The unlikely, risky midterm election outcome scenario no one is really talking about

Markets appear to be pricing in a midterm election scenario where Democrats take control of the U.S. House of Representatives and Republicans maintain control of the Senate. To lesser extent, traders are also bracing for the possibility that Republicans maintain control over both the House and Senate, or Democrats win control over both in what’s been informally named the “blue tsunami.”

But there’s a midterm election outcome scenario that is largely being overlooked by the markets.

“What if we don’t know the result on November 7th?” asked RBC Capital Markets head of U.S. equity strategy Lori Calvasina. “If enough races are too close to call on Tuesday night, and control of Congress hangs in the balance, we think it could weigh on an equity market that has already felt fragile.”

Midterm elections will take place on Tuesday, with all 435 seats in the House and 35 out of 100 seats in the Senate up for grabs. As of Monday morning, FiveThirtyEight forecasts that there’s an 80% probability that Democrats will win control of the House, while there’s an 83.2% chance that Republicans keep control of the Senate.

According to RBC, investors are anticipating that a split Congress is the most likely outcome. A Republican sweep of both the House and Senate would be viewed as a positive outcome for the stock market, while a Democratic sweep would be “a short-term negative,” especially for health care stocks.

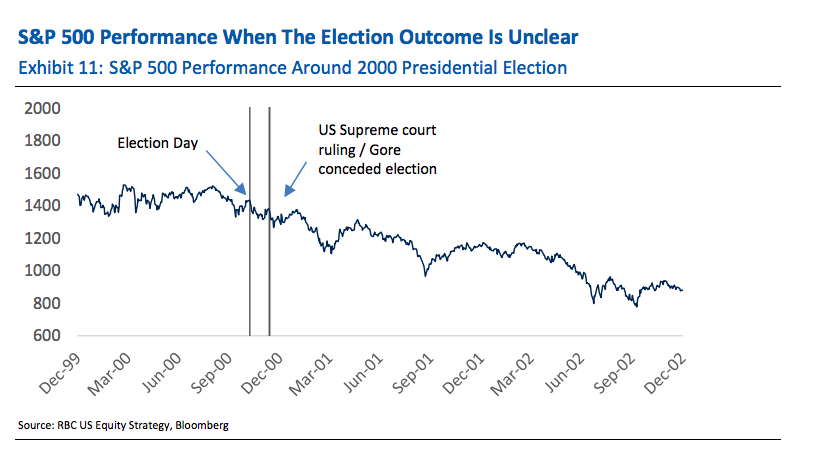

A risk for investors is the potential for an unclear outcome after Tuesday night, with RBC highlighting what happened to markets in 2000 after that election.

“The best example we have of this in recent history is the 2000 election when both the Presidency and control of Congress were unresolved for roughly a month. At the time, the equity market was already tumbling, and it continued to fall while the results were being determined,” writes Calvasina.

Presently, Republicans occupy 235 seats in the House, while Democrats hold 193, with seven vacancies. In the Senate, Republicans hold 51 seats, while Democrats fill 47 seats — the other two seats are both filled by Independents who caucus with the Democrats.

—

Julia La Roche is a finance reporter at Yahoo Finance. Follow her on Twitter. Send tips to laroche@oath.com.