House Republican to regulators: Ease Volcker rule on large banks

One House Republican is making the case for large banks to get a break from a key post-crisis regulation known as the Volcker rule. The Volcker rule, part of the Dodd-Frank financial regulatory framework, generally prohibits banks from engaging in short-term proprietary trading and limits their relationships with hedge funds and private equity funds.

Yahoo Finance obtained a letter from Rep. Blaine Luetkemeyer (R-Mo.) telling the Volcker regulators that the original intent of the statute was, in fact, to give larger banks an exemption as long as they have relatively small holdings of trading assets and liabilities.

Luetkemeyer, one of the top-ranking Republicans on the House Financial Services Committee, wrote that banks “regardless of their size” should be exempt if they have “relatively immaterial trading activities.”

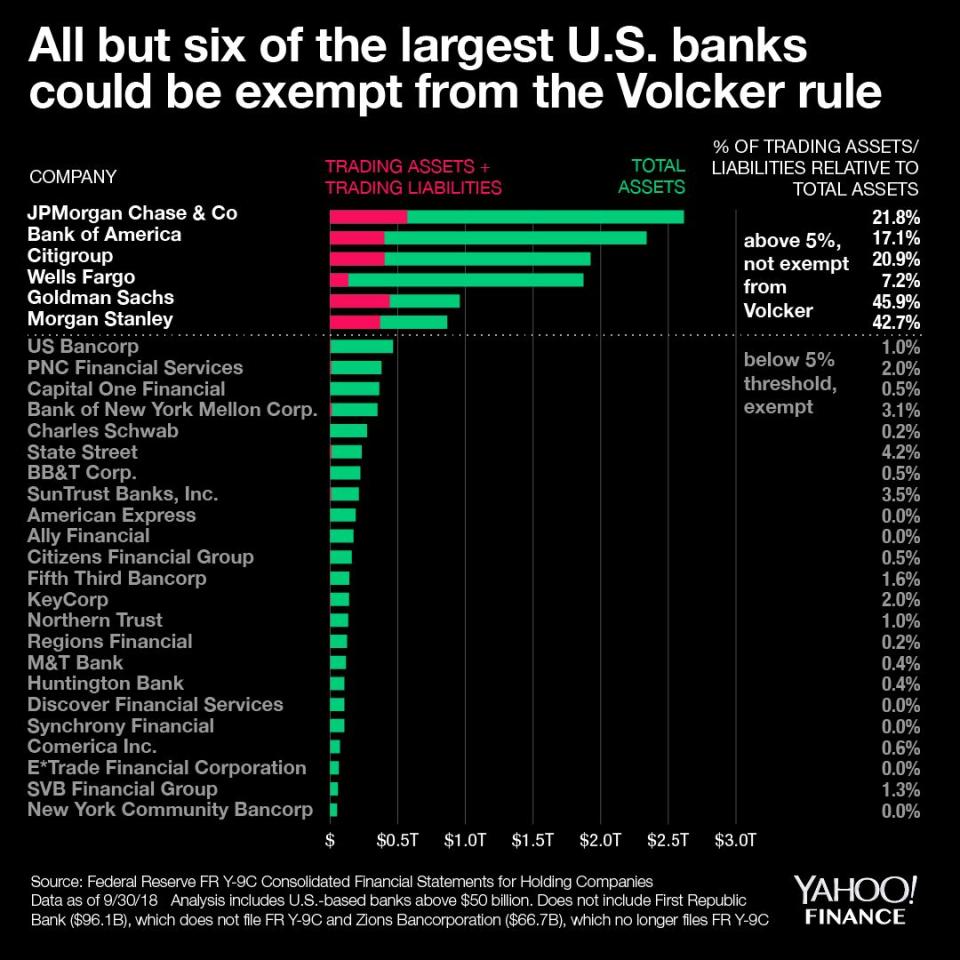

Two weeks ago, Yahoo Finance reported that some double negatives in the law could be read as freeing some of the largest U.S. banks - covering the likes of U.S. Bancorp (USB) and PNC Financial Services (PNC) - from the Volcker rule. The summary of the bill appeared to telegraph that the exemption was only for “community” banks with less than $10 billion in total assets and less than 5% of assets in trading assets and liabilities. But Yahoo Finance reported that large banks were consulting with former Trump regulator Keith Noreika on an alternative interpretation that would only require a firm to meet one of those criteria to get the exemption.

“Congress made a clear determination to tailor the Volcker Rule to only apply to those firms with greater than $10 billion in assets with a relatively significant portion of their business comprised of trading activities,” the letter dated December 21 reads.

Luetkemeyer adds that the bill also “reflects, for the most part, the position advocated by the Administration during the process.” In the U.S. Treasury’s review of banking laws, staff recommended that “proprietary trading restrictions of the rule not apply to banks with greater than $10 billion in assets unless they exceed a threshold amount of trading assets and liabilities.”

But Luetkemeyer was not one of the original drafters of the bill, and the Senate seemed fairly clear on only letting banks below $10 billion benefit.

The official bill summary says the “community bank relief” is for banks that have “less than $10 billion in total consolidated assets and total trading assets and trading liabilities that are not more than five percent of total consolidated assets.” Yahoo Finance reached out to several Senate offices involved with the original bill’s drafting, but did not receive responses to requests for comment.

Misunderstanding?

Regulators on Tuesday released a notice of proposed rulemaking clarifying that they will not let large banks resume proprietary trading, and will require companies to meet both the $10 billion threshold and the 5% trading assets and liabilities line in order to qualify for the exemption. Martin Gruenberg, a board member of the Federal Deposit Insurance Corp., said freeing banks above $10 billion from the rule “was not the intent.”

But Luetkemeyer said Gruenberg “misunderstands the underlying policy goals” and bashed the regulators for attempting to “rewrite the law and override the express statutory text” of the law.

If a large bank were to take the regulators to court to fight for the alternative interpretation, they would need to argue that the statute clearly gives them an exemption. If a court were to find ambiguity in the original legal text, they would give “Chevron deference” to the agency interpretation - which in this case is to only give banks with less than $10 billion the exemption.

The regulators’ interpretation is not set in stone; late on Friday they opened public comment on their reading of the statute which will allow any stakeholders to offer their thoughts.

A spokesperson for the Federal Reserve said they “plan to respond” to Luetkemeyer’s letter.

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

Read more:

NY Fed's Williams hints at flexibility with balance sheet unwind

Fears of looming recession cast light on Fed balance sheet

Why 2019 could be the year of the big bank merger

Congress may have accidentally freed nearly all banks from the Volcker Rule

NY Fed’s Williams: There’s still room for ‘further gradual’ rate increases