What Makes Manappuram Finance Limited (NSE:MANAPPURAM) A Great Dividend Stock?

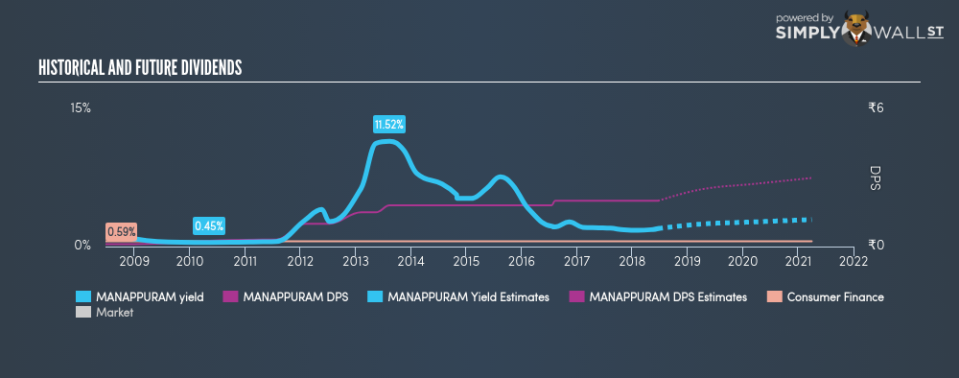

Manappuram Finance Limited (NSE:MANAPPURAM) is a true Dividend Rock Star. Its yield of 1.97% makes it one of the market’s top dividend payer. In the past ten years, Manappuram Finance has also grown its dividend from 0.10 to 2. Below, I have outlined more attractive dividend aspects for Manappuram Finance for income investors who may be interested in new dividend stocks for their portfolio. See our latest analysis for Manappuram Finance

What Is A Dividend Rock Star?

It is a stock that pays a stable and consistent dividend, having done so reliably for the past decade with the expectation of this continuing into the future. More specifically:

Its annual yield is among the top 25% of dividend payers

It has paid dividend every year without dramatically reducing payout in the past

Its has increased its dividend per share amount over the past

It is able to pay the current rate of dividends from its earnings

It has the ability to keep paying its dividends going forward

High Yield And Dependable

Manappuram Finance currently yields 1.97%, which is high for Consumer Finance stocks. But the real reason Manappuram Finance stands out is because it has a high chance of being able to continue to pay dividend at this level for years to come, something that is quite desirable if you are looking to create a portfolio that generates a steady stream of income.

Reliablity is an important factor for dividend stocks, particularly for income investors who want a strong track record of payment and a positive outlook for future payout. In the case of MANAPPURAM it has increased its DPS from ₹0.10 to ₹2 in the past 10 years. It has also been paying out dividend consistently during this time, as you’d expect for a company increasing its dividend levels. These are all positive signs of a great, reliable dividend stock.

Manappuram Finance has a trailing twelve-month payout ratio of 25.09%, meaning the dividend is sufficiently covered by earnings. Going forward, analysts expect MANAPPURAM’s payout to remain around the same level at 24.81% of its earnings, which leads to a dividend yield of around 2.66%. In addition to this, EPS should increase to ₹9.73.

Next Steps:

There aren’t many other stocks out there with the same track record as Manappuram Finance, so I would certainly recommend further examining the stock if its dividend characteristics appeal to you. However, given this is purely a dividend analysis, I recommend taking sufficient time to understand its core business and determine whether the company and its investment properties suit your overall goals. I’ve put together three relevant aspects you should further research:

Future Outlook: What are well-informed industry analysts predicting for MANAPPURAM’s future growth? Take a look at our free research report of analyst consensus for MANAPPURAM’s outlook.

Valuation: What is MANAPPURAM worth today? Even if the stock is a cash cow, it’s not worth an infinite price. The intrinsic value infographic in our free research report helps visualize whether MANAPPURAM is currently mispriced by the market.

Other Dividend Rockstars: Are there strong dividend payers with better fundamentals out there? Check out our free list of these great stocks here.