Morgan Stanley: 'We are in a bear market'

Morgan Stanley analysts delivered a six-word reality check this morning in a research note to clients: “We are in a bear market.”

Although the S&P 500 (^GSPC) index has fallen only as low as to corrective levels since hitting its September intraday high, price action among stocks this year suggests “we are in the midst of a bear market,” Morgan Stanley analyst Michael Wilson wrote.

A bear market is defined as when market prices decline 20% from a previous high. More than 40% of the stocks in the S&P 500 are down at least 20% this year, Wilson noted. The S&P 500 index as a whole has fallen as much as about 12% since hitting its highest intraday level of 2,940.91 on September 28.

However, “with the forward 12-month P/E for the S&P 500 having fallen 18% from its peak in December last year to its low at the end of October, we think 90% of the valuation damage from the Rolling Bear market is complete,” Wilson said.

Over the past several months, “it’s become apparent even to the casual observer that the US equity market is acting differently,” he added. “Our view is that the market is sniffing out an earnings recession and a sharp deceleration in economic growth.”

Dips have been followed by dips

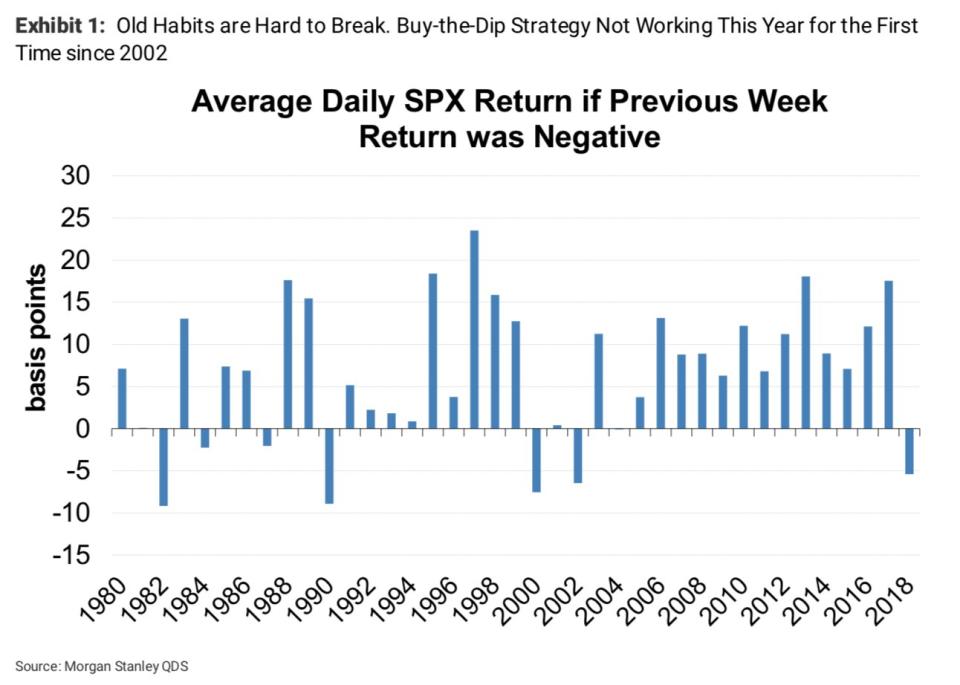

Moreover, a “buy-the dip” strategy has not worked this year, Wilson added, and the only years this strategy hasn’t yielded positive returns was during or at the beginning of bear markets. Even between 2008 and 2009, buying during market weakness turned out to be profitable. Wilson attributed this in large part to the Federal Reserve’s aggressive easing and support efforts in the form of the Troubled Asset Relief Program, which helped to offset concerns with the broader economy and with corporate earnings.

Wilson added that this year, the Federal Reserve has shifted its strategy from quantitative easing to quantitative tightening, with the central bank shrinking its balance sheet.

“Monetary stimulus is being removed in a much more deliberate way than we have seen since 2004 and fiscal stimulus has peaked,” Wilson said.

Wilson’s bearish sentiments were echoed in Goldman Sachs’ 2019 outlook report released Sunday. Goldman Sachs analyst Jan Hatzius said he anticipates growth will slow from a pace of 3.5% or more to just 1.75% by the end of 2019. Like Wilson, Hatzius cited “tighter financial conditions and a fading fiscal stimulus” as the main drivers of the deceleration.

“The bottom line for us is that until we see buying the dip rewarded or earnings for next ear reduced to a level that is achievable, we recommend trading like it’s a bear market rather than a bull,” Wilson said.

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Read more from Emily:

Netflix user growth beats expectations, shares spike

Now is a ‘once-in-a-lifetime chance’ to invest in US pot companies, investor says

There are ‘4 headwinds’ facing markets rights now