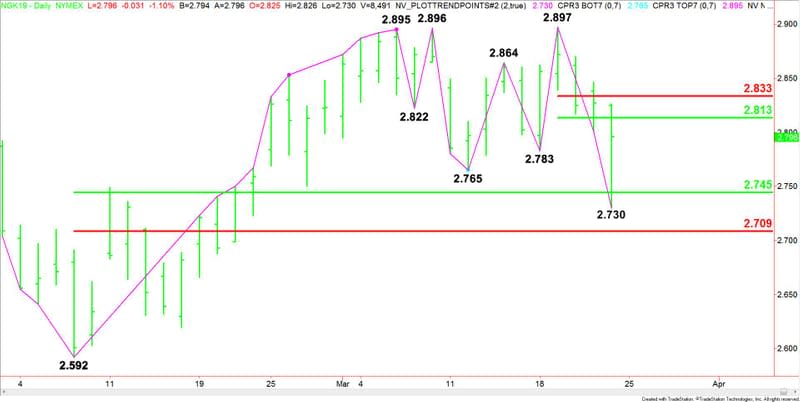

Natural Gas Price Fundamental Daily Forecast – Major Support Zone at $2.745 to $2.709 Controlling Market’s Direction

Natural gas futures fell sharply lower early Friday, but have clawed back more than half of its earlier losses. Nonetheless, the market is still trading lower shortly before the cash market opening. The plunge in prices is likely being fueled by a change in the weather forecast as the market continues to make the transition from the winter heating season into the spring injection season.

At 08:14 GMT, May natural gas futures are trading $2.797, down $0.027 or -0.96%.

U.S. Energy Information Administration Weekly Storage Report

On Thursday, the NYMEX May natural gas futures contract settled nearly unchanged amidst stable supply and demand levels.

The Energy Information Administration (EIA) announced a 47 Bcf storage withdrawal for the week-ending March 15. This was slightly lower than the 48 Bcf consensus estimate of analysts. The survey of analysts ranged from 42 Bcf to 54 Bcf.

Total stocks now stand at 1.143 trillion cubic feet, down 315 billion cubic feet from a year ago and 556 billion below the five-year average, the government said.

Supply/Demand Analysis

The forward curve showed April natural gas nearly flat. May and June futures ended less than 1 cent higher, while July and August both rose 1 cent. According to S&P Global Platts, the primary factor shaping the forward curve is a relatively unchanged supply and demand outlook.

On Friday, S&P Global Platts Analytics expects total supply to increase 0.1 Bcf to 91 Bcf on Friday and average 0.3 Bcf/d higher over the next seven days.

US dry gas production was expected to remain at 86.1 Bcf for the second day in a row, with Platts Analytics forecasting it will average 86.2 Bcf/d for the next 14 days.

Demand was expected to total 92.8 Bcf, down 0.1 Bcf compared with Wednesday.

Short-term Weather Outlook

According to NatGasWeather for March 21 to March 27, “A weather system will track across the Northeast today and Friday with rain, snow, and chilly low of 20s and 30s. The southern US will be mild to warm with highs of 60s to 80s, while mild across the western and central US with highs of 40s to 60s. After a brief break across the Midwest and Northeast last this weekend, another cold front is expected Tuesday and Wednesday with a swing back to strong demand as lows drop into the teens to 30s. Overall, national demand will swing between moderate and high into next week.”

According to the US National Weather Service for March 27 to March 31, “Look for lower-than-average temperatures in the Northeast and part of the Southeast. The outlook also calls higher-than-average temperatures in the Northwest and eastern half of the Southwest.”

Daily Forecast

The early price action suggests the market is still rangebound with buyers not willing to give up on the long-side so easily. This also suggests investor indecision as the market goes through the transition from demand to injection.

The main range is $2.592 to $2.897. Its 50% to 61.8% retracement zone at $2.745 to $2.709 stopped the selling at $2.730 early Friday and may have even encouraged new speculative buyers to re-enter after the earlier wash-out.

The new short-term range is 2.897 to $2.730. Its retracement zone at $2.813 to $2.833 is the primary upside target. Since the main trend is down, sellers are likely to show up on a retest of this zone.

This article was originally posted on FX Empire