The housing recovery has left rural America behind

The housing recovery since the financial crisis reflects a deeply fractured country.

The largest distinction is the disparity between growth in urban and rural regions of the U.S.. According to a new report from Trulia, home values in the 100 largest metro areas grew 53.1% from mid-2012 to mid-2017. That’s nearly double the home value appreciation in rural areas (27.9%) during that same period.

Housing economist Felipe Chacon, who authored the report, noted that the chasm between urban and rural is not a new phenomenon.

“The differences between metro and rural areas in job and home value trends did not start with the recovery from the recession of the past decade. This urban-rural divergence has become especially apparent in recent years. Economic trends in the aftermath of the housing crisis seems to have intensified the conditions pushing people away from rural areas and toward larger employment centers,” he said.

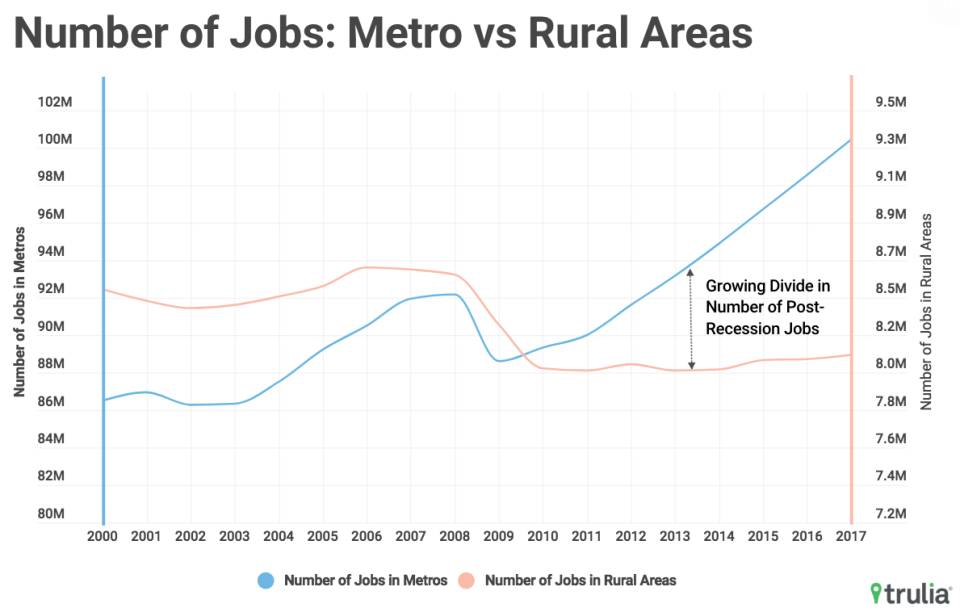

Housing follows employment patterns

It’s impossible to isolate the housing picture without examining the employment picture. The housing divide mirrors that of job growth: in the largest 100 metro areas, the number of people employed returned to pre-recession levels by mid-2012 and grew an additional 9.6% through mid-2017, according to Trulia. This compares with a mere 0.6% employment growth in rural counties during the same period, which have yet to recover to pre-recession employment levels.

The overall demographic shift indicates just how much job growth, driven by technology, comes from major cities. Over the same five-year period, the overall U.S. population grew by 3.7%. In the 100 largest metros, it expanded 4.8% and those living in rural areas fell by 1.0%, according to Trulia.

This stark disparity between economic opportunity in urban versus rural areas is leading to growing backlash of rural America, which comprises much of Trump’s core constituency. This disgruntlement has escalated in light of the administration’s decision to impose tariffs on steel and aluminum, $50 billion in Chinese imports in effect (and additional duties on $200 billion looming), and scrap the existing North American Free Trade Agreement.

Just this week, over 80 organizations representing thousands of companies joined forces to launch a lobbying campaign called “Tariffs Hurt the Heartland.” Executives of companies ranging from toys to tech are highlighting job losses, deferred investments and other second-order effects of Trump’s trade wars.

The urban boom

While rural areas have certainly been overlooked in the slow and steady road to recovery, it’s not all good news for red-hot urban markets. Affordability is still a major concern for prospective homebuyers who would rather rent than aggressively compete for limited amounts of inventory, as reflected by the sluggish summer season.

Rapid population and employment growth in the largest metro areas are pushing home prices out of reach. For instance, New York City, the nation’s largest U.S. metro, saw home prices appreciate 31% between 2012 and 2017. Los Angeles, the second-largest, experienced 68.4% growth during the same time period.

Despite this pronounced bifurcation between urban and rural economies,Robert Shiller, Yale economics professor and Nobel laureate, said there’s very little reason to believe that a bubble is brewing. He told Yahoo Finance earlier this month that he sees no signs of a crash like the one that rocked the housing market a decade ago.

“The market has been looking overheated ever since 2012 when we saw the upsurge that has been going on now for almost six years. And it looks like it’s still going up,” Shiller said in the interview with Yahoo Finance.

Chacon emphasized that the housing recovery should not be viewed as a snapshot, but in the context of a broader timeline.

“It’s important to remember though that this period of five or six years didn’t take place in a vacuum. Some of the places that were overbuilt in the mid-2000s and suffered the biggest home value depreciation during the recession have not recently constructed as much housing relative to the number of new arrivals,” he said. “For some of those places, this is probably a healthy level of development.”

Melody Hahm is a senior writer at Yahoo Finance, covering entrepreneurship, technology and real estate. Follow her on Twitter @melodyhahm.

Read more:

There’s an uptick in housing inventory, but don’t expect price relief

Highly unusual investment: Own part of this world-class bar

Men and women aren’t that different: investing app Stash

RVs and recliners are back thanks to millennials

Anaheim wants to be the Disneyland of beer