After missing in July, investors again are betting on an emerging markets comeback

In July, after a sell-off in emerging markets debt, currencies and equities, investor sentiment turned strongly bullish on the asset class and buyers piled in to what looked like bargain basement prices. Emerging markets had strongly outperformed the United States and other developed markets over the previous two years and investors expected that theme would continue.

Money managers were betting that the troubles in countries such as Argentina and Turkey, which were over-levered with debt denominated in U.S. dollars and mired in currency crises, would be shaken off by countries in stronger fiscal position, like Taiwan and Mexico.

The buy call was a big miss, with emerging markets (EM) continuing a precipitous slide and adding further losses to EM fund manager balance sheets. History may now be repeating itself as many investors say they are ready to step in and buy, arguing the fundamental story for most emerging countries does not match current asset prices.

T Rowe Price’s multi-asset portfolio allocation team recently raised its holdings of both emerging markets bonds and equities. They cite the “relative value opportunities” now present in the asset class. T Rowe fund managers also noted that they think the dollar has peaked in value against emerging markets currencies, which should eliminate a major headwind.

“When the currency markets look cheap, buy the equity markets,” said Justin Thomson, chief investment officer of international equity at T. Rowe Price, during a briefing in New York.

Thomson also said EM debt relative to developed markets has improved and fund flows are looking “much more healthy.”

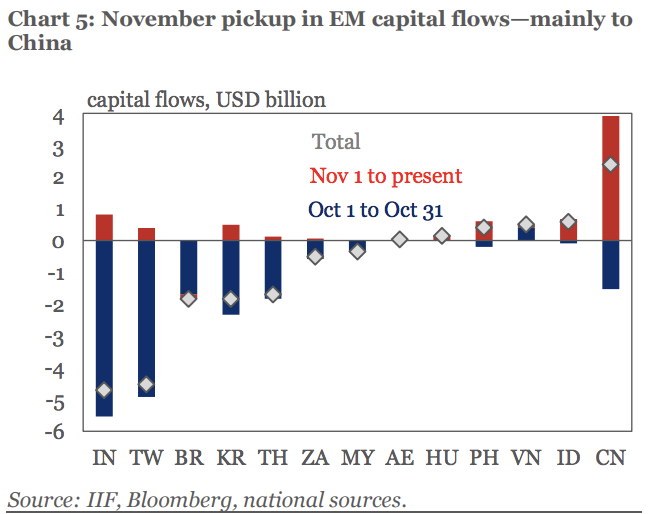

Overall in November, sentiment has flipped seemingly 180 degrees from October’s sell-off. Data from the Institute of International Finance (IIF) shows capital flows to emerging markets have notably picked up, especially in China, with net foreign investor purchases of stocks rising to around $4 billion in the first seven days of November. That was the fastest pace of weekly equity inflows since the launch of the Shanghai-Hong Kong Stock connect in 2014, IIF data shows.

The nascent month has so far proven EM bulls right, with broader emerging market equities rising as the U.S. benchmark S&P 500 has sunk. Wasif Latif, a portfolio manager and head of global multi-assets at USAA, believes this trend will continue into 2019 when U.S. stocks are in for a “reckoning.” He believes international and emerging markets, having lost so much value, now have better valuations and will outperform the U.S. His portfolio is heavily weighted towards EM and international securities.

Similarly, Michael Kass, a portfolio manager of international and emerging market equities at Baron Funds, said the problems for emerging markets this year have been driven not by central bank or fiscal policy mistakes but by “weaponized foreign policy from the United States.”

“King dollar is the weapon of choice for ‘America First,'” Kass told Yahoo Finance during a presentation at Baron Funds’ annual investment conference, referencing U.S. President Donald Trump’s signature foreign policy doctrine.

Kass, however, said he is not yet ready to dive back into EM in a big way, because he’s unsure about the trajectory of the U.S. dollar, which hit a 16-month high just last week.

IIF noted this risk to a longer-term emerging markets rally in a letter to clients, urging that “while investors have been quick to take advantage of EM bargains, uncertainty over the path of the [U.S. dollar] and declining EM growth differentials vis-à-vis mature market economies continue to represent serious headwinds for the asset class.”

The dollar did sink on Monday to a two-week low against a basket of currencies that measures its overall strength. The greenback also fell to a two-week low against the euro, the largest currency weighting in that basket, despite growing uncertainty in Europe over Brexit and Italy’s fight for higher spending than European Union regulations allow.

This may portend a reversal for emerging markets that proved illusory to investors earlier this year. But some remain unconvinced that things are headed in the right direction. Win Thin, global head of emerging markets strategy at Brown Brothers Harriman, says the run-up in Brazil – the only major equity market in the world to rise in the month of October – and other recent jolts higher are signs the market has gotten “complacent.”

As U.S. markets have sold off this week, emerging markets have fallen as well.

“I’m just not convinced,” Thin told Yahoo Finance. “I’m not convinced the worst is over.”

—

Dion Rabouin is a global markets reporter for Yahoo Finance. Follow him on Twitter: @DionRabouin.

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn.

See also:

Wall Street managers have cost Americans more than $600 billion over the past decade

It’s the end of the world as we know it, and investors feel bullish

The dollar’s status as the world’s funding currency is in question

The stock market is at ‘a crossroads’ and on course for a ‘reckoning’ in 2019, investors say

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.