International Flavors (IFF) Q4 Earnings & Sales Lag Estimates

International Flavors & Fragrances Inc. IFF reported adjusted earnings of $1.22 per share in fourth-quarter 2018, missing the Zacks Consensus Estimate of $1.34. The bottom line declined 19% from the year-ago tally of $1.51.

Including one-time items, earnings per share in the quarter was 9 cents compared with 51 cents in the year-ago quarter.

In the reported quarter, International Flavors’ net sales were $1.22 billion, reflecting year-over-year growth of 43%. Further, the top line missed the Zacks Consensus Estimate of $1.23 billion by 1%.

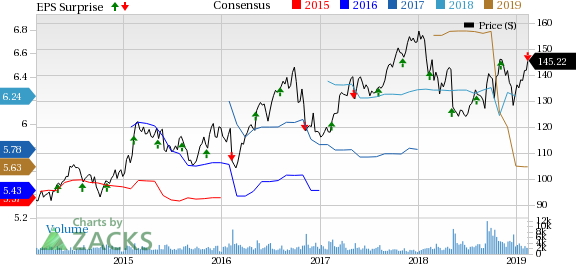

Internationa Flavors & Fragrances, Inc. Price, Consensus and EPS Surprise

Internationa Flavors & Fragrances, Inc. Price, Consensus and EPS Surprise | Internationa Flavors & Fragrances, Inc. Quote

Segmental Performances

Revenues at Taste segment remained constant at $401.6 million from fourth quarter of 2017. On a constant-currency basis, revenues grew 2% year over year. Operating profit declined 5% year over year to $77.5 million.

Revenues generated from the Scent segment came in at $457.9 million, up 1% year over year. On a constant-currency basis, revenues improved 3% year over year. Operating profit declined 4% year over year to $68 million.

In Oct 2018, International Flavors completed the acquisition of Frutarom Industries Ltd. Revenues at the Frutarom segment were $359.5 million and operating profit was $27.4 million during the fourth-quarter.

Operational Highlights

In the fourth quarter, International Flavors’ cost of goods sold rose 49% year over year to $742 million. Adjusted gross profit increased 37% year over year to $499 million. Adjusted gross margin came in at 41% compared with 42% in the year-ago quarter.

Research and development expenses flared up 8% year over year to $83 million. Adjusted selling and administrative expenses in the fourth quarter rose 49% year over year to $206 million. Adjusted operating profit increased 16% year over year to $162 million. Adjusted operating margin came in at 13.3% compared with 16.3% in the year-ago quarter.

Balance Sheet and Cash Flow

As of Dec 31, 2018, International Flavors had cash and cash equivalents of $648.5 million, showing a significant improvement from $368 million cash held at the end of 2017. Long-term debt grew to $4,504 million as of Dec 31, 2018, from $1,632 million in 2017.

International Flavors generated $436.7 million of cash from operating activities during the 12-month period ended Dec 31, 2018, compared with $390.8 million reported in the comparable period last year.

Capital invested in purchasing property, plant and equipment totaled $170 million as of Dec 31, 2018, surging 32% from the comparable period last year. Dividend paid totaled $230 in 2018.

2018 Results

International Flavors reported adjusted earnings per share of $6.28 in 2018, up 0.8% from $6.23 in the prior year. Earnings beat the Zacks Consensus Estimate of $6.12.

Sales increased 17% year over year to $3.98 billion, driven by mid-single digit growth in the both Taste and Scent segments and contribution from Frutarom-related sales. The top line beat the Zacks Consensus Estimate of $3.94 billion.

Outlook

For 2019, International Flavors provides sales guidance of $5.2-$5.3 billion. Adjusted earnings per share are expected in the band of $4.90-$5.10 and adjusted earnings excluding amortization are anticipated in the range of $6.30-$6.50. The company expects raw material cost inflation in 2019.

Share Price Performance

International Flavors’ shares have underperformed the industry it belongs to, over the past year. Its shares have gained around 0.8% compared with the industry’s 2.1% gain.

Zacks Rank & Stocks to Consider

International Flavors currently carries Zacks Rank #3 (Hold)

A few better-ranked stocks in the basic materials space are Kirkland Lake Gold Ltd. KL, The Mosaic Company MOS and Israel Chemicals Ltd ICL. While Kirkland currently sports a Zacks Rank #1 (Strong Buy), Mosaic and Israel Chemicals carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Kirkland has an expected earnings growth rate of 20.9% for 2019. The company’s shares have rallied 113.4% in the past year.

Mosaic has an expected earnings growth rate of 23.5% for 2019. Its shares have gained 23.9% in a year’s time.

Israel Chemicals has an expected earnings growth rate of 11.1% for 2019. Its shares have gained 34.3% in a year’s time.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Israel Chemicals Shs (ICL) : Free Stock Analysis Report

Internationa Flavors & Fragrances, Inc. (IFF) : Free Stock Analysis Report

The Mosaic Company (MOS) : Free Stock Analysis Report

Kirkland Lake Gold Ltd. (KL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research