Lyft's stock price crash has short sellers salivating

Cue the bear raid in money-losing hype job Lyft.

“When the Lyft IPO shares begin settling tomorrow (Tuesday) and lending programs see their lendable inventories grow, over the next several days we should see a dramatic increase in stock lending, short sale approvals and Lyft short selling,” cautioned S3 Analytics Managing Director Ihor Dusaniwsky.

A short sale is a bet against a company’s stock price. It turns profitable when the stock loses value.

With Lyft shares from the IPO not settled yet, Dusaniwsky explains, and SEC regulations prohibiting IPO underwriters from lending shares to cover short sales for 30 days, only a tiny fraction of the 34 million shares traded on Monday reflected short sales.

Why the shorts could attack Lyft

It’s all about that momentum and sentiment for IPOs in their early trading days. And suffice it to say, the momentum right now is swinging against Lyft — which could only feed a bear’s appetite to go short the stock.

Lyft shares plunged about 12% to $68.01 on Monday following a spate of selling into the close on the company’s IPO day on Friday. The ride-hailing stock’s first trade on Friday was $87.24.

Lyft shares (LYFT) fell 3% in afternoon trading on Tuesday.

One source Yahoo Finance talked with say the fast money — or those who got a taste of the IPO before the debut — are dumping shares. Some long-term investors could also be lightening their load on Lyft, too, the source said.

After Lyft didn’t finish at the highs of the session on its first day of trading (usually not a healthy near-term signal to traders), it appears Wall Street has spent the weekend digging under the hood again. It’s not like Lyft is a bad company, it’s that the road to profits is several years away at best. In other words, Lyft’s business model is unproven.

That may have many people who got into the name on pure hype on Friday reassessing.

“We understand the excitement around LYFT given a large total addressable market (TAM) and low penetration, positioning along the front lines of a shift in how we think about transportation and, of course, strong top line growth. That said, we simply have to look too far out with too many big assumptions in order to make a case for the stock. Key issues include limited visibility on the path to profitability, sustainability of revenue growth, scale of investments in bikes, scooters and self-driving cars, and valuation,” says Guggenheim analyst Jake Fuller.

Fuller initiated coverage of Lyft with a Neutral rating, but no price target. That’s pretty telling.

Lyft needs profits, real soon

If Lyft doesn’t solve one serious issue that will probably make its initial financial reports valuable lessons on calculating losses, then one of the hottest IPOs in some time could hit dud status within a year (not unlike Snapchat, Blue Apron, and GoPro).

The main issue here: Lyft has not proven that it has a clear path to profitability.

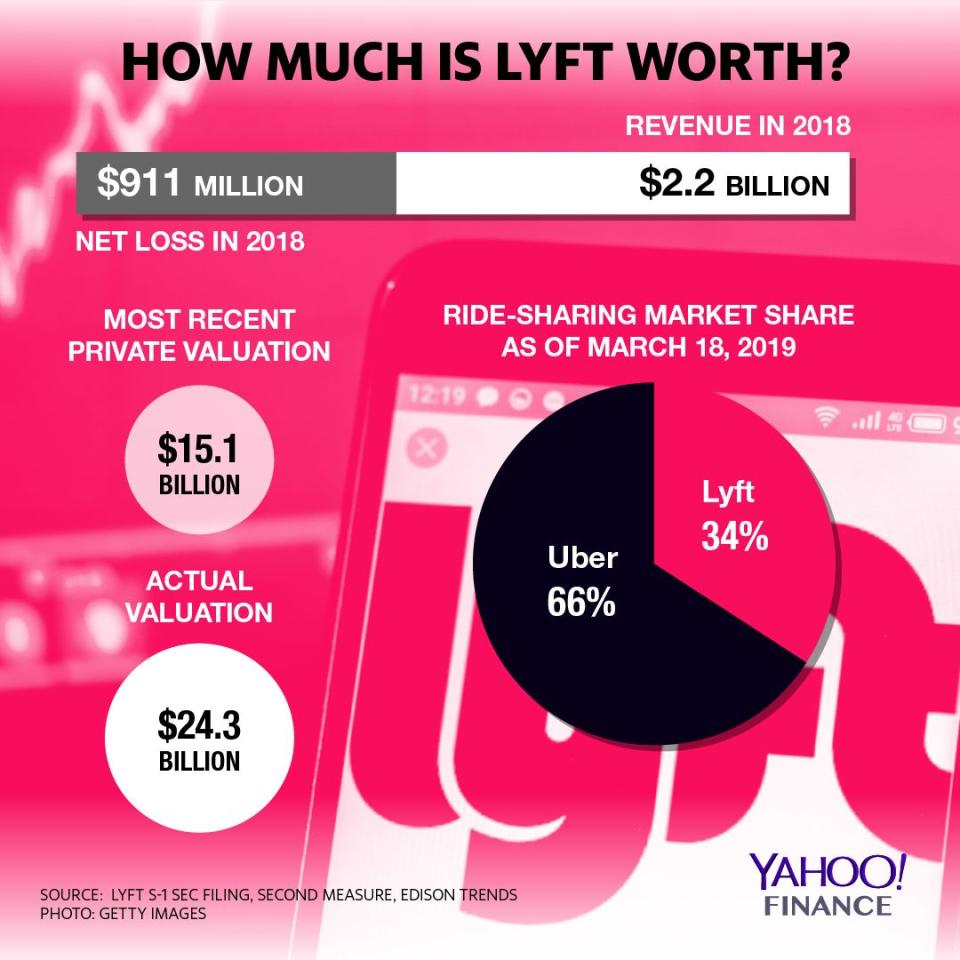

While Lyft saw sales more than double to $2.2 billion in 2018, it lost about $911 million. That’s despite Lyft’s bookings surging 76% year-over-year to $8 billion.

In fact, Lyft’s losses have worsened in recent years. Lyft’s operating losses tallied $977.8 million in 2018, up from $708.3 million in 2017 as it picked up the pace of incentives to drivers and riders.

Welcome to the big dance, shorts.

A Lyft spokeswoman didn’t return a request to make either of Lyft’s co-founders Logan Green or John Zimmer available for an interview.

Brian Sozzi is an editor-at-large at Yahoo Finance. Follow him on Twitter @BrianSozzi

Read more: