Initial claims, Kroger earnings — What you need to know in markets on Thursday

The Dow can’t get off the mat.

On Wednesday, the blue chip index fell for the seventh-straight day, its longest streak since March 2017, while tech stocks rallied as the Nasdaq made a new record high.

The benchmark S&P 500 also closed in green figures, rising 0.2% on Wednesday.

On Thursday, investors will get a few pieces of economic data to digest with the weekly report on initial claims for unemployment insurance, the Philly Fed’s reading on manufacturing activity in June, and the FHFA’s April gauge of home prices set for release in the morning.

And on the earnings side, the S&P 500 companies reporting earnings Thursday are expected to be Kroger (KR), Darden Restaurants (DRI), and Red Hat (RHT).

With no new trade developments making news on Wednesday, the big markets stories were stock-specific.

Walgreens (WBA) joining the Dow to replace General Electric (GE) marked the end of a 110-year run for GE in the blue chip index. The move comes after what’s been a terrible few years for GE, which has seen shares lose about 45% over the last five years while the Dow is up more than 50% over the same period.

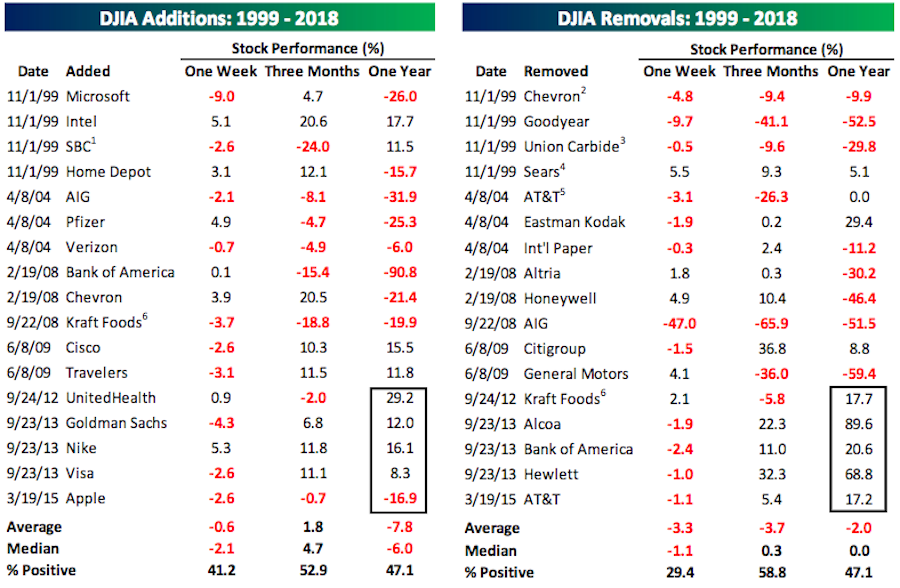

Analysts at Bespoke Investment Group noted Wednesday, however, that while performance for Dow members either being added or subtracted from the index has been all over the place following this move, those stocks taken out of the Dow have done slightly better over the following year.

Since 1999, companies added to the Dow have declined an average of 7.8% in the year following their addition while the companies that left the index have lose 2% over the next year.

Perhaps more instructively for investors, this graphic from Bespoke shows that while stocks in the aggregate usually go up, pretty crazy things can and do happen on the individual security level.

Disney (DIS) also announced on Wednesday that it had increased its offer for Fox’s studio assets, changing their all-stock bid to a mix of cash and stock worth $71.4 billion and that values Twenty-First Century Fox (FOXA) at $38 per share. This bid came in response to Comcast’s (CMCSA) all-cash offer for Fox’s studio assets valuing the company at $36 per share.

Shares of Fox rose 7.5% to close at $48.08 per share on Wednesday, indicating investors think this bidding war is not over and likely to be increased.

Another notable stock story Wednesday was Facebook’s (FB) all-time high.

Shares of the social network closed above $200 for the first time on Wednesday as the stock has rebounded sharply after its 20% decline during February and March as lawmaker focus on the company crescendoed with Mark Zuckerberg’s appearance on Capitol Hill to address the company’s use of user data.

And while anxiety around the stock and the company’s future certainly made for a clear story that worried investors, the enthusiasm around Facebook’s dominance of the online ad market is clearly back in the market.

How quickly things change.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland