U.S. economy grows faster than expected in Q3

The U.S. economy is firing on all cylinders.

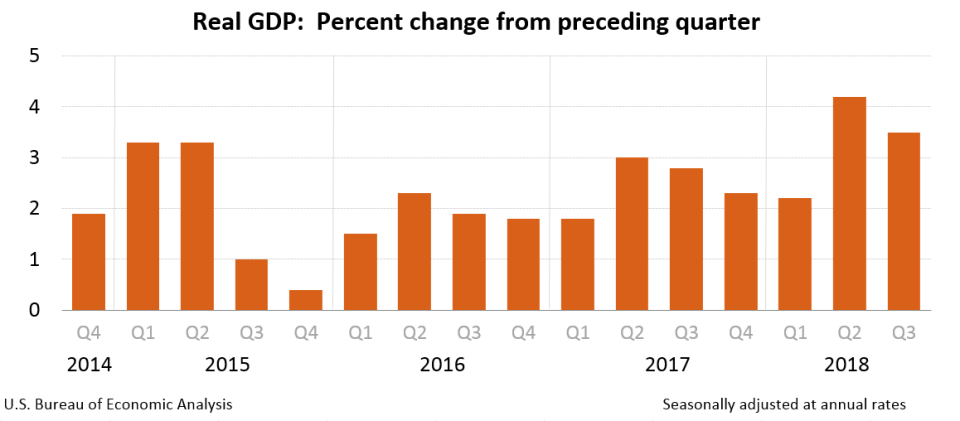

In the third quarter, U.S. GDP grew at an annualized rate of 3.5%, according to the latest data from the BEA.

Friday’s report beat expectations, as Wall Street economists expected this report to show the economy grew at an annualized rate of 3.3% during the third three-month block of the year.

The economy did grow slower than the 4.2% pace of growth seen during the second quarter, but still indicates that economic growth remains strong after tax cuts passed by the President Donald Trump late last year. The second quarter’s pace of growth was the best in four years.

Personal consumption grew by 4% during the third quarter, better than the 3.3% pace expected by economists and faster than the 3.8% pace of consumption seen during the second quarter.

In its release, the BEA said, “The increase in real GDP in the third quarter reflected positive contributions from personal consumption expenditures (PCE), private inventory investment, state and local government spending, federal government spending, and nonresidential fixed investment that were partly offset by negative contributions from exports and residential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased.”

Government spending rose at a pace of 3.3% during the third quarter, the fastest since the first quarter of 2016. Nonresidential fixed investment, which broadly captures business spending, grew at a pace of just 0.8% during the third quarter, the slowest since the fourth quarter of 2016. The build in inventories, which many economists had expected to see during the quarter, rose at the fastest pace since 2015.

Bloomberg’s U.S. chief economist Carl Riccadonna said following the report that, “The composition of growth in the third quarter has some important implications. The economy has reverted back to the `same old’ model of consumers accounting for most of the growth. Supply-siders will be disappointed to see business fixed investment essentially stalling out after a robust first half.”

In Riccadonna’s view, unless there are more tax or another change in fiscal policy, growth in the second and third quarter’s appears to be boosted by a “sugar high” from tax cuts rather than creating a new path for economic growth.

Ian Shepherson, an economist at Pantheon Macroeconomics, said of Friday’s report, “In one line: Strong GDP growth hides soft capex and massive trade deterioration.”

Following this report, stock futures remained lower though pared some losses the Nasdaq pointing to a loss of around 1.7% at the market open while the Dow appeared set to drop more than 150 points.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland