May Best Energy Dividend Paying Stocks

The cyclicality of the energy industry makes it hard for income investors to find high yielding stocks. However, as oil rebounded from its multi-year lows, certain energy companies are in position to earn profits. These favourable macroeconomic tailwinds have recently made this industry an interesting dividend play. Today I will share with you my list of high-dividend energy stocks you should consider for your portfolio.

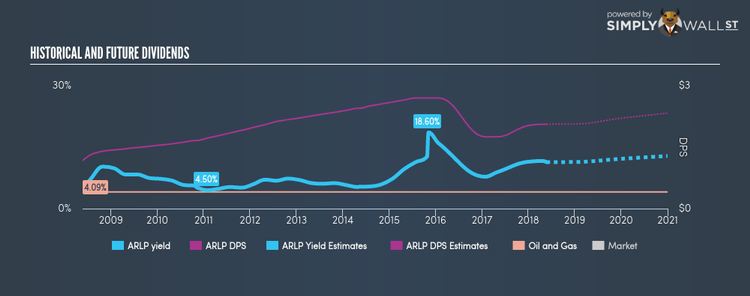

Alliance Resource Partners, L.P. (NASDAQ:ARLP)

ARLP has a great dividend yield of 11.35% and is currently distributing 66.25% of profits to shareholders , with analysts expecting the payout in three years to be 113.35%. Despite there being some hiccups, dividends per share have increased during the past 10 years. When we compare Alliance Resource Partners’s PE ratio with its industry, the company appears favorable. The US Oil and Gas industry’s average ratio of 14.4 is above that of Alliance Resource Partners’s (5.9). More on Alliance Resource Partners here.

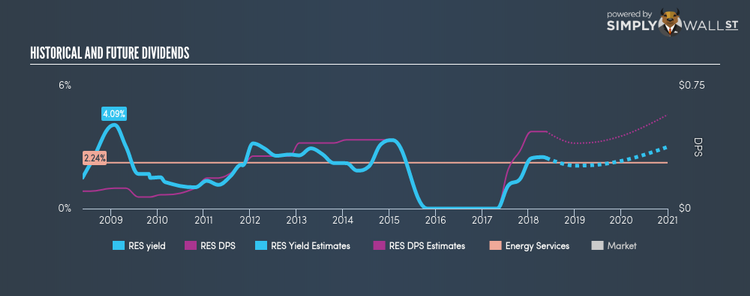

RPC, Inc. (NYSE:RES)

RES has a good-sized dividend yield of 2.47% and has a payout ratio of 23.62% , with analysts expecting a 28.75% payout in three years. Although there has been some volatility in the company’s dividend yield, the DPS over a 10 year period has increased from US$0.11 to US$0.47. Over the next year, analysts are estimating a double digit EPS growth of 30.93%. More detail on RPC here.

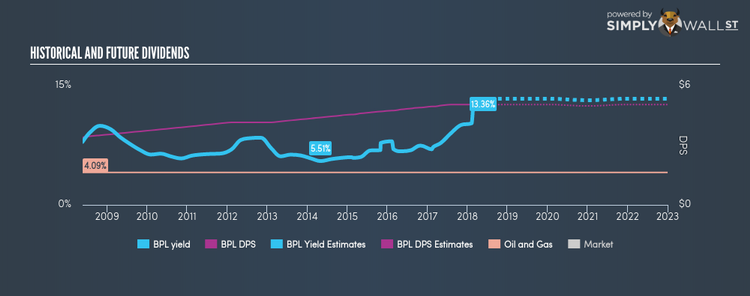

Buckeye Partners, L.P. (NYSE:BPL)

BPL has a enticing dividend yield of 13.36% and pays out 157.98% of its profit as dividends . BPL’s DPS have risen to US$5.05 from US$3.40 over a 10 year period. To the enjoyment of shareholders, the company hasn’t missed a payment during this period. More detail on Buckeye Partners here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.