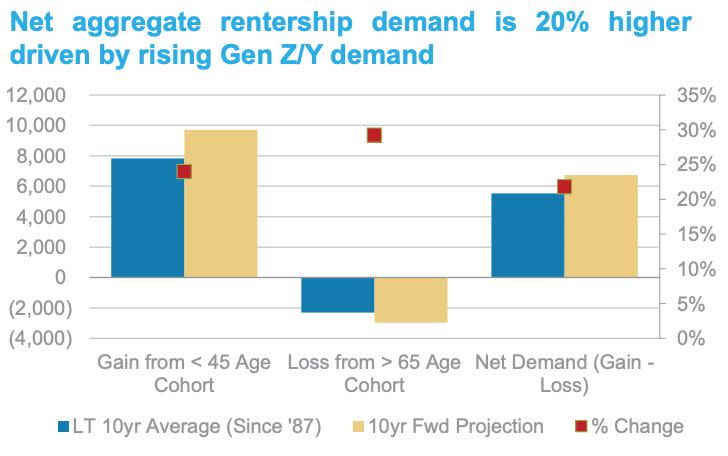

Gen Y and Z will drive up demand for rentals over the next 10 years

Millennials and Gen Z are expected to overtake baby boomers as the largest generation in the U.S. in 2020 and 2034, respectively. For the housing market, that means demand for home ownership will decline in favor of renting, according to a new report by Morgan Stanley.

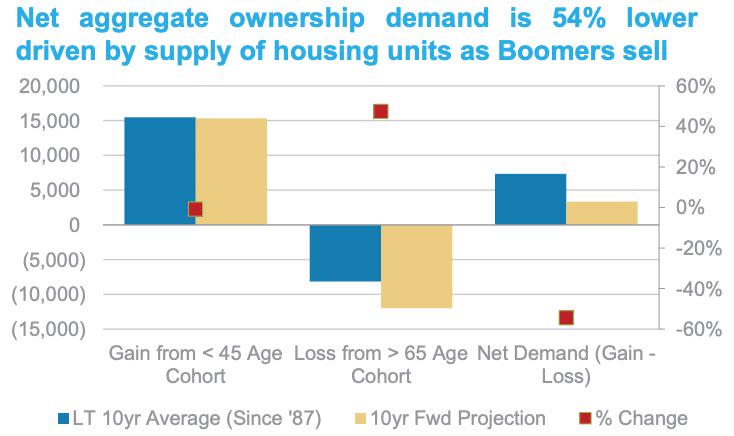

Morgan Stanley expects home ownership demand among millennials and Gen Z to reach 10 million units over the next 10 years, which is 22% lower than the 10-year rolling average of 13 million since 1987.

The Gen Z and millennial generations will contribute to a 7% increase in demand for homes over the next 10 years, but it won’t be enough to overcome the 43% pop in homes coming onto the market from baby boomers selling their homes.

Accounting for that big increase in new homes on the market, net ownership demand will drop to 3.3 million homes – 54% below the long-term average, according to the report.

Morgan Stanley analysts project that Gen Z and millennials will drive up demand for rentals by 2 million units over the next decade, bringing the total demand for rentals up to 9.7 million units – well over the 10-year average of 7.9 million.

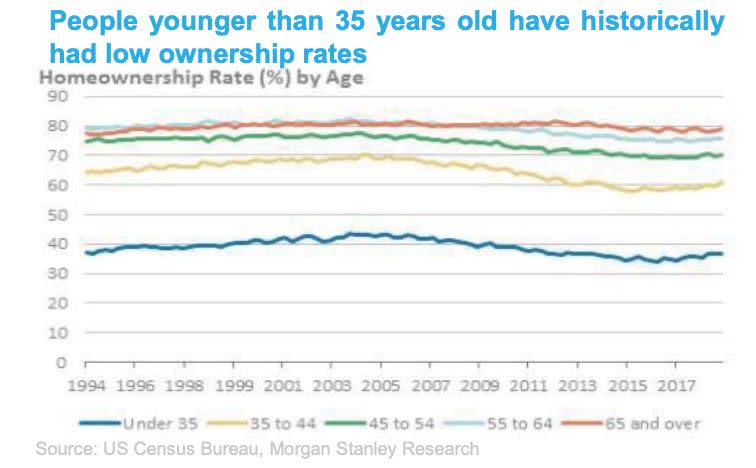

Millennials’ homeownership rate is now 8% lower than the rate for baby boomers when they were the same age, according to a 2018 study by the Urban Institute.

It’s a well-known story by now: Delaying marriage has had the biggest impact on millennial homeownership, according to the report. Being married increased the probability that young adults would purchase a home by 18%. The increasing diversity of the millennial generation is also a factor contributing to those declining homeownership rates. If racial demographics were the same in 2015 as they were in 1990, homeownership among millennials would be up about 3%, according to the Urban Institute. And student debt is another key factor – the report found that a 1% growth in debt decreases the probability of buying a home by 0.15%.

If millennials had been able to buy homes at the same rate as previous generations, the U.S. housing market would have 3.4 million more homeowners, according to the Urban Institute.

Follow Sibile Marcellus on @SibileTV

More from Sibile:

Millennials are 41% below boomers in a key wealth measure

More households subscribe to a streaming service than pay TV now: Deloitte

Trump isn’t worries about rising government debt, and neither are voters

Workers threatened by automation shift their skills to become drivers, electricians: LinkedIn