Inflation expectations dip as Fed grapples with stimulating prices

The Federal Reserve is worried about losing credibility over its inflation targeting, and New York Fed data confirmed Monday that consumers are indeed predicting smaller price increases over the next year.

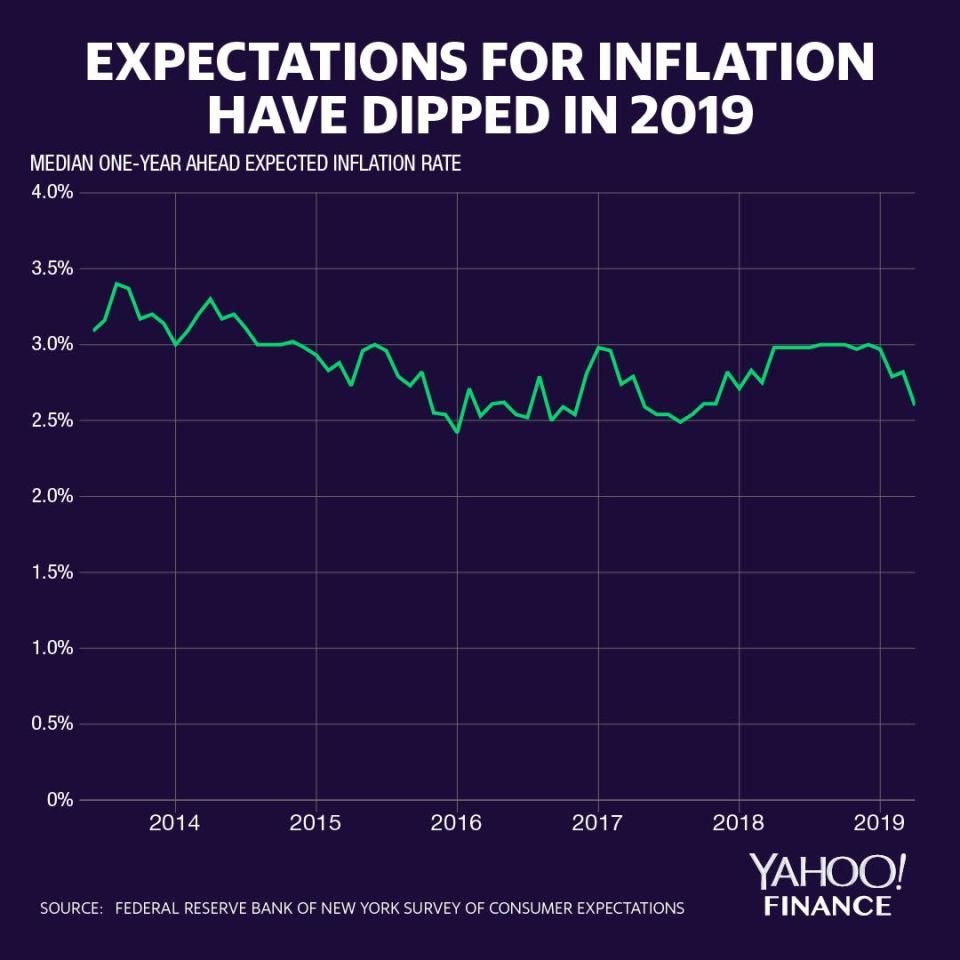

The New York Fed’s Survey of Consumer Expectations show median inflation expectations for the year ahead ticking down to 2.6% in April, down from 2.82% in March. The April reading extends the trend of downward expectations since the beginning of 2019; in December of last year, consumers told the New York Fed they expected 3% inflation in the year ahead.

Looking farther into the future, expectations for inflation over a three-year horizon also declined, to 2.7% in April, from 2.86% in March.

The survey showed, however, that dampened expectations for inflation are not aligning with expectations to consume less in the future. Expectations for median household spending growth actually increased from 3.1% in March to 3.3% in April, but the New York Fed said expectations for spending have been “volatile and exhibit seasonality.”

The survey polls about 1,300 household heads on their expectations for price changes in food, gas, housing, and education.

“Running below” our target

The new data comes as the Fed acknowledges that it is running below its 2% target for inflation.

The central bank prefers inflation readings that strip out the more volatile energy and food prices. Since implementing its 2% target in 2012, inflation from “core” personal consumption expenditures has averaged about 1.6%.

The March reading of core PCE at 1.6% pushed Fed Chairman Jerome Powell to admit in the Fed’s May 1 policy-setting meeting that inflation is “running below” its stated target.

Fed officials frequently say that inflation expectations are the key to realizing price increases. If consumers expect to consume more, prices should increase in theory.

But steering inflation is like walking a tightrope; rampant inflation brings back memories of the economically unstable 1970s but persistently low inflation could signal an economy suffering from low levels of consumption and investment.

There is a debate within the Fed as to whether or not its inflation undershoot is of serious concern. The Fed is currently undergoing a review of the way it targets its 2% goal, and policymakers are divided on the best method for addressing inflation.

While St. Louis Fed President James Bullard advocates for nominal GDP targeting, New York Fed President John Williams has touted the benefits of a closely related method called price-level targeting.

But others feel that undershooting by a few basis points is not a huge deal, suggesting that changing its strategy may instead risk destabilizing inflation. Kansas City Fed President Esther George and Cleveland Fed President Loretta Mester have said they are pleased with the current framework for targeting inflation.

The Fed will convene in Chicago in June for a more substantive discussion on how it addresses inflation.

—

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

What a higher education tech company tells us about a tightening labor market

NY Fed: Yield curve shows 27% chance of recession in the next year

Economist John Taylor: Interest rates should go to around 3%

Powell on the economy: 'We don't see any evidence at all of overheating'

Fed holds rate steady, says inflation is 'running below' its target

Congress may have accidentally freed nearly all banks from the Volcker Rule